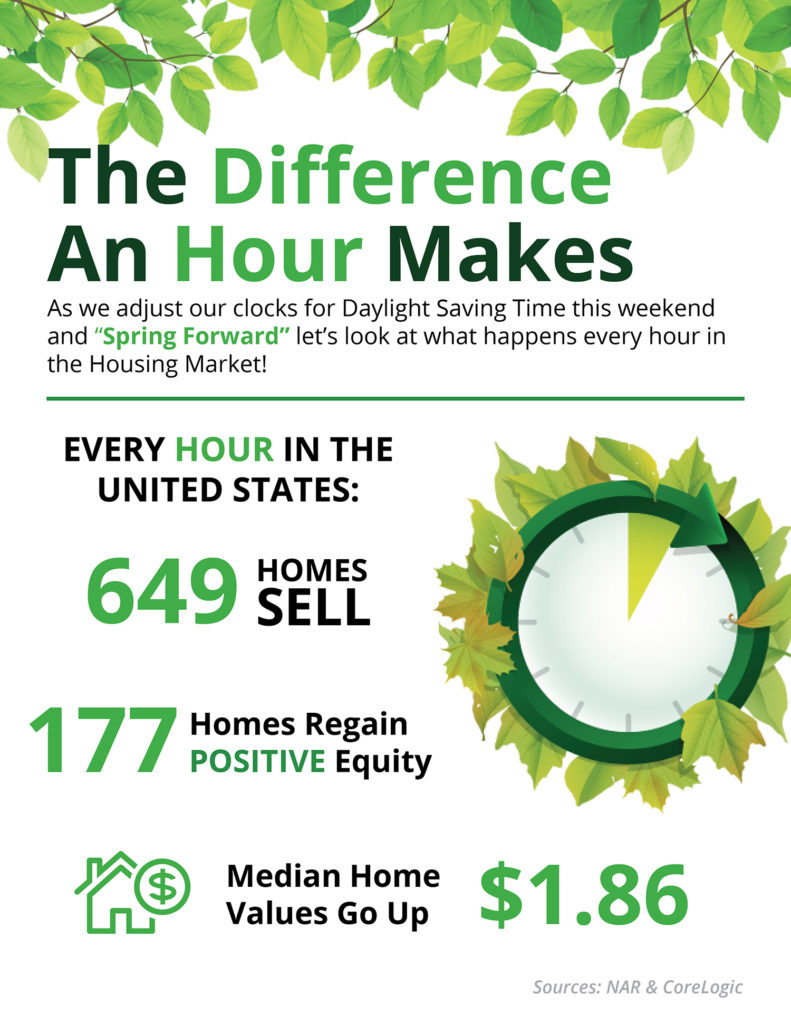

Some Highlights:Don’t forget to set your clocks forward this Sunday, March 12th at 2:00 AM EST in observance of Daylight Savings Time.Unless of course, you are a resident of Arizona or Hawaii!Every hour in the United States: 649 homes are sold, 177 homes regain equity (meaning they are no longer underwater on their mortgage), and the median home price rises $1.86! … [Read more...]

Builder Confidence Hits 11-Year High

In many areas of the country, there are not enough homes for sale to satisfy the number of buyers looking to purchase their dream homes. Experts have long proposed that a ramp-up in new, single-family home construction would be one of the many ways to overcome this inventory shortage.According to a recent survey conducted by the National Association of Home Builders (NAHB) and Wells Fargo, housing market confidence amongst builders reached an 11-year high last month.What Does High Confidence Mean for the Housing … [Read more...]

The Connection Between Home Prices & Family Wealth

Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.So, what does this mean for homeowners and their equity position?As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?Since the experts … [Read more...]

Mortgage Rates Impact on 2017 Home Values

There is no doubt that historically low mortgage interest rates were a major impetus to housing recovery over the last several years. However, many industry experts are showing concern about the possible effect that the rising rates will have moving forward.The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are all projecting that mortgage interest rates will move upward in 2017. Increasing interest rates will definitely impact purchasers and may stifle demand.In a … [Read more...]

Over Half of All Buyers Are Surprised by Closing Costs

According to a recent survey conducted by ClosingCorp, over half of all homebuyers are surprised by the closing costs required to obtain their mortgage.After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all, while another 35% were stunned by how much higher the fees were than expected.“Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance and … [Read more...]

