So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection.This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.How to Choose an InspectorYour agent will most likely have a short list of inspectors that … [Read more...]

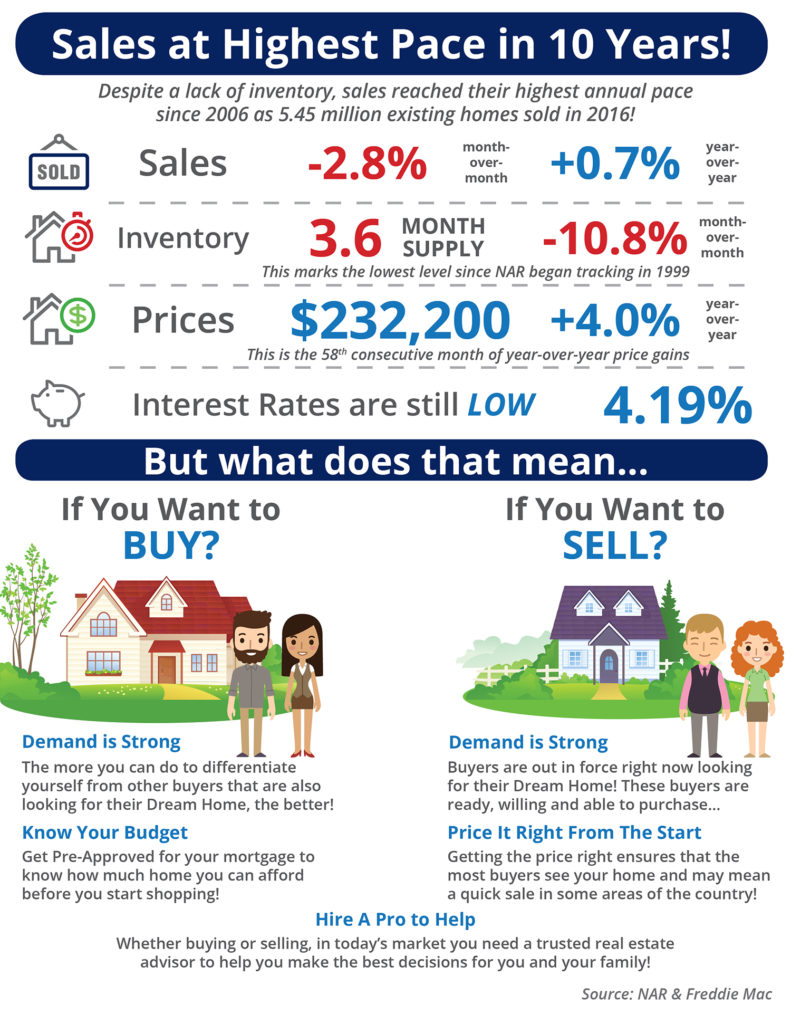

Sales at Highest Pace in 10 Years! [INFOGRAPHIC]

Highlights:45 million existing homes were sold in 2016! This is the highest mark set since 2006.Inventory of existing homes for sale dropped to a 3.6-month supply, the lowest level since NAR began tracking in 1999.The median price of homes sold in December was $232,200. This is the 58th consecutive month of year-over-year price gains. … [Read more...]

Buying a Home is More Affordable Than Renting in 66% of US Counties

According to ATTOM Data Solutions’ 2017 Rental Affordability Report, buying a home is more affordable than renting in 354 of the 540 U.S. counties they analyzed.The report found that “making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on a three-bedroom property in 354 of the 540 counties analyzed in the report (66 percent).”For the report, ATTOM Data Solutions compared recently … [Read more...]

How Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history!The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house … [Read more...]

Have You Saved Enough for Closing Costs?

There are many potential homebuyers, and even sellers, who believe that they need at least a 20% down payment in order to buy a home or move on to their next home. Time after time, we have dispelled this myth by showing that many loan programs allow you to put down as little as 3% (or 0% with a VA loan).If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs.Freddie Mac defines closing costs … [Read more...]

Will Housing Affordability Be a Challenge in 2017?

Some industry experts are saying that the housing market may be heading for a slowdown in 2017 based on rising home prices and a jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).Here is how NAR defines the index:“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent … [Read more...]

