Some Highlights:‘Millennials’ are defined as 18-36 year olds according to the US Census Bureau.According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 31 years old.More and more ‘Old Millennials’ (25-36 year olds) are realizing that homeownership is within their reach now! … [Read more...]

Home Mortgages: Rates Up, Requirements Easing

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen.The Mortgage Bankers Association (MBA) quantifies the availability of mortgage credit each month with their Mortgage Credit Availability Index (MCAI). According to the MBA, the MCAI is:“A summary measure which indicates the … [Read more...]

Millennials Flock to Low Down Payment Programs

A recent report released by Down Payment Resource shows that 65% of first-time homebuyers purchased their homes with a down payment of 6% or less in the month of January.The trend continued through all buyers with a mortgage, as 62% made a down payment of less than 20%, which is consistent with findings from December.An article by DS News points to the new wave of millennial homebuyers:“It seems that the long-awaited influx of millennial home buyers is beginning. Ellie Mae reported that mortgages to … [Read more...]

Careful…Don’t Get Caught in the Rental Trap!

There are many benefits to homeownership. One of the top benefits is being able to protect yourself from rising rents by locking in your housing cost for the life of your mortgage.Don’t Become Trapped Jonathan Smoke, Chief Economist at realtor.com, reported on what he calls a “Rental Affordability Crisis.” He warns that,“Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price … [Read more...]

Why Millennials Choose to Buy [INFOGRAPHIC]

Some Highlights:“The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”At 93%, the top reason Millennials choose to buy is to have control over their living space.Many Millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls … [Read more...]

The ‘REAL’ News about Housing Affordability

Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).Here is how NAR defines the index:“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national … [Read more...]

Buying this Spring? Be Prepared for Bidding Wars

Traditionally, spring is the busiest season for real estate. Buyers come out in force and homeowners list their houses for sale hoping to capitalize on buyer activity. This year will be no different!Buyers have already been out in force looking for their dream homes and more are on their way, but the challenge is that the inventory of homes for sale has not kept up with demand, which has lead to A LOT of competition for the homes that are available.A recent Bloomberg article touched on the current market … [Read more...]

Again… You Do Not Need 20% Down to Buy NOW!

A survey by Ipsos found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. There are two major misconceptions that we want to address today.1. Down PaymentThe survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 40% of consumers think a 20% down payment is always required. In actuality, there are many loans written with a down payment … [Read more...]

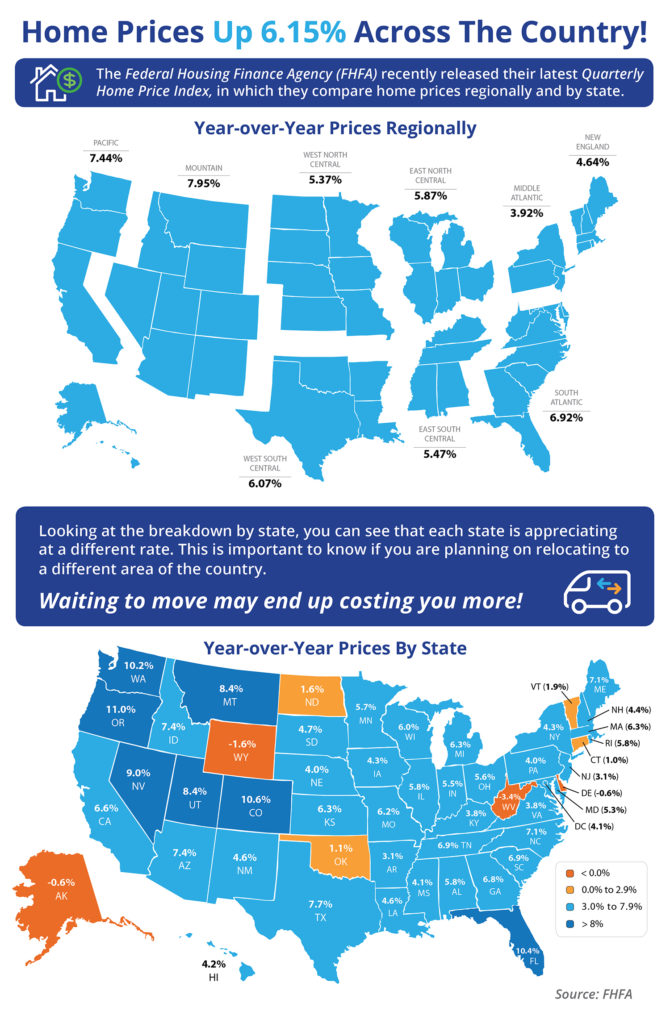

Home Prices Up 6.15% Across the Country! [INFOGRAPHIC]

Some Highlights:The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report.In the report, home prices are compared both regionally and by state.Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more!Alaska, Delaware, West Virginia & Wyoming were the only one states where home prices are lower than they were last year. … [Read more...]

Consumer Confidence in Economy & Housing is Soaring

The success of the housing market is strongly tied to the consumer’s confidence in the overall economy. For that reason, we believe 2017 will be a great year for real estate. Here is just a touch of the news coverage on the subject.HousingWire:“Consumers’ faith in the housing market is stronger than it’s ever been before, according to a newly released survey from Fannie Mae.”Bloomberg:“Americans’ confidence continued to mount last week as the Bloomberg Consumer Comfort … [Read more...]

- « Previous Page

- 1

- …

- 153

- 154

- 155

- 156

- 157

- …

- 177

- Next Page »