Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 7.1%. CoreLogic, in their most recent Home Price Insights Report, reveals that national home prices have increased by 6.9% year-over-year.The CoreLogic report broke down appreciation even further into four different price categories:Lower Priced Homes: priced at 75% or less of the medianLow-to-Middle Priced … [Read more...]

A Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture

The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the National Association of Realtors latest Existing Home Sales Report. Inventory is now 7.1% lower than this time last year, marking the 20th consecutive month of year-over-year drops.Historically, inventory must reach a 6-month supply for a normal market where home prices appreciate with inflation. Anything less than a 6-month supply is a sellers’ market, where the demand for … [Read more...]

Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.Here is a chart showing … [Read more...]

How to Get the Most Money When Selling Your Home

Every homeowner wants to make sure they get the best price when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensuring you get the highest price possible.1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them room for negotiation. In reality, this just dramatically lessens the demand for their … [Read more...]

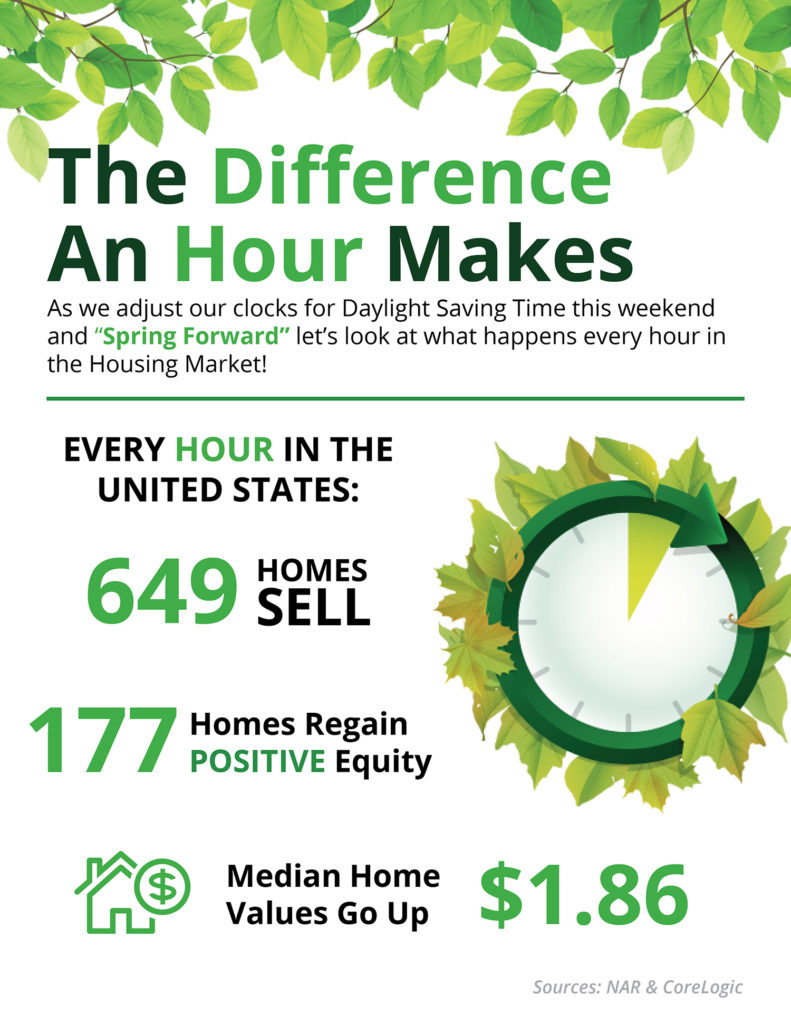

Spring Forward: The Difference An Hour Makes [INFOGRAPHIC]

Some Highlights:Don’t forget to set your clocks forward this Sunday, March 12th at 2:00 AM EST in observance of Daylight Savings Time.Unless of course, you are a resident of Arizona or Hawaii!Every hour in the United States: 649 homes are sold, 177 homes regain equity (meaning they are no longer underwater on their mortgage), and the median home price rises $1.86! … [Read more...]

Builder Confidence Hits 11-Year High

In many areas of the country, there are not enough homes for sale to satisfy the number of buyers looking to purchase their dream homes. Experts have long proposed that a ramp-up in new, single-family home construction would be one of the many ways to overcome this inventory shortage.According to a recent survey conducted by the National Association of Home Builders (NAHB) and Wells Fargo, housing market confidence amongst builders reached an 11-year high last month.What Does High Confidence Mean for the Housing … [Read more...]

