Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.So, what does this mean for homeowners and their equity position?As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?Since the experts … [Read more...]

Sellers

Resources for anyone selling or considering selling a house in St Tammany, Jefferson, or Orleans parishes.

Where Are the Home Prices Heading in the Next 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.The results of their latest survey:Home values will appreciate by 4.4% over the … [Read more...]

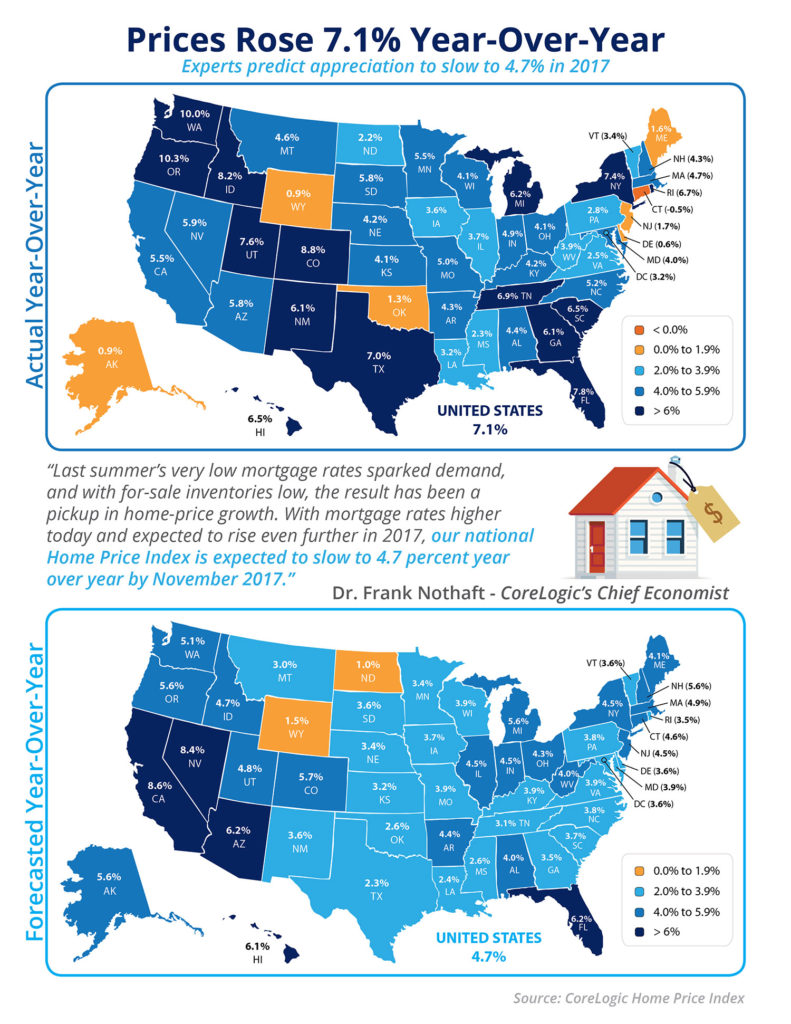

Prices Rose 7.1% Year-Over-Year [INFOGRAPHIC]

Some Highlights:CoreLogic’s latest Home Price Index shows that prices rose by 7.1% across the United States year-over-year.With mortgage interest rates rising in the short term, CoreLogic believes price appreciation will slow to 4.7% by this time next year.49 out of 50 states, and the District of Columbia, all had positive appreciation over the last 12 months, with the only exception being the state of Connecticut, which experienced a -0.5% appreciation. … [Read more...]

If Your Home Hasn’t Sold Yet… Check the Price!

The residential housing market has been hot. Home sales have bounced back solidly and are now at their second highest pace since February 2007. Demand has remained strong throughout the winter as many real estate professionals are reporting bidding wars with many homes selling above listing price. What about your house?If your house hasn’t sold, it is probably because of the price.If your home is on the market and you are not receiving any offers, look at your price. Pricing your home just 10% above market … [Read more...]

Inadequate Inventory Driving Prices Up

The latest Existing Home Sales Report from the National Association of Realtors (NAR) revealed a direct correlation between a lack of inventory and rising prices.We are all familiar with the concept of supply and demand. As the demand for an item increases the supply of that same item goes down, driving prices up.Year-over-year inventory levels have dropped each of the last 18 months, as inventory now stands at a 4.0-month supply, well below the 6.0-month supply needed for a ‘normal’ market.The median … [Read more...]

2 Tips to Ensure You Get the Most Money When Selling Your House

Every homeowner wants to make sure they get the best price when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensuring you get the highest price possible.1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them room for negotiation. In actuality, this just dramatically lessens the demand for your house … [Read more...]

Home Prices: Where Will They Be in 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.The results of their latest survey:Home values will appreciate by 4.0% over the … [Read more...]

Will Increasing Mortgage Rates Impact Home Prices?

There are some who are calling for a decrease in home prices should mortgage interest rates begin to rise rapidly. Intuitively, this makes sense as the cost of a home is determined by the price of the home, plus the cost of financing that home. If mortgage interest rates increase, fewer people will be able to buy, and logic says prices will fall if demand decreases.However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.Here is a graph showing … [Read more...]

Buying is Now 37.7% Cheaper Than Renting in the US

The results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.The updated numbers actually show that the range is an average of 17.4% less expensive in Honolulu (HI), all the way up to 53.2% less expensive in Miami & West Palm Beach (FL), and 37.7% nationwide!Other interesting findings in the report include:Interest rates have remained low, and even though home … [Read more...]

The ‘Great News’ About Rising Prices

Recently there has been a lot of talk about home prices and if they are accelerating too quickly. In some areas of the country, seller supply (homes for sale) cannot keep up with the number of buyers out looking for a home, which has caused prices to rise.The great news about rising prices, however, is that according to CoreLogic’s latest US Economic Outlook, the average American household gained over $11,000 in equity over the course of the last year, largely due to home value increases.The map below was … [Read more...]

- « Previous Page

- 1

- …

- 37

- 38

- 39

- 40

- 41

- …

- 43

- Next Page »