If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! We recently shared data from Trulia’s Market Mismatch Study which showed that in today’s premium home market, buyers are in control. The inventory of homes for sale in the luxury market far exceeds those searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer, or can be found at a discount.Those who have a … [Read more...]

Millionaire to Millennials: Buy Now!

Self-made millionaire David Bach was quoted in a CNBC article explaining that "the single biggest mistake millennials are making" is not purchasing a home because buying real estate is "an escalator to wealth.”Bach went on to explain:"If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter."In his bestselling book, “The Automatic … [Read more...]

Renting or Buying… Either Way You’re Paying a Mortgage

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage - either yours or your landlord’s.As Entrepreneur Magazine, a premier source for small business, explained this month in their article, “12 Practical Steps to Getting Rich”:“While renting on a temporary basis isn't terrible, you should most certainly own the roof … [Read more...]

First Time Homebuyer 101

Whether you’re a first time homebuyer or you're making your next purchase, buying a new home can be stressful. As lead Buyer Specialist for The Sibley Group at Keller Williams Realty, my job is to make sure the process is as enjoyable as possible. Step 1 The National Association of Realtors reports nearly 92% of first time homebuyers take to the internet to begin their search, and while that’s not a bad idea, I highly recommend meeting with an experienced local Realtor first to save yourself a good chunk of time. … [Read more...]

What Are the Experts Saying about Mortgage Rates?

Mortgage interest rates have risen over the last few months and projections are that they will continue their upswing throughout 2017. What impact will this have on the housing market? Here is what the experts are saying:Laurie Goodman, Co-director of the Urban Institute’s Housing Finance Policy Center:“In 1984, 1994, 2000, and 2013, every time we have rate increases, we have increases in nominal home prices. We expect this to be more pronounced, as there is a big demand-and-supply gap at the present … [Read more...]

4 Great Reasons to Buy This Spring!

Here are four great reasons to consider buying a home today instead of waiting.1. Prices Will Continue to RiseCoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.9% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.8% over the next year.The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.2. Mortgage Interest Rates Are Projected to IncreaseFreddie … [Read more...]

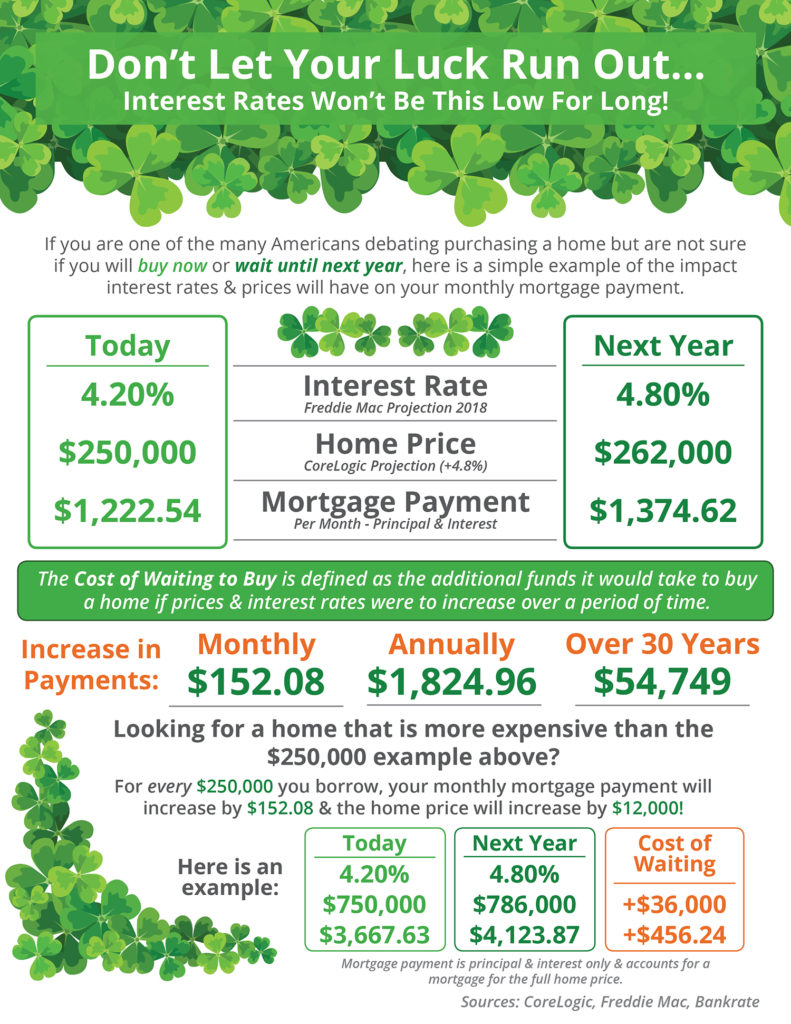

Don’t Let Your Luck Run Out [INFOGRAPHIC]

Some Highlights: The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.8% according to CoreLogic.Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage! … [Read more...]

Which Homes Have Appreciated the Most?

Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 7.1%. CoreLogic, in their most recent Home Price Insights Report, reveals that national home prices have increased by 6.9% year-over-year.The CoreLogic report broke down appreciation even further into four different price categories:Lower Priced Homes: priced at 75% or less of the medianLow-to-Middle Priced … [Read more...]

A Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture

The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the National Association of Realtors latest Existing Home Sales Report. Inventory is now 7.1% lower than this time last year, marking the 20th consecutive month of year-over-year drops.Historically, inventory must reach a 6-month supply for a normal market where home prices appreciate with inflation. Anything less than a 6-month supply is a sellers’ market, where the demand for … [Read more...]

Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.Here is a chart showing … [Read more...]

- « Previous Page

- 1

- …

- 85

- 86

- 87

- 88

- 89

- …

- 102

- Next Page »