How Long Do Most Families Stay in Their Home?

The National Association of Realtors (NAR) keeps historical data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years – an increase of almost 50%.Why the dramatic increase?The reasons for this change are plentiful!The fall in home prices during the housing crisis … [Read more...]

The Impact of Homeownership on Family Health

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.”Today, we want to cover the section of the … [Read more...]

Are You 1 of the 59 Million Planning to Buy This Year?

According to a survey conducted by Bankrate.com, one in four Americans are considering buying a home this year. If this statistic proves to be true, that means that 59 million people will be looking to enter the housing market in 2017.The survey also revealed 3 key takeaways:Those most likely to buy are ‘Older Millennials’ (ages 27-36) or ‘Generation X’ (ages 37-52)Minorities, particularly African-Americans, were twice as likely to respond that they were considering purchasing a home this … [Read more...]

US Housing Market Is Moving into ‘Buy Territory’!

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment.The BH&J Index is a quarterly report that attempts to answer the question:In today’s housing market, is it better to rent or buy a home?The index examines the entire US housing market and then isolates 23 major cities for comparison. The … [Read more...]

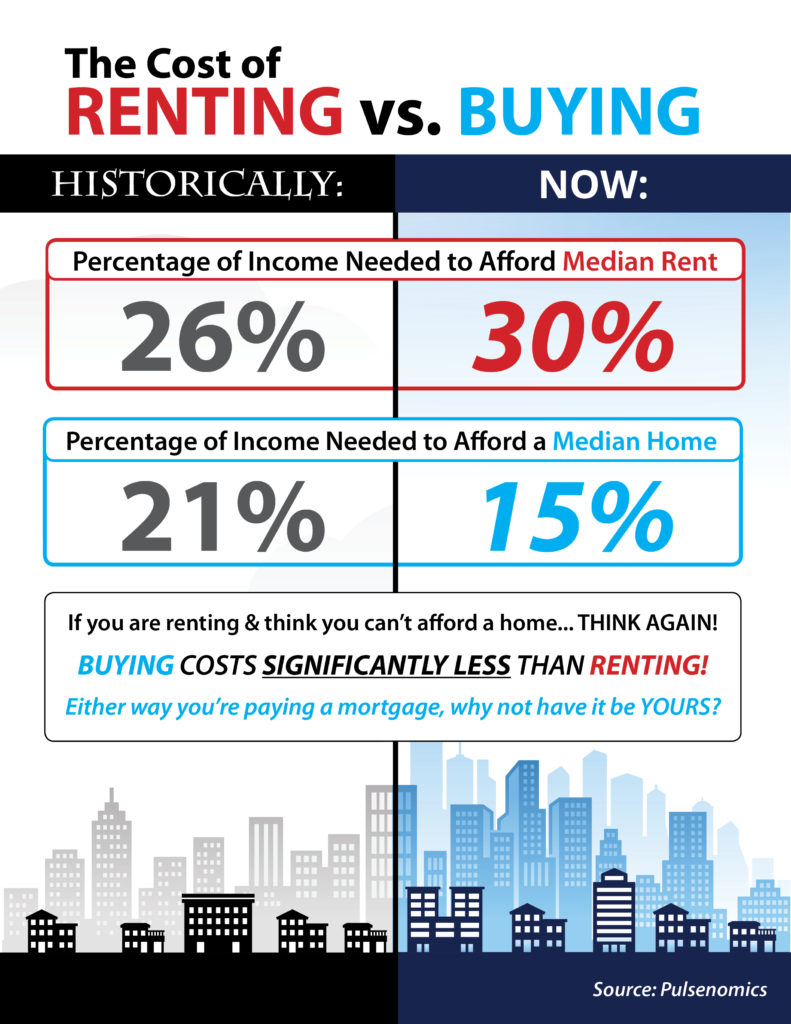

Do You Know the Real Cost of Renting vs. Buying? [INFOGRAPHIC]

Some Highlights:Historically, the choice between renting or buying a home has been a close decision.Looking at the percentage of income needed to rent a median-priced home today (30%), vs. the percentage needed to buy a median-priced home (15%), the choice becomes obvious.Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home of your own! … [Read more...]

- « Previous Page

- 1

- …

- 86

- 87

- 88

- 89

- 90

- …

- 102

- Next Page »