Buying a home is a major life decision. That’s true whether you’re purchasing for the first time or selling your house to fuel a move. And if you’re planning to buy a home, you might be hearing about today’s shifting market and wondering what it means for you. While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors. Instead, it’s necessary to consider why you want to move and how important those reasons … [Read more...]

Three Reasons To Buy a Home in Today’s Shifting Market [INFOGRAPHIC]

Some Highlights The housing market is moving away from the frenzy of the past year and it’s opening doors for you if you’re thinking about buying a home. Housing inventory is increasing, which means more options for your search. Plus, the intensity of bidding wars may ease as buyer demand moderates, leading to fewer homes selling above asking price. If you’re ready to buy a home, now may be the moment you’ve been waiting for. Let’s connect to start the homebuying process today. … [Read more...]

A Real Estate Professional Helps You Separate Fact from Fiction

If you’re following the news, chances are you’ve seen or heard some headlines about the housing market that don’t give the full picture. The real estate market is shifting, and when that happens, it can be hard to separate fact from fiction. That’s where a trusted real estate professional comes in. They can help debunk the headlines so you can really understand today’s market and what it means for you. Here are three common housing market myths you might be hearing, along with the expert analysis that provides … [Read more...]

Want To Buy a Home? Now May Be the Time.

There are more homes for sale today than at any time last year. So, if you tried to buy a home last year and were outbid or out priced, now may be your opportunity. The number of homes for sale in the U.S. has been growing over the past four months as rising mortgage rates help slow the frenzy the housing market saw during the pandemic. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains why the shifting market creates a window of opportunity for you: “This is an opportunity for … [Read more...]

A Window of Opportunity for Homebuyers

Mortgage rates are much higher today than they were at the beginning of the year, and that’s had a clear impact on the housing market. As a result, the market is seeing a shift back toward the range of pre-pandemic levels for buyer demand and home sales. But the transition back toward pre-pandemic levels isn’t a bad thing. In fact, the years leading up to the pandemic were some of the best the housing market has seen. That’s why, as the market undergoes this shift, it’s important to compare today not to the … [Read more...]

What’s Causing Ongoing Home Price Appreciation?

If you’re thinking about making a move, you probably want to know what’s going to happen to home prices for the rest of the year. While experts say price growth will moderate due to the shifting market, ongoing appreciation is expected. That means home prices won’t fall. Here’s a look at two key reasons experts forecast continued price growth: supply and demand. While Growing, Housing Supply Is Still Low Even though inventory is increasing this year as the market moderates, supply is still low. The graph below … [Read more...]

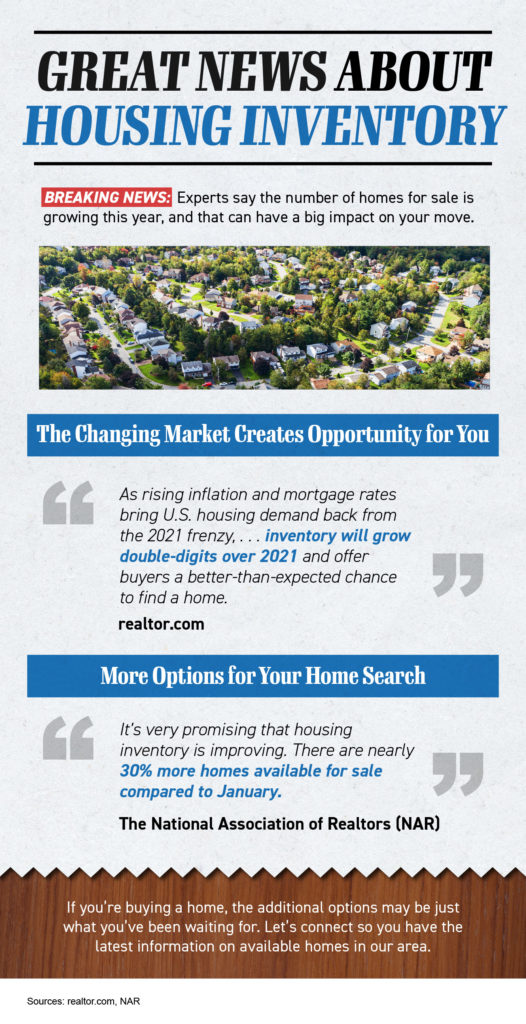

Great News About Housing Inventory [INFOGRAPHIC]

Some Highlights Experts say the number of homes for sale is growing this year, and that can have a big impact on your move. If you’re planning to buy, additional options in today’s market may be just what you’ve been waiting for. More inventory means added opportunities to find the home of your dreams. Let’s connect so you have the latest information on available homes in our area. … [Read more...]

Think Home Prices Are Going To Fall? Think Again

Over the last two years, the rate of home prices appreciated at a dramatic pace. While that led to incredible equity gains for homeowners, it’s also caused some buyers to wonder if home prices will fall. It’s important to know the housing market isn’t a bubble about to burst, and home price growth is supported by strong market fundamentals. To understand why price declines are unlikely, it’s important to explore what caused home prices to rise so much recently, and where experts say home prices are headed. Here’s … [Read more...]

Should You Buy a Home with Inflation This High?

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still going up. You no doubt are feeling the pinch on your wallet at the gas pump or the grocery store, but that news may also leave you wondering: should I still buy a home right now? Greg McBride, Chief Financial Analyst at Bankrate, explains how inflation is affecting the housing market: “Inflation will have a strong influence on where mortgage rates go in the months ahead. . . . Whenever inflation … [Read more...]

Why Pre-Approval Is a Game Changer for Homebuyers

If you’re planning to buy a home this year, you might have heard that pre-approval is a necessary step to take before starting out on your journey. But why is that? And is it still important in today’s shifting market? The truth is, getting a pre-approval letter from your lender is critical, and when it comes to your home search, it can be a game changer in so many ways. To better understand why, it’s important to know what pre-approval is. Freddie Mac defines the process like this: “A pre-approval is an … [Read more...]

- « Previous Page

- 1

- …

- 51

- 52

- 53

- 54

- 55

- …

- 176

- Next Page »