Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Along with Freddie Mac, Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors are all calling for mortgage rates to continue to rise over the next four quarters.This has caused some purchasers to lament the fact they may no longer be able to get a rate less than 4%. However, we must realize that current rates are still at historic lows.Here is a chart … [Read more...]

Why Are Mortgage Interest Rates Increasing?

According to Freddie Mac’s latest Primary Mortgage Market Survey, the 30-year fixed rate mortgage interest rate jumped up to 3.94% last week. Interest rates had been hovering around 3.5% since June, and many are wondering why there has been such a significant increase so quickly. Why did rates go up?Whenever there is a presidential election, there is uncertainty in the markets as to who will win. One way that this is noticeable is through the actions of investors. As we get closer to the first Tuesday of … [Read more...]

Buying is Now 37.7% Cheaper Than Renting in the US

The results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.The updated numbers actually show that the range is an average of 17.4% less expensive in Honolulu (HI), all the way up to 53.2% less expensive in Miami & West Palm Beach (FL), and 37.7% nationwide!Other interesting findings in the report include:Interest rates have remained low, and even though home … [Read more...]

How Historically Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.47%. Rates have remained at or below 3.5% each of the last 16 weeks, marking a historic low.The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.Purchasing power, simply put, is the amount of home you can afford buy for the budget you have available to spend. As rates increase, the price of … [Read more...]

3 Questions to Ask Before Buying Your Dream Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.Ask yourself the following 3 questions to help determine if now is actually a good time for you to buy in today’s market.1. Why am I buying a home in the first place?This truly is the most important question to answer. Forget the finances for a minute. … [Read more...]

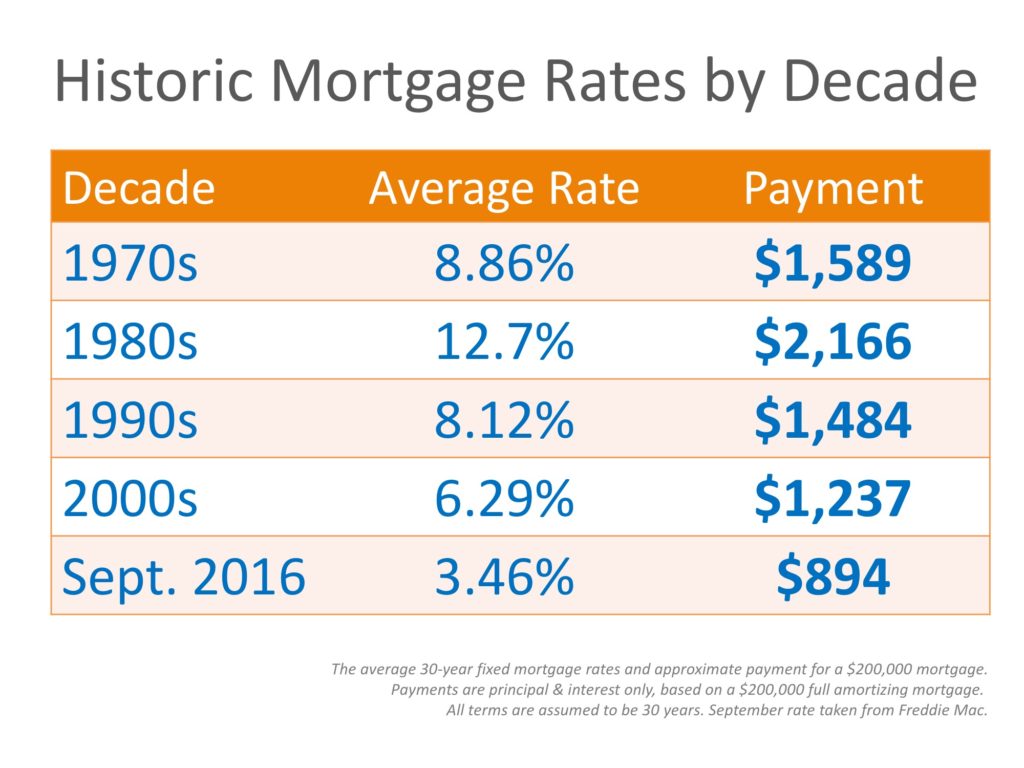

Mortgage Rates by Decade Compared to Today [INFOGRAPHIC]

Some Highlights:The interest rate you secure for your mortgage greatly influences your monthly housing costs.In the 1980s, 30-year fixed mortgage rates averaged in the high 12s making the monthly principal and interest payment over $2,000.Interest rates are still at historic lows; this is a great time lock in your housing cost and protect yourself from increasing rents, or refinance your current mortgage. … [Read more...]

Interest Rates Remain at Historic Lows… But for How Long?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment; The higher the rate, the greater your payment will be. That is why it is important to look at where the experts believe rates are headed when deciding to buy now or wait until next year.The 30-year fixed mortgage rate has fallen half a percentage point since the beginning of the year and has remained at or below 3.5% for the last 11 weeks according to Freddie Mac’s Primary Mortgage Market Survey.The chart below shows … [Read more...]

Whether You Rent or Buy, You’re Paying a Mortgage

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.As The Joint Center for Housing Studies at Harvard University explains:“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down … [Read more...]

Buying a Home is 36% Less Expensive Than Renting Nationwide!

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States. The updated numbers actually show that the range is an average of 5% less expensive in Orange County (CA) all the way up to 46% in Houston (TX), and 36% Nationwide! Other interesting findings in the report include: Interest rates have remained low and even though home prices have appreciated … [Read more...]

Put Your Housing Cost To Work For You!

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. As we have said before, mortgage interest rates are still near historic lows and rents continue to rise. Housing Cost & Net Worth Whether you rent or buy, you have a monthly housing cost. As a buyer, you are contributing to YOUR net worth. Every mortgage payment is a form of what Harvard University’s Joint Center for Housing Studies calls “forced … [Read more...]