Last week, CNBC ran an article quoting self-made millionaire David Bach explaining that not purchasing a home is "the single biggest mistake millennials are making" because buying real estate is "an escalator to wealth.”Bach went on to explain:"If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter."In his bestselling book, “The Automatic Millionaire,” Bach does the … [Read more...]

5 Reasons to Resolve to Hire a Real Estate Professional [INFOGRAPHIC]

Some Highlights:As we usher in the new year, one thing is for certain… if you plan to buy or sell a house this year, you need a real estate professional on your team!There are many benefits to using a local professional!Pick a pro who knows your local market and can help you navigate the housing market! … [Read more...]

Homeowner’s Net Worth Is 45x Greater Than A Renter’s

Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400).In a Forbes article, the National Association of Realtors’ (NAR) Chief Economist Lawrence Yun predicts that by the end of 2016, the net worth gap will widen even further to 45 times greater.The graph below … [Read more...]

The Fed Raised Rates: What Does that Mean for Housing?

You may have heard that the Federal Reserve raised rates last week… But what does that mean if you are looking to buy a home in the near future? Many in the housing industry have predicted that the Federal Open Market Committee (FOMC), the policy-making arm of the Federal Reserve, would vote to raise the federal fund's target rate at their December meeting. For only the second time in a decade, this is exactly what happened. There were many factors that contributed to the 0.25 point increase (from 0.50 to … [Read more...]

Student Loans = Higher Credit Scores

According to a recent analysis by CoreLogic, Millennial renters (aged 20-34) who have student loan debt also have higher credit scores than those who do not have student loans.This may come as a surprise, as there is so much talk about student loans burdening Millennials and holding them back from many milestones that previous generations have been able to achieve (i.e. homeownership, investing for retirement).CoreLogic used the information provided on rental applications and the applicants’ credit history … [Read more...]

Whether You Rent or Buy: Either Way You’re Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.Are you ready … [Read more...]

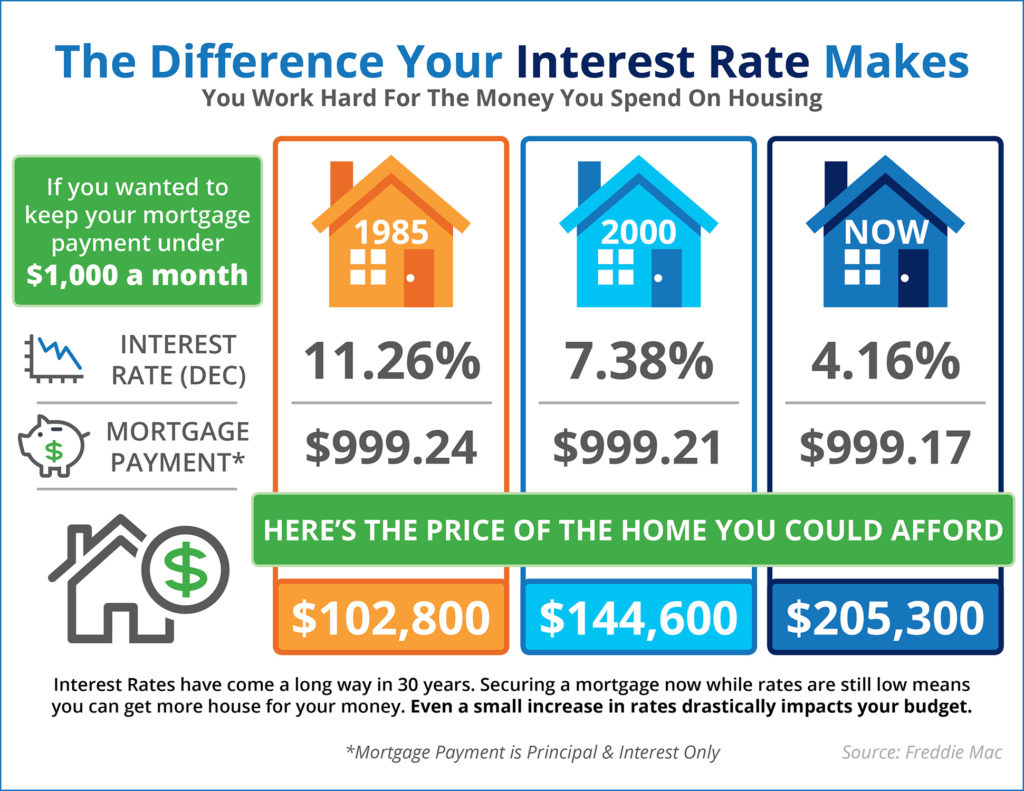

The Impact Your Interest Rate Has on Your Buying Power [INFOGRAPHIC]

Some Highlights:Your monthly housing cost is directly tied to the price of the home you purchase and the interest rate you secure for your mortgage.Over the last 30 years, interest rates have fluctuated greatly with rates in the double digits in the 1980s, all the way down to the near 4% we are experiencing now.Your purchasing power is greatly impacted by the interest rate you secure. Act now before rates go up! … [Read more...]

