There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage - either yours or your landlord’s.As Entrepreneur Magazine, a premier source for small business, explained this month in their article, “12 Practical Steps to Getting Rich”:“While renting on a temporary basis isn't terrible, you should most certainly own the roof … [Read more...]

What Are the Experts Saying about Mortgage Rates?

Mortgage interest rates have risen over the last few months and projections are that they will continue their upswing throughout 2017. What impact will this have on the housing market? Here is what the experts are saying:Laurie Goodman, Co-director of the Urban Institute’s Housing Finance Policy Center:“In 1984, 1994, 2000, and 2013, every time we have rate increases, we have increases in nominal home prices. We expect this to be more pronounced, as there is a big demand-and-supply gap at the present … [Read more...]

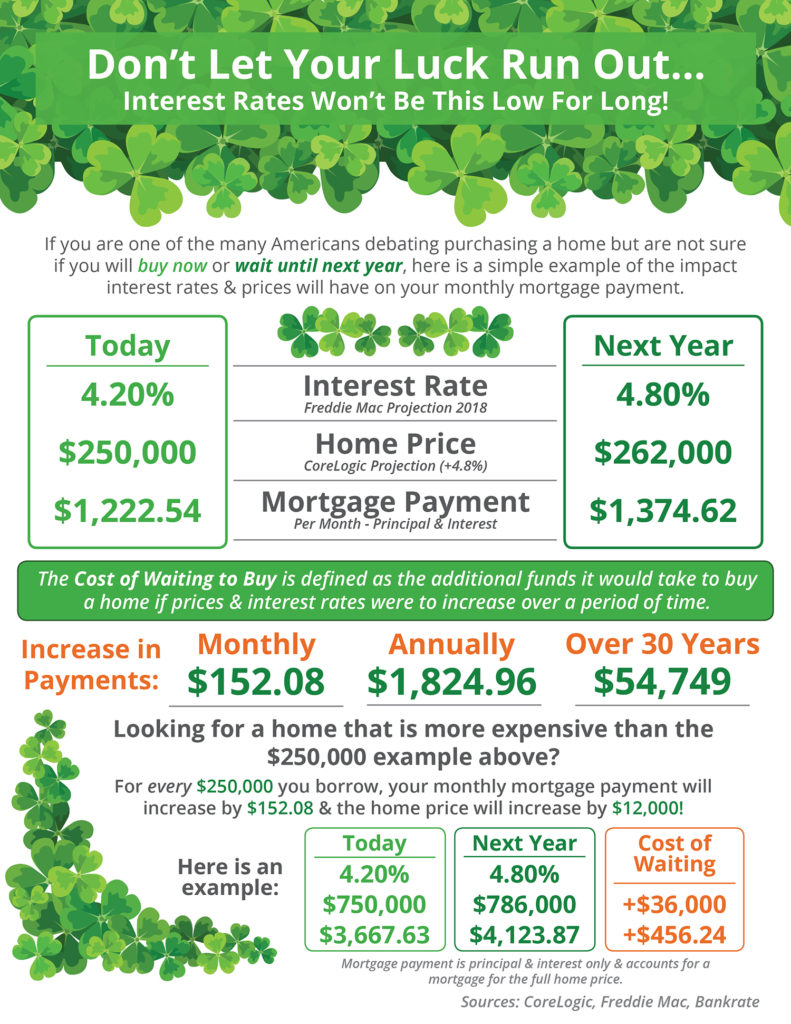

Don’t Let Your Luck Run Out [INFOGRAPHIC]

Some Highlights: The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.8% according to CoreLogic.Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage! … [Read more...]

Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.Here is a chart showing … [Read more...]

Mortgage Rates Impact on 2017 Home Values

There is no doubt that historically low mortgage interest rates were a major impetus to housing recovery over the last several years. However, many industry experts are showing concern about the possible effect that the rising rates will have moving forward.The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are all projecting that mortgage interest rates will move upward in 2017. Increasing interest rates will definitely impact purchasers and may stifle demand.In a … [Read more...]

How Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history!The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house … [Read more...]

