In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search.If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale through rose-colored glasses.Do … [Read more...]

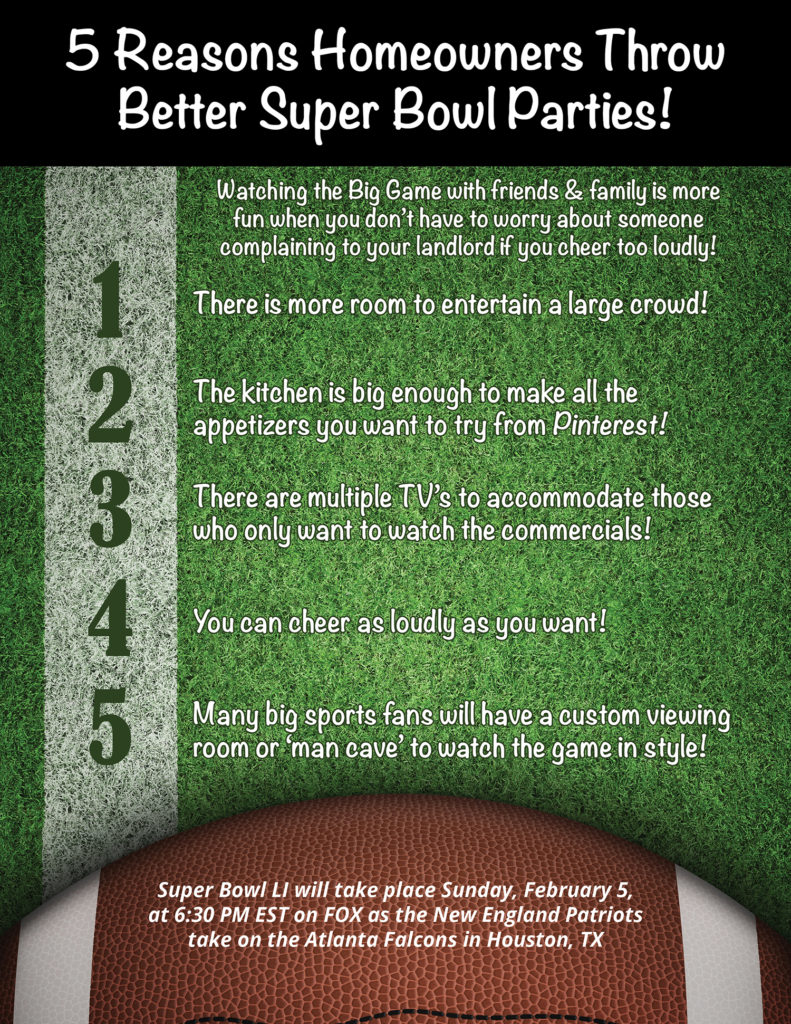

5 Reasons Homeowners Throw Better Super Bowl Parties! [INFOGRAPHIC]

Highlights:Watching the Big Game at home with your friends & family offers many advantages.There’s more room to entertain a large crowd, and you don’t have to worry about complaints to your landlord if you cheer too loudly!The kitchen is big enough to make as many appetizers as you want, and if some of your guests are only there to watch the commercials, they can do so on a different TV in another room! … [Read more...]

No Matter What the Groundhog Says, Here are 5 Reasons to Sell Before Spring!

Is spring closer than we think? Depending on which groundhog you listen to today, you may have less time than you think to get your home on the market before the busy spring season.Many sellers feel that the spring is the best time to place their homes on the market as buyer demand traditionally increases at that time of year. However, the next six weeks before spring hits also have their own advantages.Here are five reasons to sell now.1. Demand is Strong Foot traffic refers to the number of people who are … [Read more...]

Buyer Demand Is Outpacing the Supply of Homes for Sale

The price of any item is determined by the supply of that item, as well as the market demand. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index.Their latest edition sheds some light on the relationship between Seller Traffic (supply) and Buyer Traffic (demand).Buyer DemandThe map below was created after asking the question: … [Read more...]