Building Your Family’s Wealth Over the Next 5 Years

Over the next five years, home prices are expected to appreciate 3.24% per year on average and to grow by 21.4% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.So, what does this mean for homeowners and their equity position?As an example, let’s assume a young couple purchases and closes on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?Since the experts predict that … [Read more...]

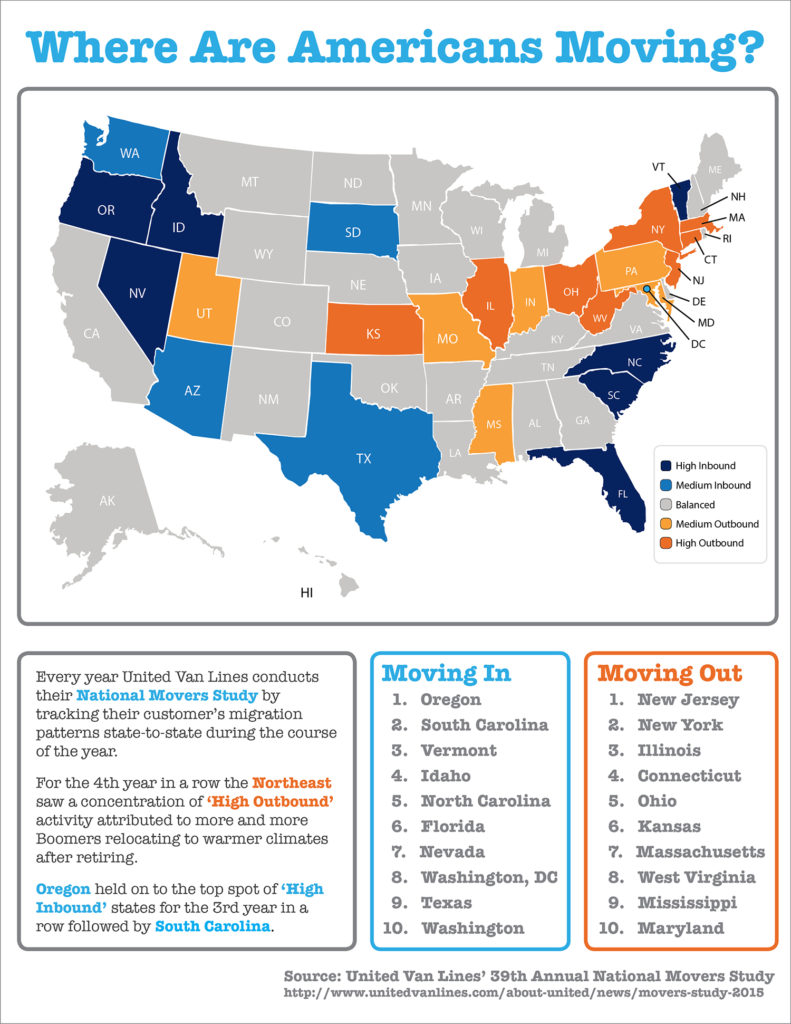

Americans Are on The Move [INFOGRAPHIC]

Some Highlights:For the 4th year in a row, the Northeast saw a concentration of High Outbound activity.Oregon held on to the top stop of High Inbound states for the 3rd year in a row.Much of this Outbound activity can be attributed to Boomers relocating to warmer climates after retiring. … [Read more...]

Will Increasing Mortgage Rates Impact Home Prices?

There are some who are calling for a decrease in home prices should mortgage interest rates begin to rise rapidly. Intuitively, this makes sense as the cost of a home is determined by the price of the home, plus the cost of financing that home. If mortgage interest rates increase, fewer people will be able to buy, and logic says prices will fall if demand decreases.However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.Here is a graph showing … [Read more...]

- « Previous Page

- 1

- …

- 89

- 90

- 91

- 92

- 93

- …

- 102

- Next Page »