The sense of pride you’ll feel when you purchase a home can’t be overstated. For first-generation homebuyers, that feeling of accomplishment is even greater. That’s because the pride of homeownership for first-generation buyers extends far beyond the homebuyer. AJ Barkley, Head of Neighborhood and Community Lending for Bank of America, says: “Achieving this goal can create a sense of pride and accomplishment that resonates both for the buyer and those closest to them, including their parents and future … [Read more...]

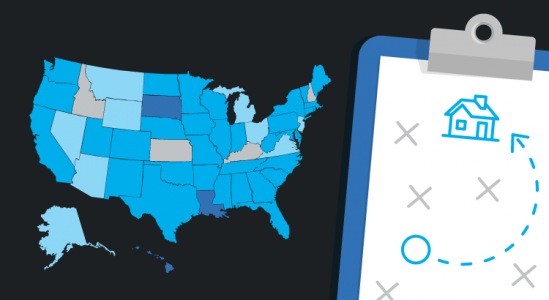

What’s Causing Today’s Competitive Real Estate Market? [INFOGRAPHIC]

Some Highlights Today’s strong sellers’ market is the direct result of high demand and low supply. Low mortgage rates and generational trends have created an increased demand for homes. Meanwhile, the slower pace of new home construction and homeowners staying in their homes longer have both led to today’s low supply. If you’re thinking of selling, let’s connect to talk about our local area and how you can take advantage of today’s housing market. … [Read more...]

Is a 20% Down Payment Really Necessary To Purchase a Home?

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is the biggest hurdle. That may be because those individuals assume a 20% down payment is necessary. While putting more money down if you’re able can benefit buyers, putting 20% down is not mandatory. As Freddie Mac puts … [Read more...]

More Young People Are Buying Homes

There’s a common misconception that younger generations aren’t interested in homeownership. Many people point to the fact that millennials put off purchasing their first home as a reason for this belief. Odeta Kushi, Deputy Chief Economist for First American, explains why millennials have put off certain milestones linked to homeownership. Those delays led to their homeownership rates trailing slightly behind older generations: “Historically, millennials have delayed the critical lifestyle choices often linked to … [Read more...]

The Truths Young Homebuyers Need To Hear

For many young or first-time homebuyers, purchasing a home can feel intimidating. A recent survey shows some homebuyers ages 25 to 40 may be unsure about the homebuying process and what they can afford. It found: “1 in 4 underestimated their buying potential by $150k or more” “1 in 4 underestimated the increase in value by $100k or more” “47% don’t know what a good interest rate is” Because they feel uncertain, many young homebuyers have given up on their search, or worse, they’ve decided homebuying isn’t for … [Read more...]

Multigenerational Housing Is Gaining Momentum [INFOGRAPHIC]

Some Highlights If your house is feeling a little cramped with the addition of adult children or aging parents, it might be time to consider a move-up into a multigenerational home that better suits your changing needs. With benefits that include a combined homebuying budget and shared caregiving duties, an increasing number of households are discovering the value of a multigenerational home. With such high demand for houses today, now is a great time to sell so you can upgrade to a multigenerational home that may … [Read more...]

Is Homeownership Still Considered Part of the American Dream?

Since the birth of our nation, homeownership has always been considered a major piece of the American Dream. As Frederick Peters reports in Forbes: “The idea of a place of one’s own drives the American story. We became a nation out of a desire to slip the bonds of Europe, which was still in many respects a collection of feudal societies. Old rich families, or the church, owned all the land and, with few exceptions, everyone else was a tenant. The magic of America lay not only in its sense of opportunity, but also … [Read more...]

Millennials: Is It Time to Buy a Bigger Home?

In today’s housing market, all eyes are on millennials. Not only are millennials the largest generation, but they’re also currently between 25 and 40 years old. These are often considered prime homebuying years when many people begin to form their own households and invest in real estate. If you’re like many millennials who are spending much more time at home these days, you may have a growing need for more space or upgraded features, making moving more desirable than ever. For those millennials who already own a … [Read more...]

Knowledge Is Power on the Path to Homeownership

Homeownership is on the goal list for many young adults, but sometimes it’s hard to know exactly how to get there. From understanding the homebuying process to pre-approval and down payment assistance options, uncertainty along the way can ultimately hold some buyers back. Today, there are over 75 million Millennials and 67 million Gen Z’ers in the U.S., making up a significant number of both current and soon-to-be homebuyers. According to a recent Fannie Mae survey of more than 2,000 of these individuals: “88% … [Read more...]

4 Reasons Why the Election Won’t Dampen the Housing Market

Tomorrow, Americans will decide our President for the next four years. That decision will have a major impact on many aspects of life in this country, but the residential real estate market will not be one of them. Analysts will try to measure the impact feasible changes in regulations might have on housing, the effect of a possible first-time buyer program, and any number of other situations based on who wins. The housing market, however, will remain strong for four reasons: 1. Demand Is Strong among … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 11

- Next Page »