If you’re planning to buy a home this year, you may be focused on the spring market. And hoping that when spring does hit, you’ll see:Mortgage rates drop a little more.More homes hit the market.But here’s what most buyers don’t realize. Buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.Here are three reasons why accelerating your timeline over the next few weeks could actually be a better play.1. Holding Out for Lower Rates May Pay Off A lot of buyers are … [Read more...]

Home Insurance Costs Are Rising: What Buyers Should Plan For

Buying a home is one of the biggest purchases you’ll ever make. And homeowner’s insurance is what protects that investment. Think of it as your safety net. NerdWallet explains it:Covers Repairs and Rebuilding Costs: If your home is damaged by fire, storms, or other covered events, it helps pay for repairs and possibly even a full rebuild, if that’s deemed necessary.Protects Your Belongings: It can also cover personal items like furniture, electronics, jewelry, and clothing if they’re stolen or damaged.Provides … [Read more...]

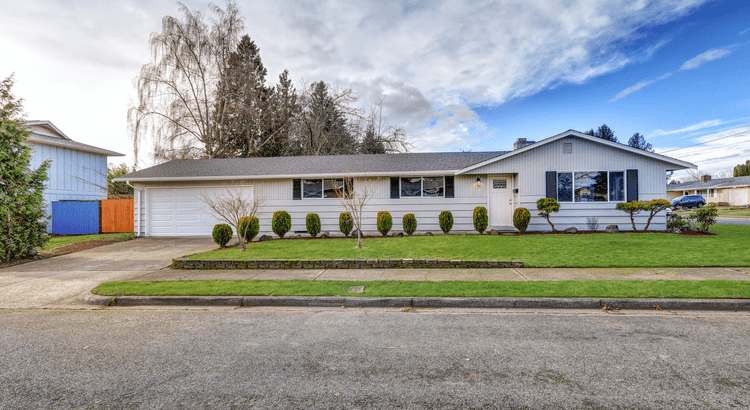

You May Not Want To Skip Over That House That’s Been Sitting on the Market

When you see a house that’s been sitting on the market for a while, the reaction is almost automatic. You start thinking:What’s wrong with it?Why hasn’t anyone bought it yet?Am I missing something?That mindset made sense a few years ago. But in today’s market, you may actually miss out.More Time on Market Isn't Automatically a Concern AnymoreA few years ago, homes sold in just a matter of days. Sometimes, hours. Anything that lingered longer than that raised concerns. But that’s no longer the baseline.Inventory has … [Read more...]

Why Pre-Approval Should Be Your First Step – Not an Afterthought

Finding the right home feels exciting – but being pre-approved for your loan is what makes it possible. Whether you’re planning to buy soon or still just thinking about it, getting pre-approved is one of the best moves you can make. Here’s why.1. What Is Pre-Approval, Really?Pre-approval is much more than a guess. It means a lender has reviewed your finances (things like your income, assets, credit score, debts, and savings) and told you how much they’re willing to let you borrow for your loan.It’s basically a … [Read more...]

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Momentum is quietly building in the housing market. New data from NerdWallet shows more Americans are starting to think about buying a home again. Last year, 15% of respondents said they planned to buy a home in the next 12 months. This year, that number rose to 17%.That 2% increase might not sound like a big jump, but in a market where buyer demand has been cooling for the past few years, it’s a sign things are starting to shift. More people are feeling ready (or at least closer to ready) to take the leap and buy … [Read more...]

Is January the Best Time To Buy a Home?

You may not want to put your homebuying plans into hibernation mode this winter. While a lot of people assume spring is the ideal time to buy a house, new data shows January may actually be the best time of year for budget-conscious buyers. Kind of surprising, right? Here’s why January deserves a serious look.1. Prices Tend To Be Lower This Time of YearLending Tree says January is the least expensive month to buy a home. And there’s something to that. January has historically offered one of the lowest … [Read more...]

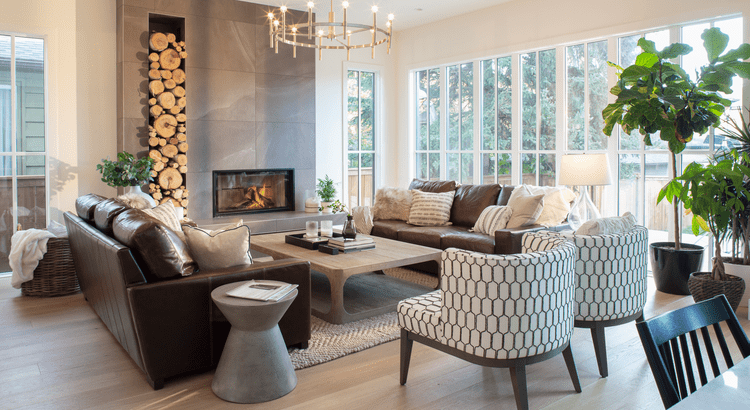

This May Be the Best Time To Buy a Brand-New Home

New home construction today is giving buyers something it feels like they haven't gotten much lately: a real shot at both the home they want and the deal they need. More brand-new options are on the market right now, and builders are rolling out incentives that make these homes more affordable than many people expect.It’s a combination that doesn’t come around often – and it’s putting buyers in a surprisingly strong position this season. Here’s why this moment matters and why it’s worth partnering with your own … [Read more...]

How To Find the Best Deal Possible on a Home Right Now

Want to know how to find the best deal possible in today’s housing market? Here’s the secret. Focus on homes that have been sitting on the market for a while.Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And that’s where the savviest buyers are finding homes other buyers overlook.The Opportunity: 1 in 5 Homes Has Had a Price Cut This YearAccording to Realtor.com, about 1 in every 5 listings (20.2%) have dropped their asking price at least once. And while so … [Read more...]

Most Experts Are Not Worried About a Recession

Homebuyers are watching the economy closely, and for good reason. Buying a home is one of the biggest purchases most people ever make. And some recession talk in the media has made a lot of would-be buyers second guess their plans.In the latest LendingTree survey, almost 2 in 3 Americans said they think a recession is coming. And 74% of respondents say that's having an impact on their financial decisions.But here’s the good news: the experts aren’t nearly as concerned.Most Americans Expect a Recession, But Most … [Read more...]

The VA Home Loan Advantage: What Every Veteran Should Know Right Now

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful homebuying tools out there. The chance to buy a home without having a down payment.Unfortunately, 70% of Veterans (that's 7 out of every 10) don’t know about this benefit, according to Veterans United.And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really need to know about Veterans Affairs (VA) home loans right now.Why VA Home Loans Can Be a … [Read more...]

- 1

- 2

- 3

- …

- 12

- Next Page »