The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.”Today, we want to cover the section of the … [Read more...]

Homeownership Offers Stability & Wealth Creation

The most recent Housing Pulse Survey released by the National Association of Realtors revealed that the two major reasons Americans prefer owning their own home instead of renting are:They want the opportunity to build equity.They want a stable and safe environment.Building EquityIn a recent article by The Mortgage Reports, they report that “buying and owning a home is the essence of ‘The American Dream.’ Each month, your housing payments go toward owning your home instead of … [Read more...]

Lack of Homes for Sale Slowing Down the Housing Market

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up. Home sales are up. Distressed sales (foreclosures and short sales) have fallen dramatically. It seems that 2017 will be the year that the housing market races forward again.However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the winter, supply is not keeping … [Read more...]

Daydreaming About Your Perfect Home? Know What You WANT vs. What You NEED

In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search.If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale through rose-colored glasses.Do … [Read more...]

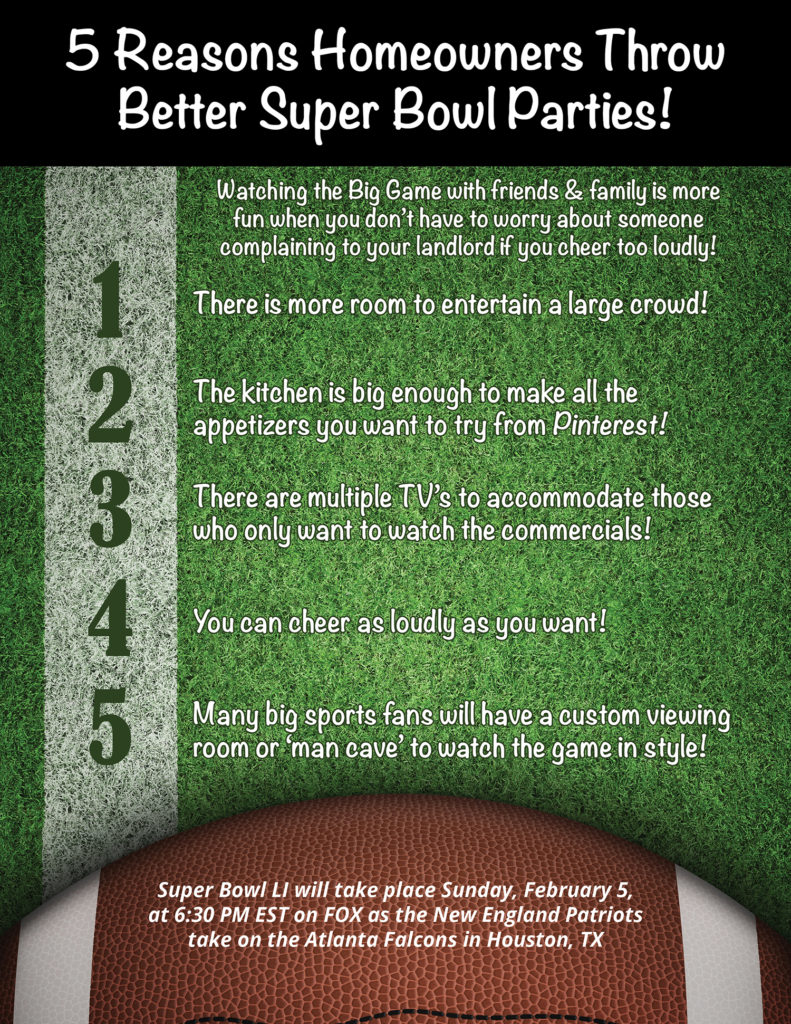

5 Reasons Homeowners Throw Better Super Bowl Parties! [INFOGRAPHIC]

Highlights:Watching the Big Game at home with your friends & family offers many advantages.There’s more room to entertain a large crowd, and you don’t have to worry about complaints to your landlord if you cheer too loudly!The kitchen is big enough to make as many appetizers as you want, and if some of your guests are only there to watch the commercials, they can do so on a different TV in another room! … [Read more...]

