You want mortgage rates to fall – and they've started to. But is it going to last? And how low will they go?Experts say there’s room for rates to come down even more over the next year. And one of the leading indicators to watch is the 10-year treasury yield. Here's why.The Link Between Mortgage Rates and the 10-Year Treasury YieldFor over 50 years, the 30-year fixed mortgage rate has closely followed the movement of the 10-year treasury yield, which is a widely watched benchmark for long-term interest rates (see … [Read more...]

What Buyers Say They Need Most (And How the Market’s Responding)

A recent survey from Bank of America asked would-be homebuyers what would help them feel better about making a move, and it’s no surprise the answers have a clear theme. They want affordability to improve, specifically prices and rates (see below):Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.Prices Are ModeratingOver the past few years, home prices … [Read more...]

3 Reasons Affordability Is Showing Signs of Improvement This Fall

For the past couple of years, it’s been tough for a lot of homebuyers to make the numbers work. Home prices shot up. Mortgage rates too. And a number of people hit pause because it just didn’t feel possible. Maybe you were one of them.But there’s some encouraging news. If you’ve been waiting for a better time to jump back in, affordability may finally be showing signs of improvement this fall.The latest data from Redfin shows the typical monthly mortgage payment has been coming down, and is now about $290 lower … [Read more...]

What a Fed Rate Cut Could Mean for Mortgage Rates

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will drop? Let’s clear up the confusion.The Fed Doesn’t Directly Set Mortgage RatesRight now, all eyes are on the Fed. Most economists expect they'll cut the Federal Funds Rate at their mid-September meeting to try to head off a potential recession.According to the CME FedWatch Tool, markets are already betting on it. There’s virtually a 100% chance of a September cut. … [Read more...]

Mortgage Rates Just Saw Their Biggest Drop in a Year

You’ve been waiting for what feels like forever for mortgage rates to finally budge. And last week, they did – in a big way.On Friday, September 5th, the average 30-year fixed mortgage rate fell to the lowest level since October 2024. It was the biggest one-day decline in over a year.What Sparked the Drop?According to Mortgage News Daily, this was a reaction to the August jobs report, which came out weaker-than-expected for a second month in a row. That sent signals across the financial markets, and then mortgage … [Read more...]

Condos Could Be a Win for Today’s Buyers

Not every homebuyer wants the biggest house on the block. Some want something simpler, more affordable, and easier to maintain, especially in a market where every dollar counts. That’s where condos come in.For first-time buyers, they can be a smart way to get into homeownership without stretching your budget. For downsizers, they offer less space to maintain with the flexibility to stay in a great location.And right now, condos are one of the most buyer-friendly parts of the market.Condo Inventory Is Up, And That … [Read more...]

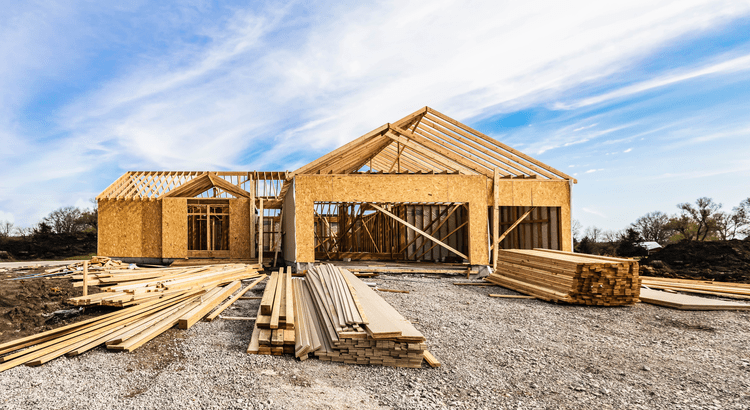

Are These Myths About Buying a Newly Built Home Holding You Back?

If you’ve been skipping over newly built homes in your search, you might be doing so based on outdated assumptions. Let’s clear up a few of the most common myths, so you don’t miss out on a solid opportunity.Myth 1: New Homes Are More ExpensiveIt’s easy to assume a new build will cost more than an existing home, but that’s not necessarily true, especially right now.Data from Census and the National Association of Realtors (NAR) shows the median price of a newly built home today is actually lower than a home that’s … [Read more...]

3 Advantages of Buying a Newly Built Home Today

Some HighlightsPrices, rates, and finding the right home are three of the biggest challenges for buyers today. You may find better luck with all 3 if you look at newly built homes.There are more available. Builders are more flexible on prices right now. And people who buy new homes tend to get lower rates in this market thanks to the incentives builders can offer.Connect with an agent if you want to see the new builds available in and around your area. … [Read more...]

The Truth About Down Payments (It’s Not What You Think)

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in.“I’ll never save enough.”“I need a small fortune just to get started.”“I guess I’ll just rent forever.”Sound familiar? You’re not alone. And you’re definitely not out of luck.Here’s the thing: a lot of what you’ve heard about down payments just isn’t true. And once you know the facts, you might realize you’re a lot closer to owning a home than you think.Let’s break it all down and bust some big down payment … [Read more...]

Why a Newly Built Home Might Be the Move Right Now

Are you looking for better home prices, or even a lower mortgage rate? You might find both in one place: a newly built home. While many buyers are overlooking new construction, it could be your best opportunity in today’s market. Here’s why.There are more brand-new homes available right now than there were even just a few months ago. According to the most recent data from the Census and the National Association of Realtors (NAR), roughly 1 in 5 homes for sale right now is new construction. So, if you’re not looking … [Read more...]