A new study by WalletHub used “30 key metrics, ranging from share of millennials to millennial unemployment rate to millennial voter-turnout rate” to find out which states are the ‘Best States for Millennials.’ The Top 5 Best States for Millennials are: Washington, D.C. (also ranks highest in percentage of millennials already living there!) North Dakota (lowest unemployment rate) Minnesota (highest millennial homeownership rate) Massachusetts (highest percentage of millennials with … [Read more...]

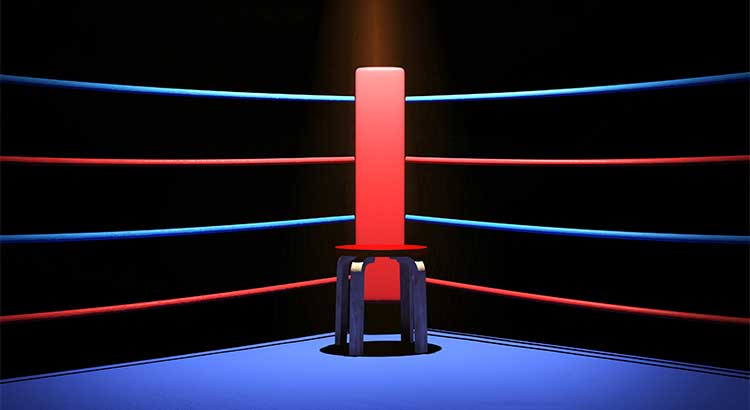

Thinking of Selling Your Home? Why You Need A Pro in Your Corner

With home prices on the rise and buyer demand strong, some sellers may be tempted to try and sell their homes on their own (FSBO) without using the services of a real estate professional. Real estate agents are trained and experienced in negotiation and, in most cases, the seller is not. Sellers must realize that their ability to negotiate will determine whether or not they get the best deal for themselves and their families. Here is a list of some of the people with whom the seller must be prepared to negotiate if … [Read more...]

Buying a Home Is Cheaper Than Renting in the Majority of the US

The results of the 2018 Rental Affordability Report from ATTOM show that buying a median-priced home is more affordable than renting a three-bedroom property in 54% of U.S. counties analyzed for the report. The updated numbers show that renting a three-bedroom property in the United States requires an average of 38.8% of income. The least affordable market for renting was Marin County, CA, just over the Golden Gate Bridge from San Francisco, where renters spend a staggering 79.5% of average wages on … [Read more...]

Is Family Mortgage Debt Out of Control?

Some homeowners have recently done a “cash out” refinance and have taken a portion of their increased equity from their house. Others have sold their homes and purchased more expensive homes with larger mortgages. At the same time, first-time buyers have become homeowners and now have mortgage payments for the first time. These developments have caused concern that families might be reaching unsustainable levels of mortgage debt. Some are worried that we may be repeating a behavior that helped … [Read more...]

How Much Do You Need to Make to Buy a Home in Your State?

It’s no mystery that cost of living varies drastically depending on where you live, so a new study by GOBankingRates set out to find out what minimum salary you would need to make in order to buy a median-priced home in each of the 50 states, and Washington, D.C. States in the Midwest came out on top as most affordable, requiring the smallest salaries in order to buy a median-priced home. States with large metropolitan areas saw a bump in the average salary needed to buy with California, Washington, D.C., and … [Read more...]

Rising Prices Help You Build Your Family’s Wealth

Over the next five years, home prices are expected to appreciate, on average, by 3.6% per year and to grow by 18.2% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey. So, what does this mean for homeowners and their equity position? As an example, let’s assume a young couple purchased and closed on a $250,000 home this January. If we only look at the projected increase in the price of that home, how much equity will they earn over the next 5 … [Read more...]

Getting Pre-Approved Should Always Be Your First Step

In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the number of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search. Even if you are in a market that is not as competitive, understanding your budget will give you the confidence of knowing if your dream home is … [Read more...]

A Tale of Two Markets [INFOGRAPHIC]

Some Highlights: A trend that has been emerging for some time now is the contrast between inventory & demand in the Premium & Luxury Markets vs. the Starter & Trade-Up Home Markets and what that’s, in turn, doing to prices! Inventory continues to rise in the luxury & premium home markets which is causing prices to cool. Demand continues to rise with low inventory in the starter & trade-up home markets, causing prices to rise! … [Read more...]

The COST of Your Next Home Will Be LESS Than Your Parents’ Home Was

There is no doubt that the price of a home in most regions of the country is greater now than at any time in history. However, when we look at the cost of a home, it is cheaper to own today than it has been historically. The Difference Between PRICE and COST The price of a home is the dollar amount you and the seller agree to at the time of purchase. The cost of a home is the monthly expense you pay for your mortgage payment. To accurately compare costs in different time periods, we must look at home prices, … [Read more...]

Mortgage Interest Rates Have Begun to Level Off

Whether you are a buyer searching for your first home, or a homeowner looking to move up to your next home, you should pay attention to where mortgage interest rates are heading. Over the course of 2018, according to Freddie Mac’s Primary Mortgage Market Survey, rates have increased from 3.95% in the first week of January to 4.40% in the first week of April. At first glance, the difference between these numbers in such a short amount of time could be concerning, but if we look at the graph below, we’ll … [Read more...]

- « Previous Page

- 1

- …

- 192

- 193

- 194

- 195

- 196

- …

- 249

- Next Page »