This year, mortgage rates have started to slowly climb above recent record-breaking lows. Many homeowners planning to move may feel like they’ve missed the chance to score a great rate on their next mortgage. In reality, there’s still time to secure a rate far below the historic norm. Here’s why. After creeping up for seven consecutive weeks, average mortgage rates have dropped more recently (See graph below). With rates taking a slight dip over the past two weeks at the same time the inventory of houses for sale … [Read more...]

How a Change in Mortgage Rate Impacts Your Homebuying Budget

Mortgage rates are on the rise this year, but they’re still incredibly low compared to the historic average. However, anytime there’s a change in the mortgage rate, it affects what you can afford to borrow when you’re buying a home. As Sam Khater, Chief Economist at Freddie Mac, shares: “Since January, mortgage rates have increased half a percentage point from historic lows and home prices have risen, leaving potential homebuyers with less purchasing power.” (See graph below): When buying a home, it’s important … [Read more...]

Buyer & Seller Perks in Today’s Housing Market

Right now, the housing market is full of outstanding opportunities for both buyers and sellers. Whether you’re thinking of buying your first home, moving up to a bigger one, or selling so you can downsize this spring, there are perks today that are powering big moves for people across the country. Here are the top two to keep on the radar this season. The Biggest Perk for Buyers: Low Mortgage Rates Today’s most compelling buyer incentive is low mortgage interest rates. The 30-year fixed-rate is now averaging just … [Read more...]

Will the Housing Market Bloom This Spring?

Spring is almost here, and many are wondering what it will bring for the housing market. Even though the pandemic continues on, it’s certain to be very different from the spring we experienced at this time last year. Here’s what a few industry experts have to say about the housing market and how it will bloom this season. Danielle Hale, Chief Economist, realtor.com: “Despite early weakness, we expect to see new listings grow in March and April as they traditionally do heading into spring, and last year’s … [Read more...]

6 Simple Graphs Proving This Is Nothing Like Last Time

Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year before. 2020 was so strong that many now fear the market’s exuberance mirrors that of the last housing boom and, as a result, we’re now headed for another crash. However, there are many reasons this real estate market is nothing like 2008. Here are six … [Read more...]

How Upset Should You Be about 3% Mortgage Rates?

Last Thursday, Freddie Mac announced that their 30-year fixed mortgage rate was over 3% (3.02%) for the first time since last July. That news dominated real estate headlines that day and the next. Articles talked about the “negative impact” it may have on the housing market. However, we should realize two things: 1. The bump-up in rate should not have surprised anyone. Many had already projected that rates would rise slightly as we proceeded through the year. 2. Freddie Mac’s comments about the rate increase were … [Read more...]

How Smart Is It to Buy a Home Today?

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move. However, there’s one category that provides a simple answer. When deciding to buy now or wait until next year, the financial aspect of the purchase is easy to evaluate. You just need to ask yourself … [Read more...]

The Reason Mortgage Rates Are Projected to Increase and What It Means for You

We’re currently experiencing historically low mortgage rates. Over the last fifty years, the average on a Freddie Mac 30-year fixed-rate mortgage has been 7.76%. Today, that rate is 2.81%. Flocks of homebuyers have been taking advantage of these remarkably low rates over the last twelve months. However, there’s no guarantee rates will remain this low much longer. Whenever we try to forecast mortgage rates, we should consider the advice of Mark Fleming, Chief Economist at First American: “You know, the fallacy of … [Read more...]

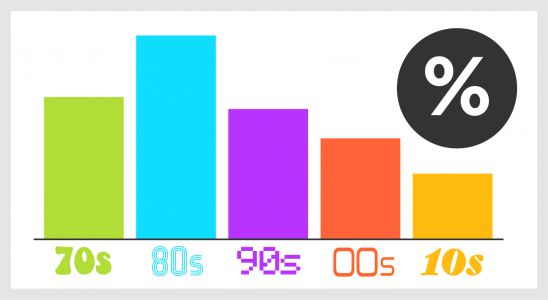

Home Mortgage Rates by Decade [INFOGRAPHIC]

Some Highlights Mortgage interest rates have dropped considerably over the past year, and compared to what we’ve seen in recent decades, it’s a great time to buy a home. Locking in a low rate today could save you thousands of dollars over the lifetime of your home loan, but these low rates may not last forever. If you’re in a position to buy a home, let’s connect to determine your best move in today’s housing market while interest rates are still in your favor. … [Read more...]

Will Low Mortgage Rates Continue through 2021?

With mortgage interest rates hitting record lows so many times recently, some are wondering if we’ll see low rates continue throughout 2021, or if they’ll start to rise. Recently, Freddie Mac released their quarterly forecast, noting: “The average 30-year fixed-rate mortgage hit a record low over a dozen times in 2020 and the low interest rate environment is projected to continue through this year. We expect interest rates to average below 3% through the end of 2021. While this is a modest rise from 2020 averages, … [Read more...]

- « Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 29

- Next Page »