Homeownership is one of the best ways to invest in your financial future, especially as your home equity grows. Home equity is a form of forced savings that can work to your advantage as the value of your home appreciates. Across the country, home equity was increasing before the health crisis swept our nation, and it continues to grow throughout the year, giving sellers powerful options in this market. According to the just-released Q2 Homeowner Equity Insights Report by CoreLogic: “U.S. homeowners with … [Read more...]

Home Builder Confidence Hits All-Time Record

Last week, the National Association of Home Builders (NAHB) reported their Housing Market Index (HMI) hit an all-time high in the 35-year history of the series with a score of 83. The index gauges builder perceptions of current single-family home sales and sale expectations for the next six months, as well as the traffic of prospective buyers of new homes. As the following chart shows, confidence dropped dramatically when stay-in-place orders were originally mandated earlier this year. Since then, it has soared … [Read more...]

Is the Economic Recovery Beating All Projections?

Earlier this year, many economists and market analysts were predicting an apocalyptic financial downturn that would potentially rattle the U.S. economy for years to come. They immediately started to compare it to the Great Depression of a century ago. Six months later, the economy is still trying to stabilize, but it is evident that the country will not face the total devastation projected by some. As we continue to battle the pandemic, forecasts are now being revised upward. The Wall Street Journal (WSJ) just … [Read more...]

Homes Across the Country Are Selling Fast [INFOGRAPHIC]

Some Highlights Buyers are actively searching for and purchasing homes at a record-breaking pace. According to the latest report from the National Association of Realtors (NAR), in July, 68% of homes were on the market for less than a month. With homes moving from listing day to pending sale in an average of just 22 days, it’s a great time to sell a house. Let’s connect today so you can make your move while buyers are scooping homes up faster than they’re coming to market. … [Read more...]

How Low Inventory May Impact the Housing Market This Fall

Real estate continues to be called the ‘bright spot’ in the current economy, but there’s one thing that may hold the housing market back from achieving its full potential this year: the lack of homes for sale. Buyers are actively searching for and purchasing homes, looking to capitalize on today’s historically low interest rates, but there just aren’t enough houses for sale to meet that growing need. Sam Khater, Chief Economist at Freddie Mac, explains: “Mortgage rates have hit … [Read more...]

The Surging Real Estate Market Continues to Climb

Earlier this year, realtor.com announced the release of the Housing Recovery Index, a weekly guide showing how the pandemic has impacted the residential real estate market. The index leverages a weighted average of four key components of the housing industry by tracking each of the following: Housing Demand – Growth in online search activity Home Price – Growth in asking prices Housing Supply – Growth of new listings Pace of Sales – Difference in time-on-market The index compares the … [Read more...]

Is Now a Good Time to Move?

How long have you lived in your current home? If it’s been a while, you may be thinking about moving. According to the latest Profile of Home Buyers and Sellers by the National Association of Realtors (NAR), in 2019, homeowners were living in their homes for an average of 10 years. That’s a long time to time to be in one place, considering the average length of time homeowners used to stay put hovered closer to 6 years. With today’s changing homebuyer needs, especially given how the current health … [Read more...]

Two New Surveys Indicate Urban to Suburban Lean

There has been much talk around the possibility that Americans are feeling less enamored with the benefits of living in a large city and now may be longing for the open spaces that suburban and rural areas provide. In a recent Realtor Magazine article, they discussed the issue and addressed comments made by Lawrence Yun, Chief Economist for the National Association of Realtors (NAR): “While migration trends were toward urban centers before the pandemic, real estate thought leaders have predicted a suburban … [Read more...]

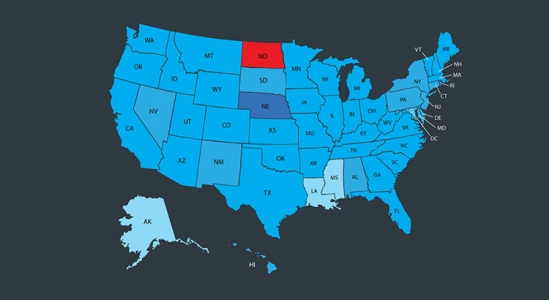

Homebuyer Traffic Is on the Rise

One of the biggest surprises of 2020 is the resilience of the residential real estate market. Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), is now forecasting that more homes will sell this year than last year. He’s also predicting home sales to increase by 8-12% next year. There’s strong evidence that he will be right. ShowingTime, a leading showing software and market stat service provider for the residential real estate industry, just reported on their latest the … [Read more...]

The Latest Unemployment Rate Fell to 8.4%

Last Friday, the Bureau for Labor Statistics released their Employment Report for August 2020. The big surprise was that the unemployment rate fell to 8.4%, a full percent lower than what many analysts had forecasted earlier in the week. Though it is tough to look at this as great news when millions of Americans are still without work, the number of unemployed is currently much lower than most experts had projected it would be just a few months ago. Not Like the Great Depression or Even the Great Recession Jason … [Read more...]

- « Previous Page

- 1

- …

- 62

- 63

- 64

- 65

- 66

- …

- 133

- Next Page »