What Would a Millennial Baby Boom Mean for Housing?

Recently released data from the National Center for Health Statistics revealed that 1.3 million Millennial women gave birth for the first time in 2015. There are now over 16 million women in this generation who have become mothers.“All told, Millennial women (those born between 1981 to 1997) accounted for about eight in ten (82%) of U.S. births in 2015.”The data also shows that this generation has waited until later in life to become parents as only 42% of Millennial women were moms in 2014, compared to … [Read more...]

Why Pre-Approval Should Be Your First Step

In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.Even if you are in a market that is not as competitive, knowing your budget will give you the confidence of knowing if your dream home is within your … [Read more...]

You Need a Professional on Your Team When Buying a Home

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to do it on their own. In today’s market: you need an experienced professional!You Need an Expert Guide if You Are Traveling a Dangerous PathThe field of real estate is loaded with land mines; you need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and is ready for you to move into can be … [Read more...]

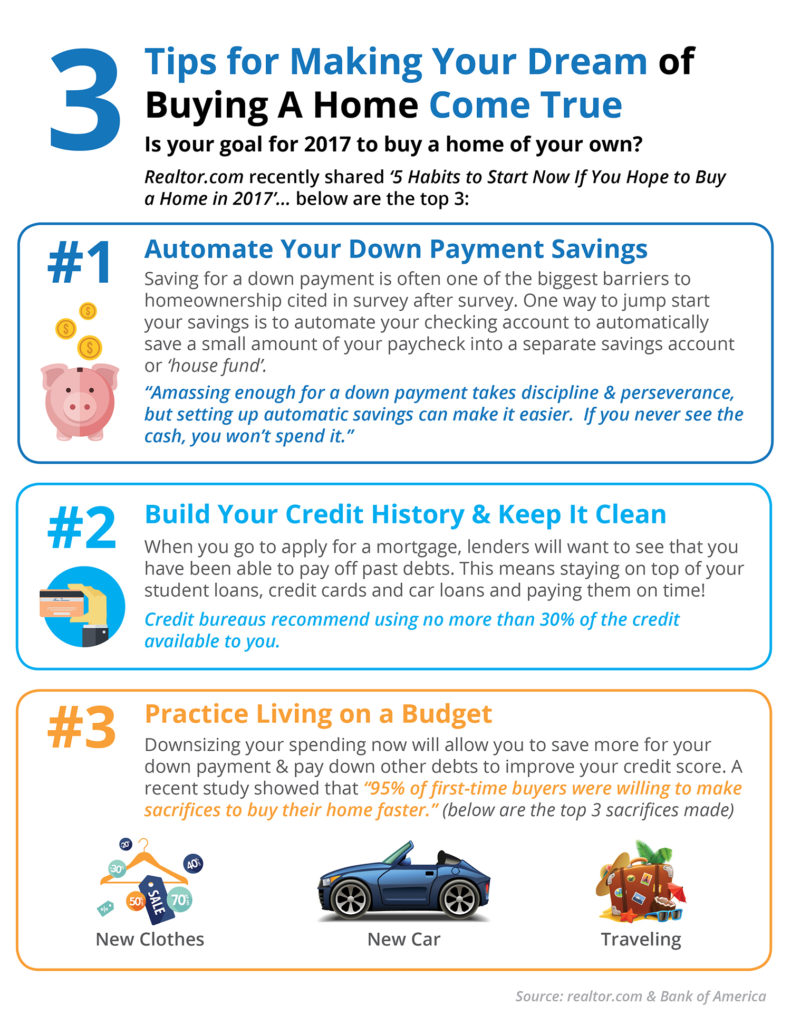

3 Tips for Making Your Dream of Buying a Home Come True [INFOGRAPHIC]

Some Highlights:Realtor.com recently shared “5 Habits to Start Now If You Hope to Buy a Home in 2017.”Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking a lot about it.Living within a budget now will help you save money for down payments and pay down other debts that might be holding you back. … [Read more...]

- « Previous Page

- 1

- …

- 88

- 89

- 90

- 91

- 92

- …

- 102

- Next Page »