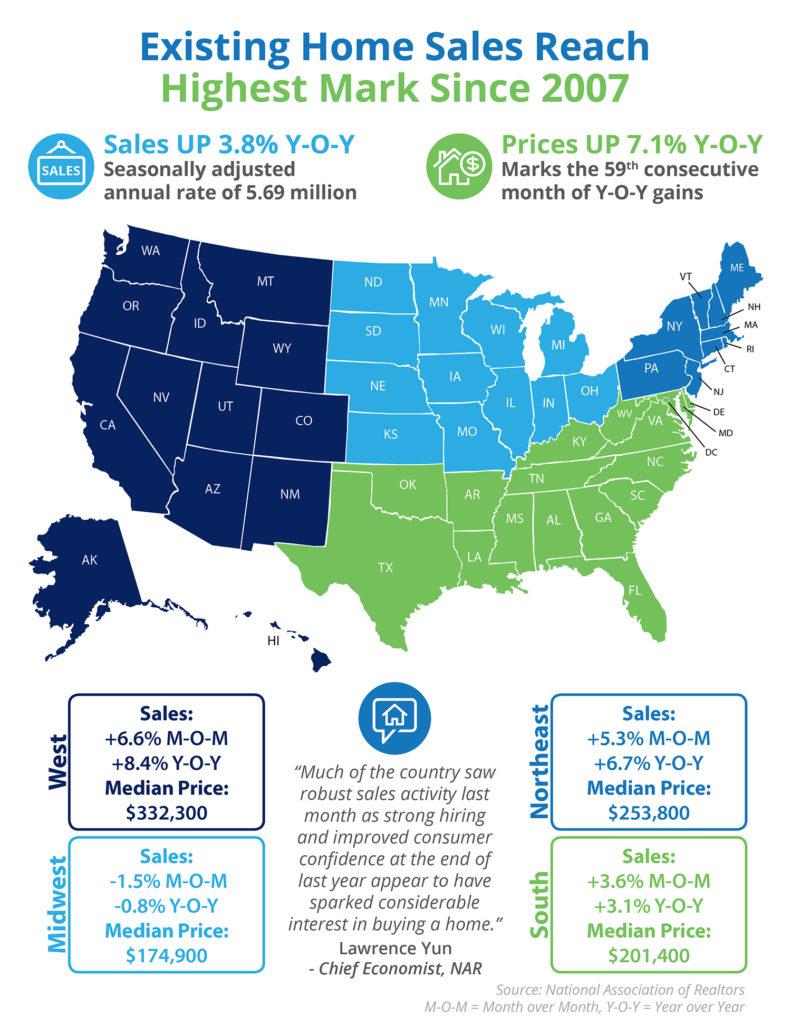

Highlights:Sales of existing homes reached the highest pace in a decade at a seasonally adjusted annual rate of 5.69 million.January marked the 59th consecutive month of year-over-year price gains as the median home price rose 7.1% to $228,900.NAR’s Chief Economist, Lawrence Yun had this to say, “Much of the country saw robust sales activity last month as strong hiring and improved consumer confidence at the end of last year appear to have sparked considerable interest in buying a home." … [Read more...]

The Impact of Homeownership on Family Health

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.”Today, we want to cover the section of the … [Read more...]

Are You 1 of the 59 Million Planning to Buy This Year?

According to a survey conducted by Bankrate.com, one in four Americans are considering buying a home this year. If this statistic proves to be true, that means that 59 million people will be looking to enter the housing market in 2017.The survey also revealed 3 key takeaways:Those most likely to buy are ‘Older Millennials’ (ages 27-36) or ‘Generation X’ (ages 37-52)Minorities, particularly African-Americans, were twice as likely to respond that they were considering purchasing a home this … [Read more...]

US Housing Market Is Moving into ‘Buy Territory’!

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment.The BH&J Index is a quarterly report that attempts to answer the question:In today’s housing market, is it better to rent or buy a home?The index examines the entire US housing market and then isolates 23 major cities for comparison. The … [Read more...]

