When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal.One great example of an agent who is in your corner and is always looking out for your best interests is one of the main characters on ABC’s Modern Family, Phil Dunphy.For those who aren’t familiar, the character Phil is a Realtor … [Read more...]

Homeowner’s Net Worth Is 45x Greater Than A Renter’s

Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400).In a Forbes article, the National Association of Realtors’ (NAR) Chief Economist Lawrence Yun predicts that by the end of 2016, the net worth gap will widen even further to 45 times greater.The graph below … [Read more...]

Top 5 Reasons You Should Not For Sale By Owner

In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers.Here are the top five reasons:1. Exposure to Prospective BuyersRecent studies have shown that 94% of buyers search online for a home. That is in comparison to only 17% looking at print newspaper ads. Most real estate agents have an … [Read more...]

Existing Home Sales Surge Through The Holidays [INFOGRAPHIC]

Some Highlights:November’s Existing Home Sales report revealed that sales are now at an annual pace of 5.61 million which is “now the highest since February 2007 (5.79 million) and is 15.4% higher than a year ago (4.86 million).”Total housing inventory (or the inventory of homes for sale) fell 8.0% from last month and is now 9.3% lower than November 2015.Inventory has dropped year-over-year for the last 18 months.The median price for all home sales in November was $234,900, up 6.8% from last year … [Read more...]

The Fed Raised Rates: What Does that Mean for Housing?

You may have heard that the Federal Reserve raised rates last week… But what does that mean if you are looking to buy a home in the near future? Many in the housing industry have predicted that the Federal Open Market Committee (FOMC), the policy-making arm of the Federal Reserve, would vote to raise the federal fund's target rate at their December meeting. For only the second time in a decade, this is exactly what happened. There were many factors that contributed to the 0.25 point increase (from 0.50 to … [Read more...]

Student Loans = Higher Credit Scores

According to a recent analysis by CoreLogic, Millennial renters (aged 20-34) who have student loan debt also have higher credit scores than those who do not have student loans.This may come as a surprise, as there is so much talk about student loans burdening Millennials and holding them back from many milestones that previous generations have been able to achieve (i.e. homeownership, investing for retirement).CoreLogic used the information provided on rental applications and the applicants’ credit history … [Read more...]

Whether You Rent or Buy: Either Way You’re Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.Are you ready … [Read more...]

2 Tips to Ensure You Get the Most Money When Selling Your House

Every homeowner wants to make sure they get the best price when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensuring you get the highest price possible.1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them room for negotiation. In actuality, this just dramatically lessens the demand for your house … [Read more...]

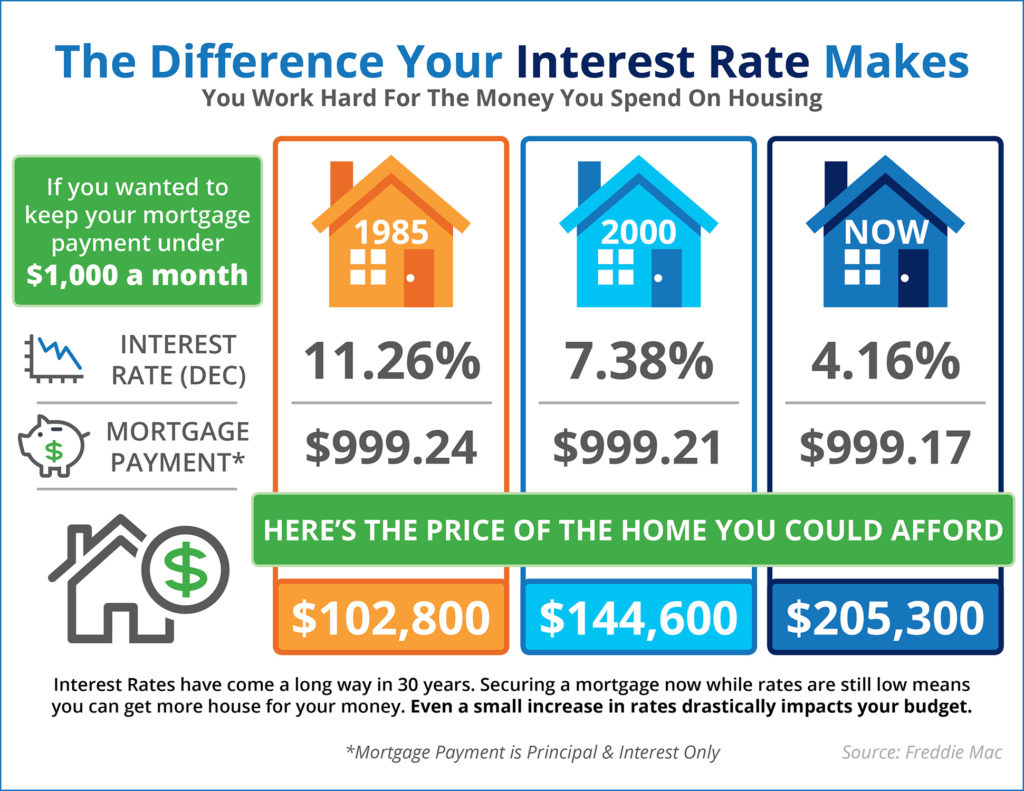

The Impact Your Interest Rate Has on Your Buying Power [INFOGRAPHIC]

Some Highlights:Your monthly housing cost is directly tied to the price of the home you purchase and the interest rate you secure for your mortgage.Over the last 30 years, interest rates have fluctuated greatly with rates in the double digits in the 1980s, all the way down to the near 4% we are experiencing now.Your purchasing power is greatly impacted by the interest rate you secure. Act now before rates go up! … [Read more...]

Why You Shouldn’t Take Your House Off the Market During the Holidays

If you are one of the many homeowners who is debating taking your home off the market for the next few weeks, don’t! You will miss the great opportunity you have right now!The latest Existing Home Sales Report from The National Association of Realtors (NAR), revealed that the inventory of homes for sale has dropped to a 4.3-month supply.Historically, a 6-month supply is necessary for a ‘normal’ market, explained below:There are more buyers that are ready, willing, and able to buy now than there … [Read more...]

- « Previous Page

- 1

- …

- 226

- 227

- 228

- 229

- 230

- …

- 249

- Next Page »