The National Association of Realtors recently released their 2016 Investment and Vacation Home Buyers Survey. The survey revealed many characteristics of both vacation home purchasers and investors. Two weeks ago, we posted on the vacation home market. Today, we want to concentrate on the investor real estate market. The survey revealed that investment-home sales in 2015 jumped 7.0 percent to an estimated 1.09 million from 1.02 million in 2014. Lawrence Yun, NAR’s chief economist discussed the increase in … [Read more...]

Sellers

Resources for anyone selling or considering selling a house in St Tammany, Jefferson, or Orleans parishes.

Selling Your Home? Make Sure the Price Is Right!

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them. There is no “later.” Sellers sometimes think, “If the home doesn’t … [Read more...]

Vacation Home Sales: Sales Down, Prices Up

The National Association of Realtors recently released their 2016 Investment and Vacation Home Buyers Survey. The survey revealed many characteristics of both vacation home purchasers and investors. Today, we want to concentrate on the vacation real estate market. The survey found that vacation home sales last year declined to an estimated 920,000, down 18.5% from their most recent peak level of 1.13 million in 2014. However, this is still the second highest number of vacation sales since 2006. Lawrence Yun, … [Read more...]

Don’t Wait! Move Up To Your Dream Home Now!

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates have stayed near historic lows. Sellers should realize that waiting to make the move when mortgage rates are projected to increase probably doesn’t make sense. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain budget for your monthly housing … [Read more...]

Gap Between Homeowner’s & Appraiser’s Opinions Widen

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. One major challenge in such a market is the bank appraisal. If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that closed recently) to defend the price when performing the appraisal for the bank. Every month, Quicken Loans measures the disparity between what a homeowner believes their house is worth as compared to an … [Read more...]

What If I Wait Until Next Year To Buy A Home?

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first-time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home. Let us explain. There are many factors that influence the ‘cost’ of a home. Two of the major ones are the home’s appreciation over time, and the interest rate at which a buyer can borrow the funds necessary to purchase … [Read more...]