Is This the Year to Move Up to Your Dream Home? If So, Do it Early

It appears that Americans are regaining faith in the U.S. economy. The following indexes have each shown a dramatic jump in consumer confidence in their latest surveys:The University of Michigan Consumer Sentiment IndexNational Federation of Independent Businesses' Small Business Optimism IndexCNBC All-America Economic SurveyThe Conference Board Consumer Confidence SurveyIt usually means good news for the housing market when the country sees an optimistic future. People begin to dream again about the home their … [Read more...]

The Fed Raised Rates: What Does that Mean for Housing?

You may have heard that the Federal Reserve raised rates last week… But what does that mean if you are looking to buy a home in the near future? Many in the housing industry have predicted that the Federal Open Market Committee (FOMC), the policy-making arm of the Federal Reserve, would vote to raise the federal fund's target rate at their December meeting. For only the second time in a decade, this is exactly what happened. There were many factors that contributed to the 0.25 point increase (from 0.50 to … [Read more...]

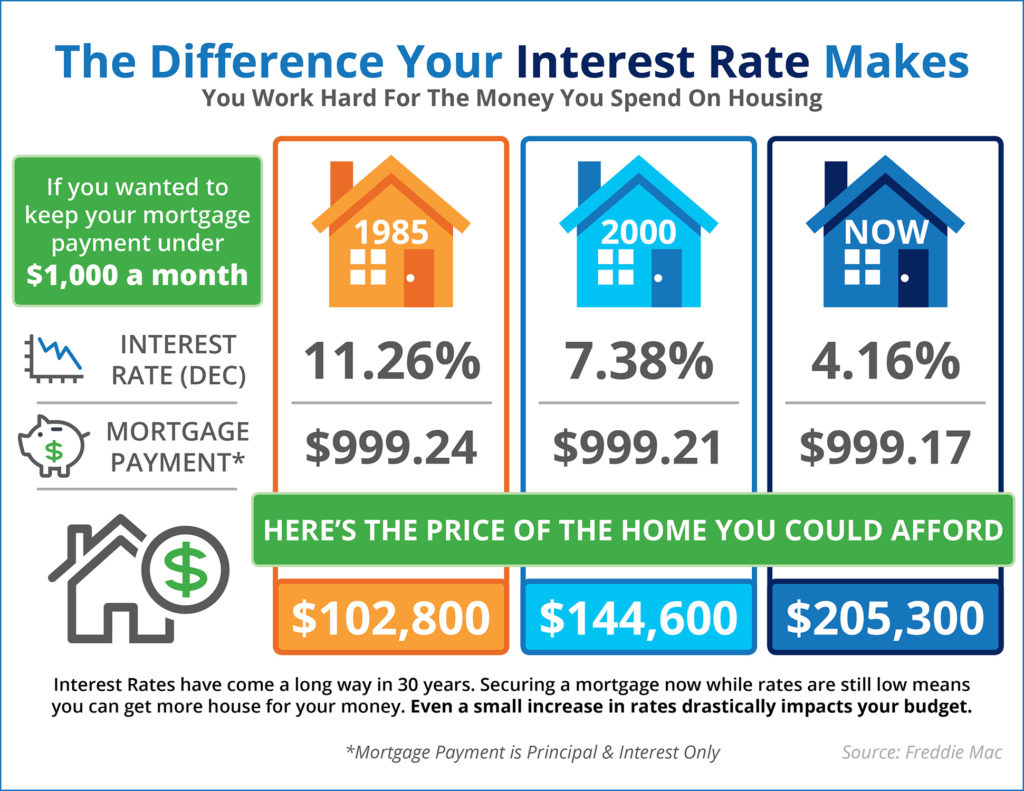

The Impact Your Interest Rate Has on Your Buying Power [INFOGRAPHIC]

Some Highlights:Your monthly housing cost is directly tied to the price of the home you purchase and the interest rate you secure for your mortgage.Over the last 30 years, interest rates have fluctuated greatly with rates in the double digits in the 1980s, all the way down to the near 4% we are experiencing now.Your purchasing power is greatly impacted by the interest rate you secure. Act now before rates go up! … [Read more...]

Will Increasing Mortgage Rates Impact Home Prices?

There are some who are calling for a decrease in home prices should mortgage interest rates begin to rise rapidly. Intuitively, this makes sense as the cost of a home is determined by the price of the home, plus the cost of financing that home. If mortgage interest rates increase, fewer people will be able to buy, and logic says prices will fall if demand decreases.However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.Here is a graph showing … [Read more...]