If you’re hoping to buy a home this year, you’re probably paying close attention to mortgage rates. Since mortgage rates impact what you can afford when you take out a home loan – and affordability is a challenge today – it’s a good time to look at the big picture of where mortgage rates have been historically compared to where they are now. Beyond that, it’s important to understand their relationship with inflation for insights into where mortgage rates might go in the near future.

Giving Context to the Sticker Shock

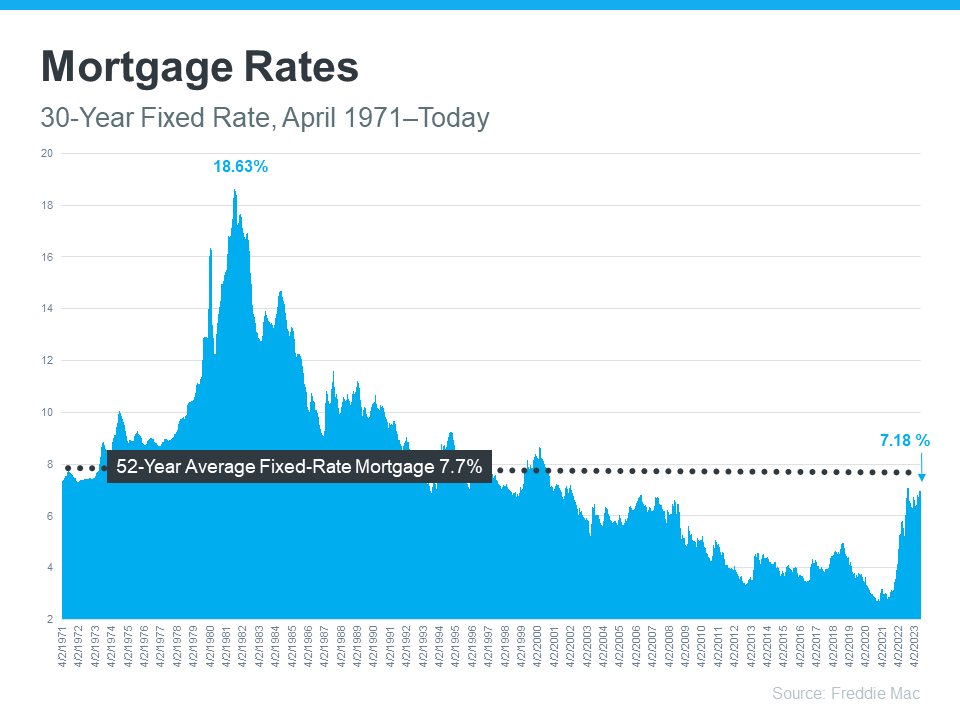

Freddie Mac has been tracking the 30-year fixed mortgage rate since April of 1971. Every week, they release the results of their Primary Mortgage Market Survey, which averages mortgage application data from lenders across the country (see graph below):

Looking at the right side of the graph, mortgage rates have increased significantly since the start of last year. But even with that rise, today’s rates are still below the 52-year average. While that historical perspective is good context, buyers have gotten used to mortgage rates between 3% and 5%, which is where they’ve been over the past 15 years.

Looking at the right side of the graph, mortgage rates have increased significantly since the start of last year. But even with that rise, today’s rates are still below the 52-year average. While that historical perspective is good context, buyers have gotten used to mortgage rates between 3% and 5%, which is where they’ve been over the past 15 years.

That’s important because it explains why the recent jump in rates might have you feeling sticker shock even though they’re close to their long-term average. While many buyers have adjusted to the elevated rates over the past year, a slightly lower rate would be a welcome sight. To determine if that’s a realistic possibility, it’s important to look at inflation.

Where Could Mortgage Rates Go in the Future?

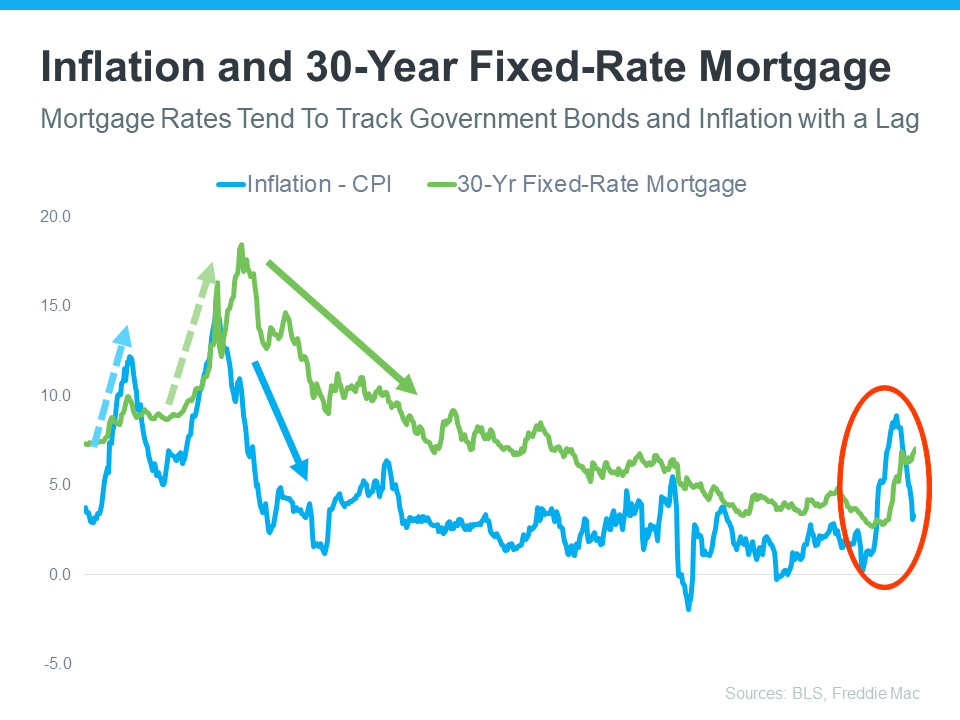

The Federal Reserve has been working hard to lower inflation since early 2022. That’s significant because, historically, there’s been a connection between inflation and mortgage rates (see graph below):

This graph shows a pretty reliable relationship between inflation and mortgage rates. Looking at the left side of the graph, each time inflation moves significantly (shown in blue), mortgage rates follow suit shortly after (shown in green).

This graph shows a pretty reliable relationship between inflation and mortgage rates. Looking at the left side of the graph, each time inflation moves significantly (shown in blue), mortgage rates follow suit shortly after (shown in green).

The circled portion of the graph points out the most recent spike in inflation, with mortgage rates following closely behind. As inflation has moderated a bit this year, mortgage rates haven’t yet made a similar move.

That means, if history is any guide, the market is waiting for mortgage rates to follow inflation and head back down. It’s impossible to accurately predict where mortgage rates will go for sure, but moderating inflation means mortgage rates going down in the near future would fit a well-established trend.

Bottom Line

To understand where mortgage rates may be going, it’s helpful to look at where they’ve been in the past. There’s a clear connection between inflation and mortgage rates, and if that historical relationship holds true, the recent decline in inflation may mean good news for the future of mortgage rates and your homeownership goals.