A recent report released by Down Payment Resource shows that 65% of first-time homebuyers purchased their homes with a down payment of 6% or less in the month of January.The trend continued through all buyers with a mortgage, as 62% made a down payment of less than 20%, which is consistent with findings from December.An article by DS News points to the new wave of millennial homebuyers:“It seems that the long-awaited influx of millennial home buyers is beginning. Ellie Mae reported that mortgages to … [Read more...]

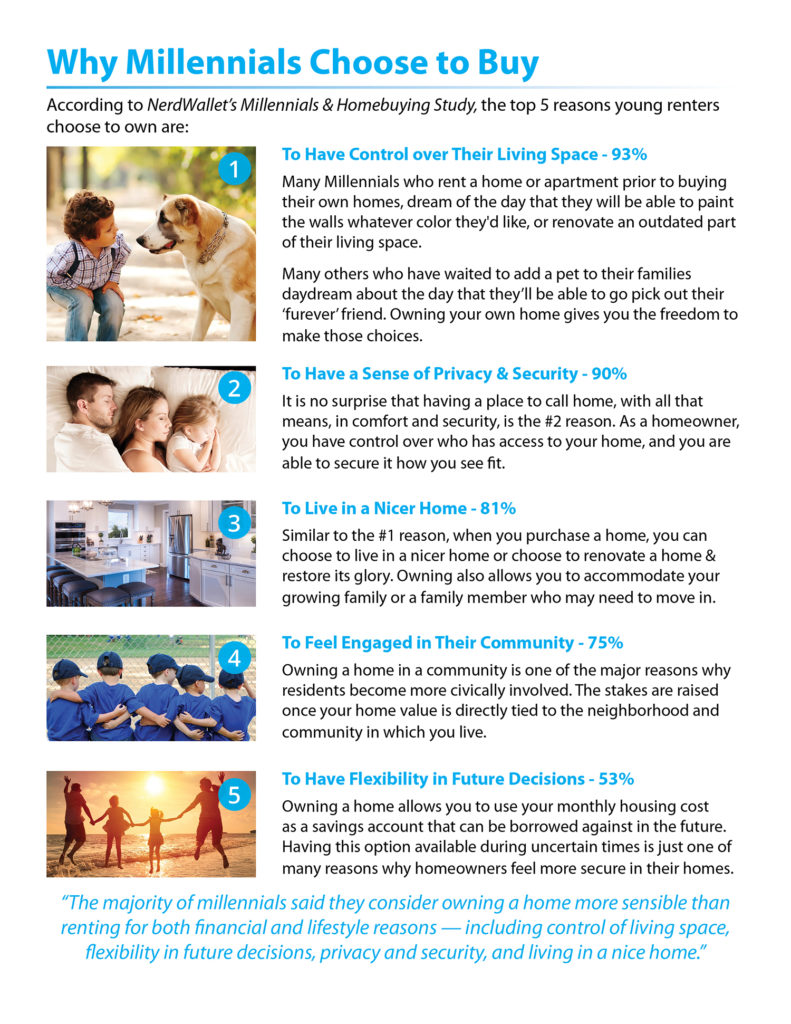

Why Millennials Choose to Buy [INFOGRAPHIC]

Some Highlights:“The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”At 93%, the top reason Millennials choose to buy is to have control over their living space.Many Millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls … [Read more...]

Looking to Move-Up to a Luxury Home? Now’s the Time!

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! We recently shared data from Trulia’s Market Mismatch Study which showed that in today’s premium home market, buyers are in control. The inventory of homes for sale in the luxury market far exceeds those searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer, or can be found at a discount.Those who have a … [Read more...]

Millionaire to Millennials: Buy Now!

Self-made millionaire David Bach was quoted in a CNBC article explaining that "the single biggest mistake millennials are making" is not purchasing a home because buying real estate is "an escalator to wealth.”Bach went on to explain:"If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter."In his bestselling book, “The Automatic … [Read more...]

First Time Homebuyer 101

Whether you’re a first time homebuyer or you're making your next purchase, buying a new home can be stressful. As lead Buyer Specialist for The Sibley Group at Keller Williams Realty, my job is to make sure the process is as enjoyable as possible. Step 1 The National Association of Realtors reports nearly 92% of first time homebuyers take to the internet to begin their search, and while that’s not a bad idea, I highly recommend meeting with an experienced local Realtor first to save yourself a good chunk of time. … [Read more...]

What Would a Millennial Baby Boom Mean for Housing?

Recently released data from the National Center for Health Statistics revealed that 1.3 million Millennial women gave birth for the first time in 2015. There are now over 16 million women in this generation who have become mothers.“All told, Millennial women (those born between 1981 to 1997) accounted for about eight in ten (82%) of U.S. births in 2015.”The data also shows that this generation has waited until later in life to become parents as only 42% of Millennial women were moms in 2014, compared to … [Read more...]

Millionaire to Millennials: Buy a Home!!

Last week, CNBC ran an article quoting self-made millionaire David Bach explaining that not purchasing a home is "the single biggest mistake millennials are making" because buying real estate is "an escalator to wealth.”Bach went on to explain:"If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter."In his bestselling book, “The Automatic Millionaire,” Bach does the … [Read more...]

Student Loans = Higher Credit Scores

According to a recent analysis by CoreLogic, Millennial renters (aged 20-34) who have student loan debt also have higher credit scores than those who do not have student loans.This may come as a surprise, as there is so much talk about student loans burdening Millennials and holding them back from many milestones that previous generations have been able to achieve (i.e. homeownership, investing for retirement).CoreLogic used the information provided on rental applications and the applicants’ credit history … [Read more...]

Think All Millennials Live in Their Parent’s Basement? Think Again!

According to the Census Bureau, millennials have overtaken baby boomers as the largest generation in U.S. History. Millennials, or America's youth born between 1982-2000, now represent more than one quarter of the nation’s population, totaling 83.1 million.There has been a lot of talk about how, as a generation, millennials have ‘failed to launch’ into adulthood and have delayed moving out of their family’s home. Some experts have even questioned whether or not millennials want to move … [Read more...]

2 Myths About Mortgages That May Be Holding Back Buyers

Fannie Mae’s “What do consumers know about the Mortgage Qualification Criteria?” Study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home.Myth #1: “I Need a 20% Down Payment”Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down … [Read more...]