Housing Market Expected to “Spring Forward”

Just like our clocks this weekend in the majority of the country, the housing market will soon “spring forward!” Similar to tension in a spring, the lack of inventory available for sale in the market right now is what is holding back the market.Many potential sellers believe that waiting until Spring is in their best interest, and traditionally they would have been right.Buyer demand has seasonality to it, which usually falls off in the winter months, especially in areas of the country impacted by … [Read more...]

Thinking of Selling? Do it TODAY!!

That headline might be a little aggressive. However, as the data on the 2017 housing market begins to roll in, we can definitely say one thing: If you are considering selling, IT IS TIME TO LIST YOUR HOME!The February numbers are not in yet, but the January numbers were sensational. Lawrence Yun, Chief Economist for the National Association of Realtors, said:“Much of the country saw robust sales activity last month as strong hiring and improved consumer confidence at the end of last year appear to have … [Read more...]

The Connection Between Home Prices & Family Wealth

Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.So, what does this mean for homeowners and their equity position?As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?Since the experts … [Read more...]

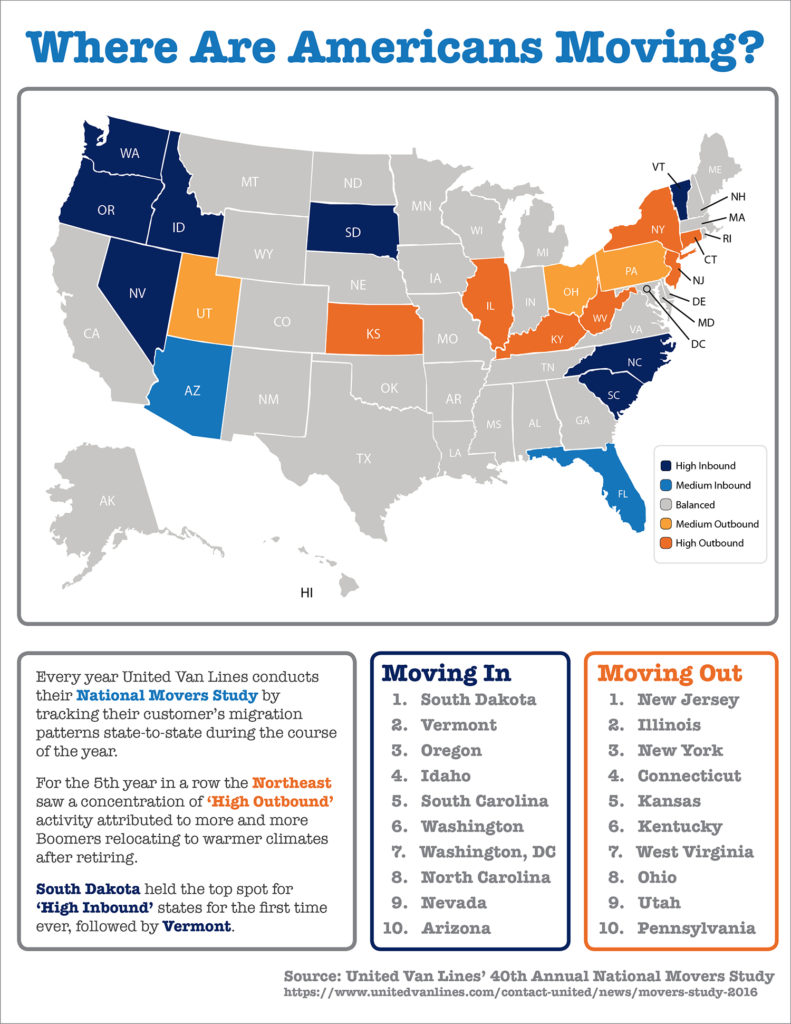

Where Did Americans Move in 2016?

Some Highlights:For the 5th year in a row, the Northeast saw a concentration of “High Outbound” activity.For the first time ever, South Dakota held the top spot for “High Inbound” states.Much of America’s outbound activity can be attributed to Boomers relocating to warmer climates after retiring. … [Read more...]

- « Previous Page

- 1

- …

- 220

- 221

- 222

- 223

- 224

- …

- 249

- Next Page »