Buyer Demand Is Outpacing the Supply of Homes for Sale

The price of any item is determined by the supply of that item, as well as the market demand. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index.Their latest edition sheds some light on the relationship between Seller Traffic (supply) and Buyer Traffic (demand).Buyer DemandThe map below was created after asking the question: … [Read more...]

Thinking of Making an Offer? 4 Tips for Success

So you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market that you want to make sure you make a good offer so that you can guarantee your dream of making this house yours comes true!Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the 4 Tips they covered along with some additional information for your consideration:1. Understand How … [Read more...]

2 Myths That May Be Holding Back Buyers

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.” Myth #1: “I Need a 20% Down Payment” Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) … [Read more...]

What to Expect From Your Home Inspection

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection.This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.How to Choose an InspectorYour agent will most likely have a short list of inspectors that … [Read more...]

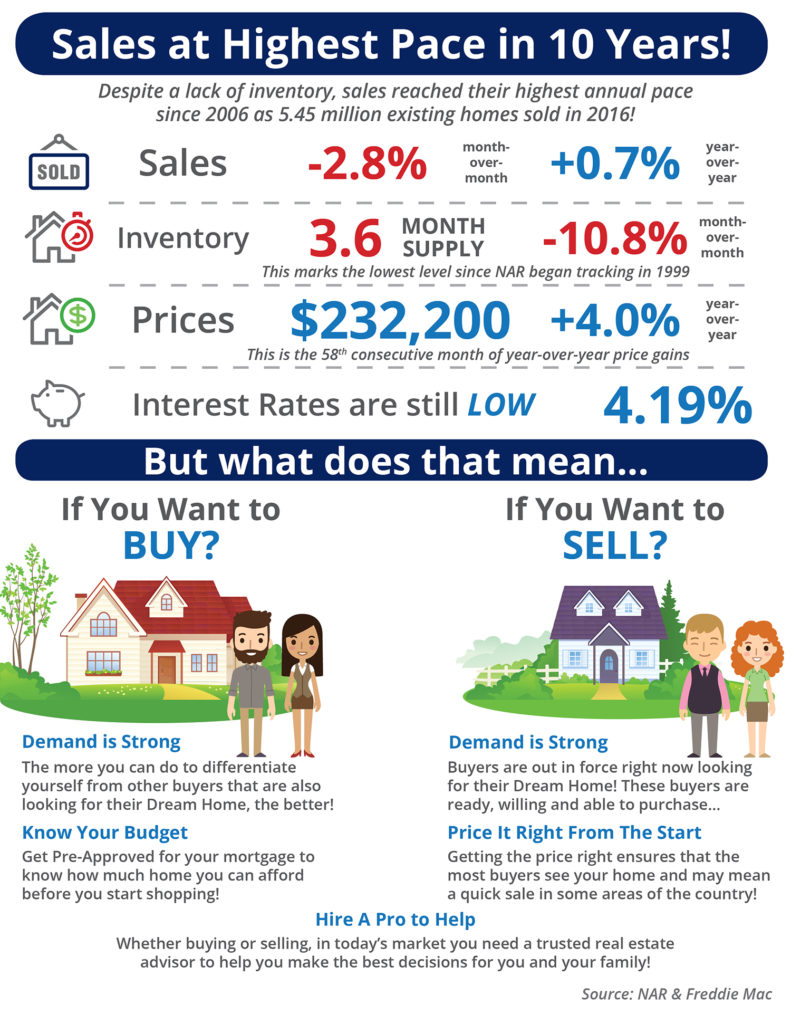

Sales at Highest Pace in 10 Years! [INFOGRAPHIC]

Highlights:45 million existing homes were sold in 2016! This is the highest mark set since 2006.Inventory of existing homes for sale dropped to a 3.6-month supply, the lowest level since NAR began tracking in 1999.The median price of homes sold in December was $232,200. This is the 58th consecutive month of year-over-year price gains. … [Read more...]

- « Previous Page

- 1

- …

- 157

- 158

- 159

- 160

- 161

- …

- 177

- Next Page »