Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household … [Read more...]

Slaying Home Buying Myths [INFOGRAPHIC]

Some Highlights:Interest rates are still below historic numbers.88% of property managers raised their rent in the last 12 months!The credit score requirements for mortgage approval continue to fall. … [Read more...]

Home Mortgages: Rates Up, Requirements Easing

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen.The Mortgage Bankers Association (MBA) quantifies the availability of mortgage credit each month with their Mortgage Credit Availability Index (MCAI). According to the MBA, the MCAI is:“A summary measure which indicates the … [Read more...]

Millennials Flock to Low Down Payment Programs

A recent report released by Down Payment Resource shows that 65% of first-time homebuyers purchased their homes with a down payment of 6% or less in the month of January.The trend continued through all buyers with a mortgage, as 62% made a down payment of less than 20%, which is consistent with findings from December.An article by DS News points to the new wave of millennial homebuyers:“It seems that the long-awaited influx of millennial home buyers is beginning. Ellie Mae reported that mortgages to … [Read more...]

Again… You Do Not Need 20% Down to Buy NOW!

A survey by Ipsos found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. There are two major misconceptions that we want to address today.1. Down PaymentThe survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 40% of consumers think a 20% down payment is always required. In actuality, there are many loans written with a down payment … [Read more...]

2 Myths That May Be Holding Back Buyers

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.” Myth #1: “I Need a 20% Down Payment” Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) … [Read more...]

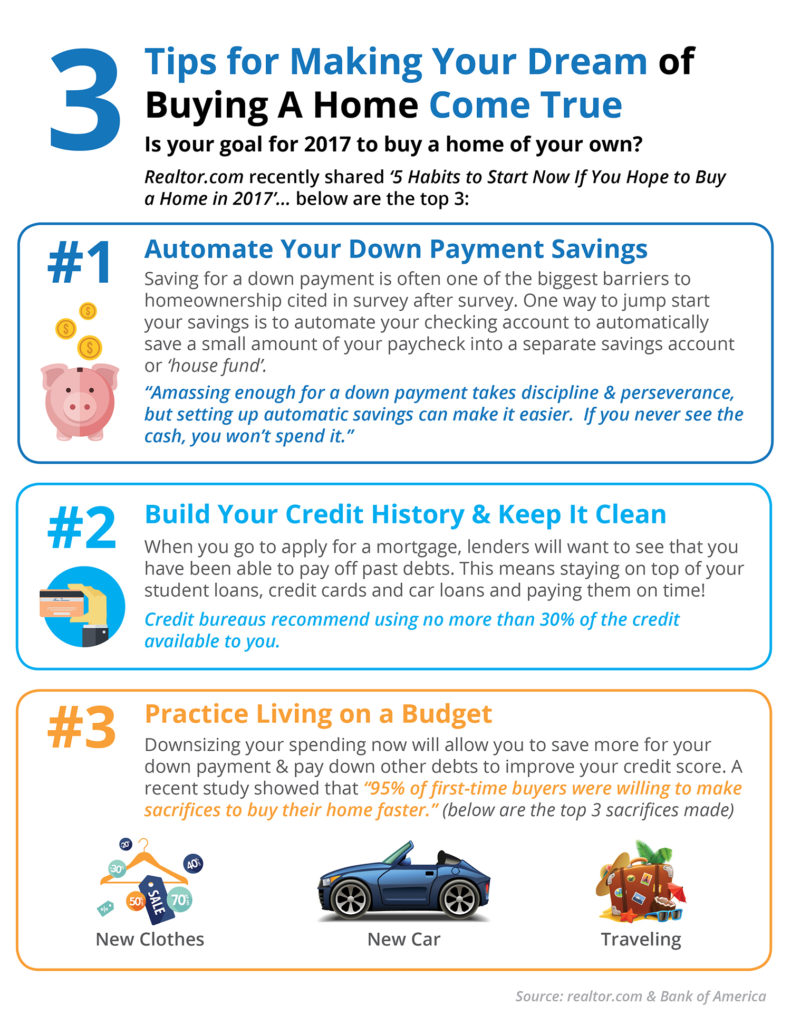

3 Tips for Making Your Dream of Buying a Home Come True [INFOGRAPHIC]

Some Highlights:Realtor.com recently shared “5 Habits to Start Now If You Hope to Buy a Home in 2017.”Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking a lot about it.Living within a budget now will help you save money for down payments and pay down other debts that might be holding you back. … [Read more...]

The Dangers of “Tight Mortgage Credit” Headlines

The availability of mortgage credit is not at the same level that it was during the boom in housing (2005), and that’s good news. However, the constant headlines which talk about “tight credit” are causing some potential home buyers to doubt their ability to purchase. We want to rectify the misconception of what is required for a down payment in order to purchase a home in today’s market.Freddie Mac recently discussed the confusion many first-time homebuyers have about the down payment they … [Read more...]

You Can Save for a Down Payment Faster Than You Think

In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home. Depending on where you live, median rents, incomes and home prices all vary. By determining the percentage of income a renter spends on housing in each state, and the amount needed for a 10% down payment, they were able to establish how long (in years) it would take for an average resident to save. According to the … [Read more...]

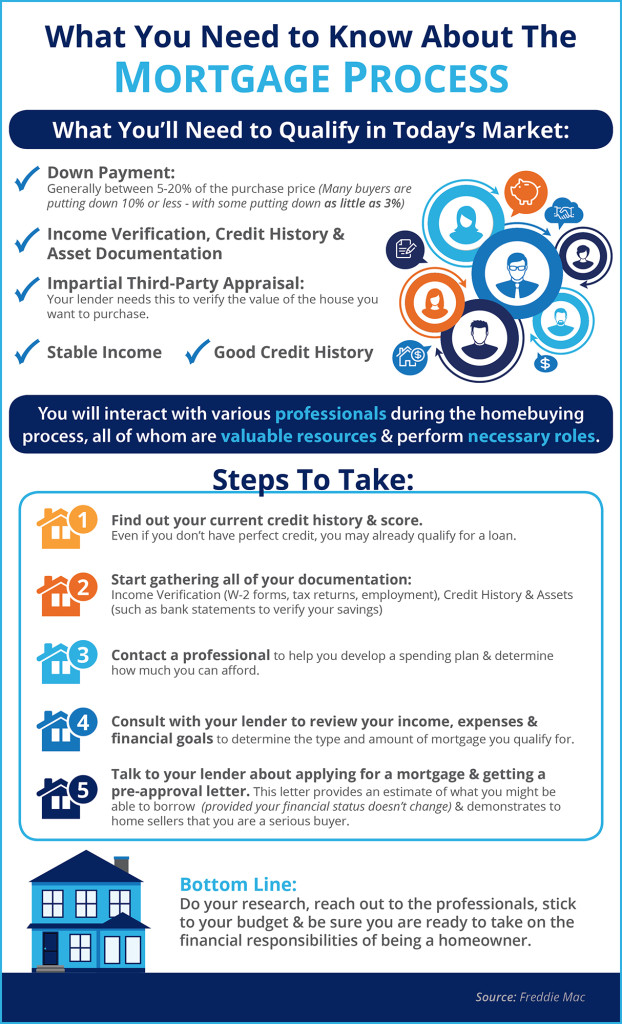

The Mortgage Process: What You Need To Know [INFOGRAPHIC]

Some Highlights: Many buyers are purchasing a home with a down payment as little as 3%. You may already qualify for a loan, even if you don't have perfect credit. Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford. … [Read more...]