If you’re searching for a home online, you’re not alone; lots of people are doing it. The question is, are you using all of your available resources, and are you using them wisely? Here’s why the Internet is a great place to start the home-buying process, and the truth on why it should never be your only go-to resource when it comes to making such an important decision. According to the National Association of Realtors (NAR), the three most popular information sources home buyers use in the home … [Read more...]

Be on the Lookout for Gen Z: The Next Generation of Homebuyers

Gen Zers are the next generation of homeowners, and they’re eager to jump in and buy their first homes. Whether you are part of this generation or any other, it’s never too early to start saving, so you can reach your homeownership goal sooner rather than later. You’ve likely heard a ton about Millennials, but what about Gen Z? In the next 5 years, this generation will be between the ages of 23 and 28, and they’re eager to become homeowners faster than you may think. According to … [Read more...]

You Need More Than a Guide. You Need a Sherpa.

In today’s world, hiring an agent who has a finger on the pulse of the market will make your buying or selling experience an educated one. In a normal housing market, whether you’re buying or selling a home, you need an experienced guide to help you navigate the process. You need someone you can turn to who will tell you how to price your home correctly right from the start. You need someone who can help you determine what to offer on your dream home without paying too much or offending the seller with … [Read more...]

Homeownership is the Top Contributor to Your Net Worth

Recently two U.S. Census Bureau researchers released their findings on the biggest determinants of household wealth. What they found may help shape your view on building your family’s net worth. Many people plan to build their net worth by buying CDs or stocks, or just having a savings account. Recently, however, Economist Jonathan Eggleston and Survey Statistician Donald Hays, both of the U.S. Census Bureau, shared the biggest determinants of wealth, “The biggest determinants of household wealth [are] … [Read more...]

What FICO® Score Do You Need to Qualify for a Mortgage?

It’s common knowledge that your FICO® score plays an important role in the homebuying process. However, many buyers have misconceptions regarding what exactly is required to get the loans they need. While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner … [Read more...]

62% of Buyers Are Wrong About Down Payment Needs

Contrary to common misconception, a down payment is often much less than many believe. According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market: “More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.” When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think … [Read more...]

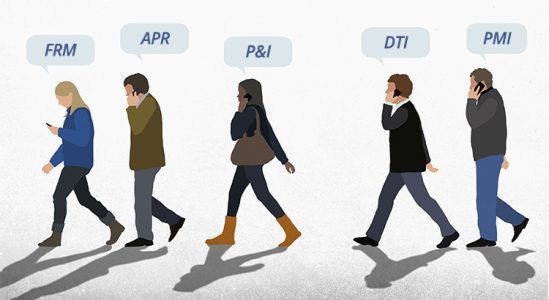

5 Homebuying Acronyms You Need to Know [INFOGRAPHIC]

Some Highlights: Learning the lingo of homebuying is an important part of feeling successful when buying a home. From APR to P&I, you need to know the acronyms that will come up along the way, and what they mean when you hear them. Your local professionals are here to help you feel confident and informed from start to finish…and this infographic will help you as you go. … [Read more...]

Homeowners Are Happy! Renters? Not So Much.

When people talk about homeownership and the American Dream, much of the conversation revolves around the financial benefits of owning a home. However, two recent studies show that the non-financial benefits might be even more valuable. In a recent survey, Bank of America asked homeowners: “Does owning a home make you happier than renting?” 93% of the respondents answered yes, while only 7% said no. The survey also revealed: More than 80% said they wouldn’t go back to renting 88% agreed that … [Read more...]

Are You Ready for the ‘Black Friday’ of Real Estate?

According to a new study from realtor.com, the week of September 22 is the best time of year to buy a home, making it ‘Black Friday’ for homebuyers. Every year, ‘Black Friday’ is a highly anticipated event for eager shoppers. Some people prepare for weeks, crafting and refining a strategic shopping agenda, determining exactly when to arrive at each store, and capturing a wish list of discounted must-have items to purchase. But what about buying a home? Is there a ‘Black Friday’ … [Read more...]

Should You Fix Your House Up or Sell Now?

If you’re thinking about remodeling your house before you list it, take a look at these three tips to help you decide if you really need to fix it up before you sell. The answer may surprise you. With the fall season upon us, change is in the air. For many families, children are growing up and moving out of the house, maybe leaving for college or taking a jump into the working world. Parents are finding themselves as empty nesters for the first time. The question inevitably arises: is it finally time to … [Read more...]

- « Previous Page

- 1

- …

- 102

- 103

- 104

- 105

- 106

- …

- 177

- Next Page »