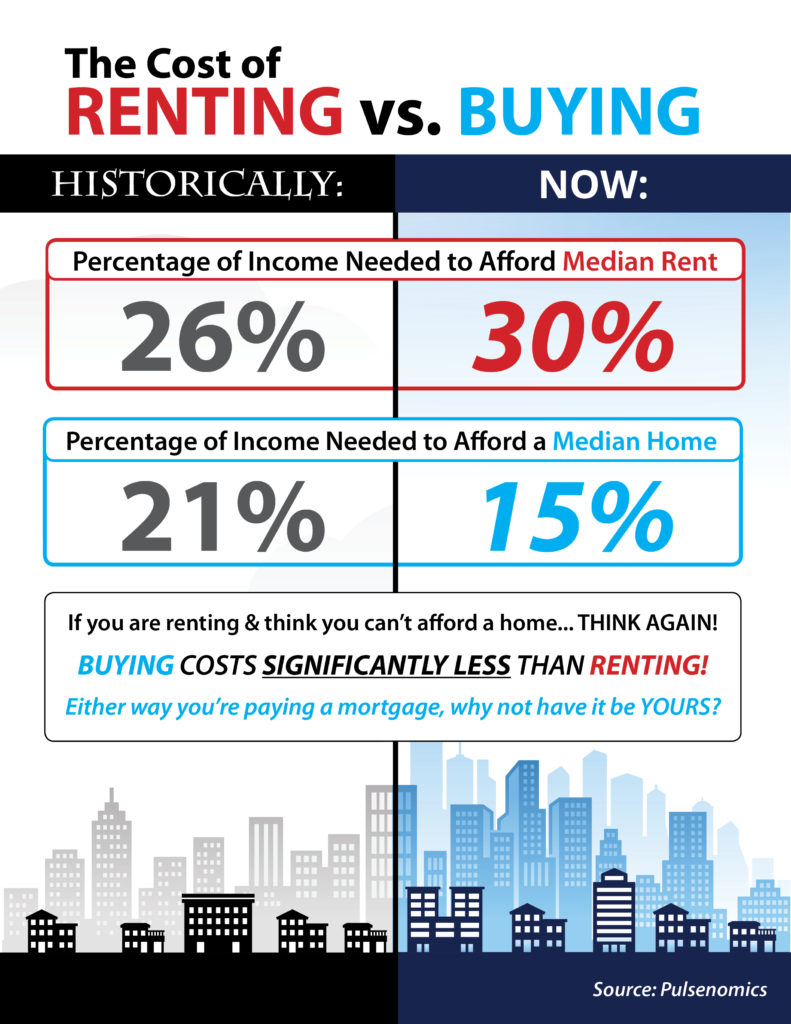

Do You Know the Real Cost of Renting vs. Buying? [INFOGRAPHIC]

Some Highlights:Historically, the choice between renting or buying a home has been a close decision.Looking at the percentage of income needed to rent a median-priced home today (30%), vs. the percentage needed to buy a median-priced home (15%), the choice becomes obvious.Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home of your own! … [Read more...]

The Impact of Homeownership on Civic Involvement

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.”Today, we want to cover the section of the … [Read more...]

The Great News About Rising Prices for Homeowners

Recently there has been a lot of talk about home prices and if they are accelerating too quickly. As we mentioned before, in some areas of the country, seller supply (homes for sale) cannot keep up with the number of buyers out looking for a home, which has caused prices to rise.The great news about rising prices, however, is that according to CoreLogic’s US Economic Outlook, the average American household gained over $11,000 in equity over the course of the last year, largely due to home value … [Read more...]

First Comes Love… Then Comes Mortgage?

According to the National Association of REALTORS most recent Profile of Home Buyers & Sellers, married couples once again dominated the first-time homebuyer statistics in 2016 at 58% of all buyers. It is no surprise that having two incomes to save for down payments and contribute to monthly housing costs makes buying a home more attainable.But, many couples are also deciding to buy a home before spending what would be a down payment on a wedding, as unmarried couples made up 14% of all first-time buyers last … [Read more...]

3 Questions to Ask If You Want to Buy Your Dream Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.Ask yourself the following 3 questions to help determine if now is a good time for you to buy in today’s market.1. Why am I buying a home in the first place? This is truly the most important question to answer. Forget the finances for a minute. Why … [Read more...]

5 Reasons to Love Using A RE Pro [INFOGRAPHIC]

Highlights:Hiring a real estate professional to guide you through the process of buying a home or selling your house can be one of the best decisions you make!They are there for you to help with paperwork, explaining the process, negotiations, and helping you with pricing (both when making an offer or setting the right price for your home).One of the top reasons to hire a real estate professional is their understanding of your local market and how the conditions in your neighborhood will impact your experience. … [Read more...]

- « Previous Page

- 1

- …

- 156

- 157

- 158

- 159

- 160

- …

- 177

- Next Page »