Thinking of Making an Offer? 4 Tips for Success

So you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market that you want to make sure you make a good offer so that you can guarantee your dream of making this house yours comes true!Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the 4 Tips they covered along with some additional information for your consideration:1. Understand How … [Read more...]

2 Myths That May Be Holding Back Buyers

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.” Myth #1: “I Need a 20% Down Payment” Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) … [Read more...]

What to Expect From Your Home Inspection

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection.This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.How to Choose an InspectorYour agent will most likely have a short list of inspectors that … [Read more...]

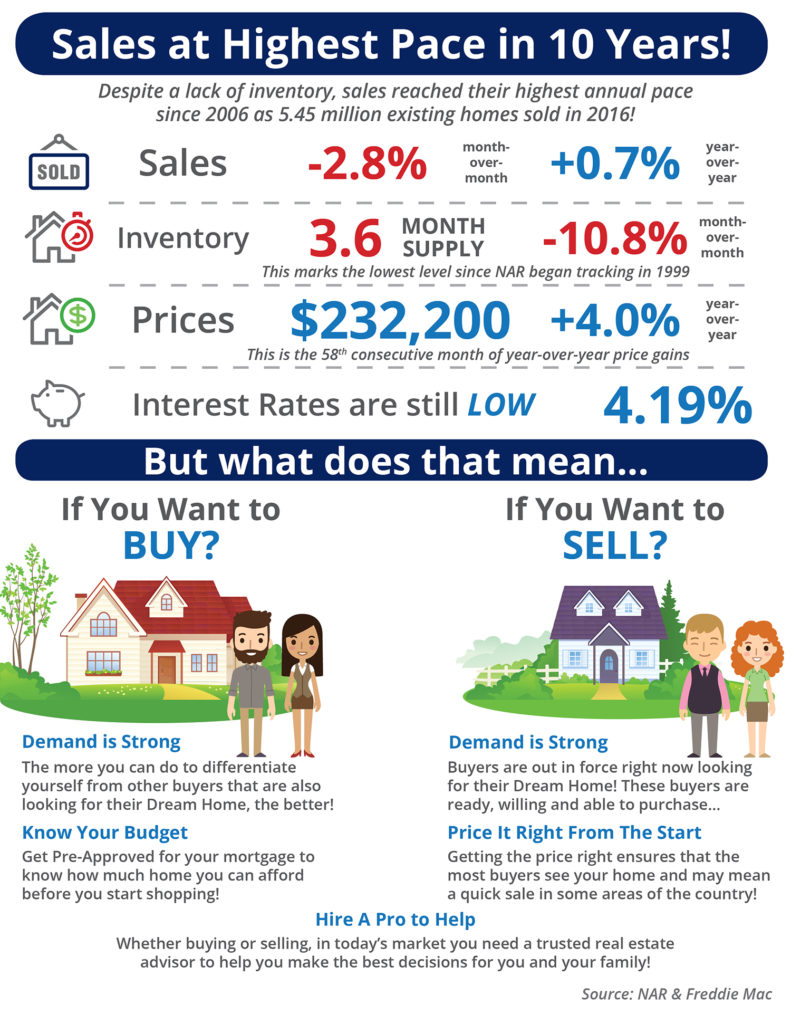

Sales at Highest Pace in 10 Years! [INFOGRAPHIC]

Highlights:45 million existing homes were sold in 2016! This is the highest mark set since 2006.Inventory of existing homes for sale dropped to a 3.6-month supply, the lowest level since NAR began tracking in 1999.The median price of homes sold in December was $232,200. This is the 58th consecutive month of year-over-year price gains. … [Read more...]

Thinking of Selling? Why Now is the Time

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year.The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of … [Read more...]

Buying a Home is More Affordable Than Renting in 66% of US Counties

According to ATTOM Data Solutions’ 2017 Rental Affordability Report, buying a home is more affordable than renting in 354 of the 540 U.S. counties they analyzed.The report found that “making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on a three-bedroom property in 354 of the 540 counties analyzed in the report (66 percent).”For the report, ATTOM Data Solutions compared recently … [Read more...]

- « Previous Page

- 1

- …

- 223

- 224

- 225

- 226

- 227

- …

- 249

- Next Page »