So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection.This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.How to Choose an InspectorYour agent will most likely have a short list of inspectors that … [Read more...]

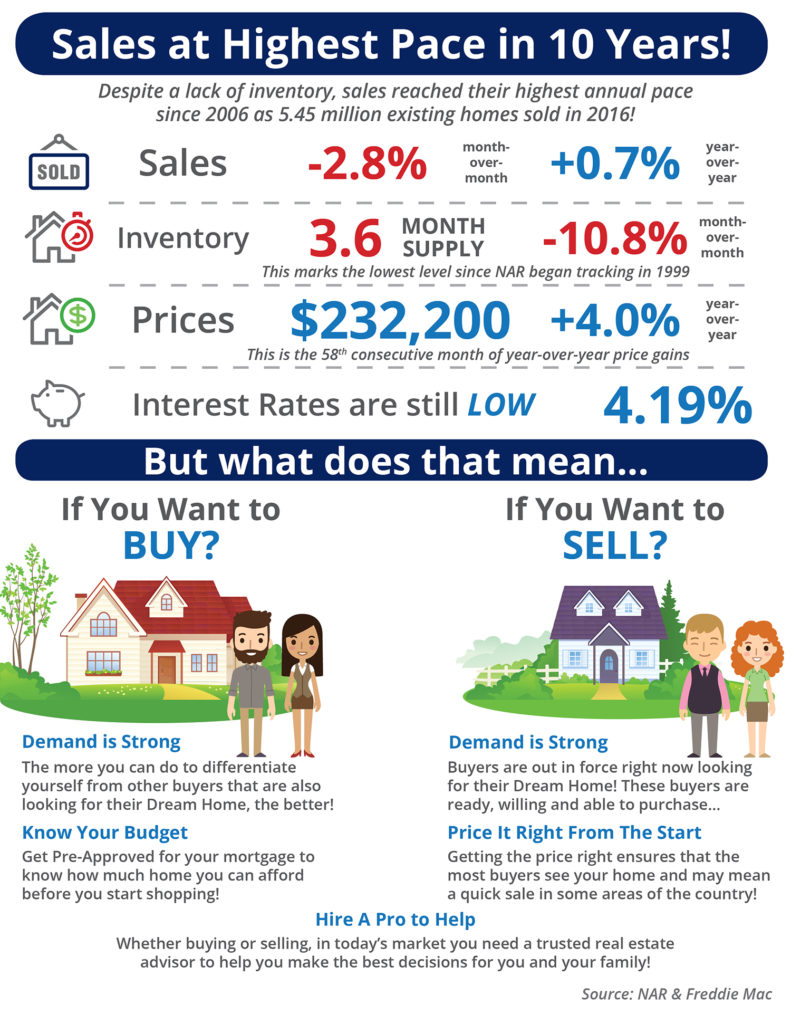

Sales at Highest Pace in 10 Years! [INFOGRAPHIC]

Highlights:45 million existing homes were sold in 2016! This is the highest mark set since 2006.Inventory of existing homes for sale dropped to a 3.6-month supply, the lowest level since NAR began tracking in 1999.The median price of homes sold in December was $232,200. This is the 58th consecutive month of year-over-year price gains. … [Read more...]

Thinking of Selling? Why Now is the Time

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year.The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of … [Read more...]

Buying a Home is More Affordable Than Renting in 66% of US Counties

According to ATTOM Data Solutions’ 2017 Rental Affordability Report, buying a home is more affordable than renting in 354 of the 540 U.S. counties they analyzed.The report found that “making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on a three-bedroom property in 354 of the 540 counties analyzed in the report (66 percent).”For the report, ATTOM Data Solutions compared recently … [Read more...]

How Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history!The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house … [Read more...]

Have You Saved Enough for Closing Costs?

There are many potential homebuyers, and even sellers, who believe that they need at least a 20% down payment in order to buy a home or move on to their next home. Time after time, we have dispelled this myth by showing that many loan programs allow you to put down as little as 3% (or 0% with a VA loan).If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs.Freddie Mac defines closing costs … [Read more...]

Tips for Preparing Your House For Sale [INFOGRAPHIC]

Highlights:When listing your house for sale your top goal will be to get the home sold for the best price possible!There are many small projects that you can do to ensure this happens!Your real estate agent will have a list of specific suggestions for getting your house ready for market and is a great resource for finding local contractors who can help! … [Read more...]

Will Housing Affordability Be a Challenge in 2017?

Some industry experts are saying that the housing market may be heading for a slowdown in 2017 based on rising home prices and a jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).Here is how NAR defines the index:“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent … [Read more...]

What Would a Millennial Baby Boom Mean for Housing?

Recently released data from the National Center for Health Statistics revealed that 1.3 million Millennial women gave birth for the first time in 2015. There are now over 16 million women in this generation who have become mothers.“All told, Millennial women (those born between 1981 to 1997) accounted for about eight in ten (82%) of U.S. births in 2015.”The data also shows that this generation has waited until later in life to become parents as only 42% of Millennial women were moms in 2014, compared to … [Read more...]

5 Myths About Real Estate Reality TV Explained

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV binge session? We’ve all been there… watching entire seasons of “Love it or List it,” “Fixer Upper,” “House Hunters,” “Property Brothers,” and so many more, just in one sitting.When you’re in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need … [Read more...]

- « Previous Page

- 1

- …

- 224

- 225

- 226

- 227

- 228

- …

- 250

- Next Page »