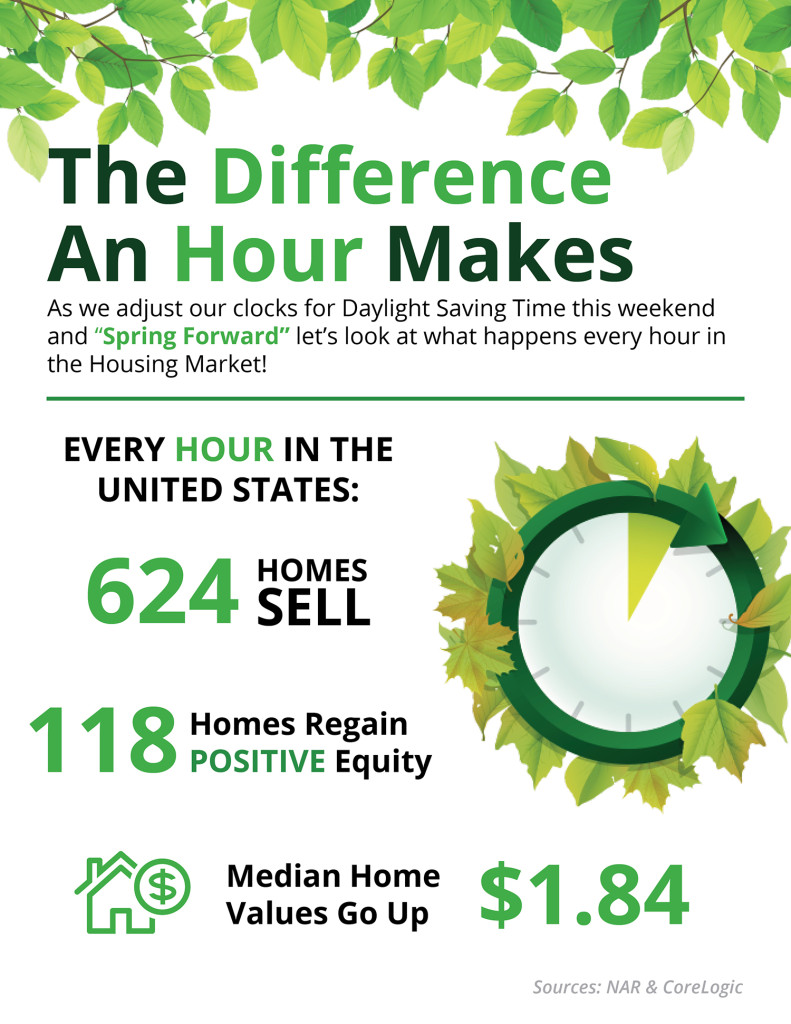

The Difference An Hour Makes This Spring [INFOGRAPHIC]

Some Highlights: Sunday, March 13th, we "Spring Forward" one hour for Daylight Savings Time (except for our friends in AZ). Every hour in the United States, 624 homes will sell and 118 homes will regain positive equity. The median home value will also increase each hour in the United States by $1.84. … [Read more...]

Put Your Housing Cost To Work For You!

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. As we have said before, mortgage interest rates are still near historic lows and rents continue to rise. Housing Cost & Net Worth Whether you rent or buy, you have a monthly housing cost. As a buyer, you are contributing to YOUR net worth. Every mortgage payment is a form of what Harvard University’s Joint Center for Housing Studies calls “forced … [Read more...]

Put Your Housing Cost To Work For You!

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. As we have said before, mortgage interest rates are still near historic lows and rents continue to rise. Housing Cost & Net Worth Whether you rent or buy, you have a monthly housing cost. As a buyer, you are contributing to YOUR net worth. Every mortgage payment is a form of what Harvard University’s Joint Center for Housing Studies calls “forced … [Read more...]

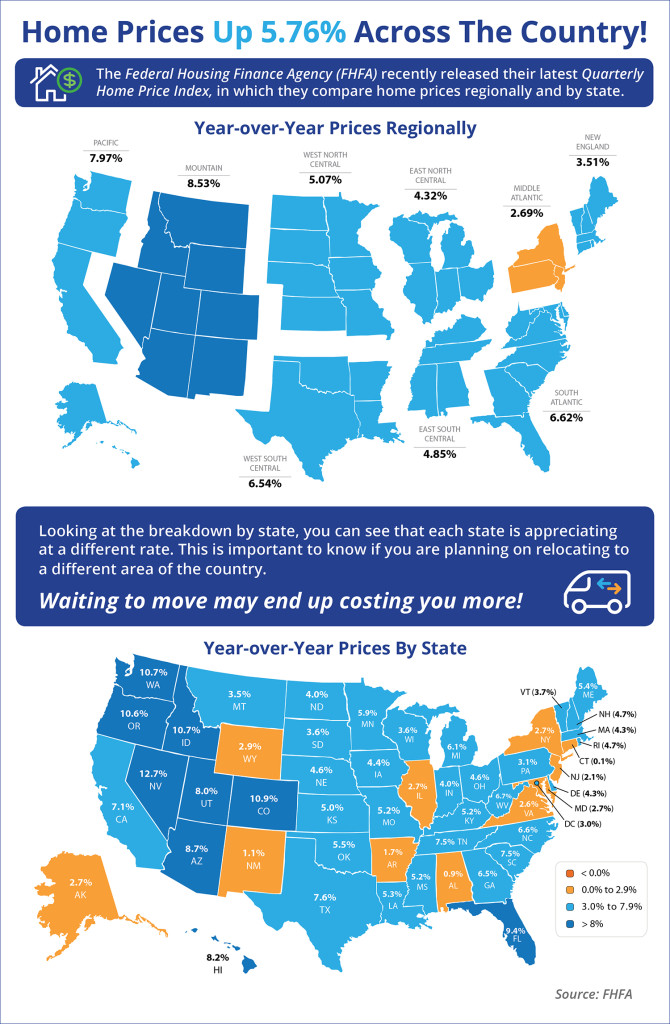

Home Prices Up 5.76% Across The Country! [INFOGRAPHIC]

Some Highlights: The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report. In the report, home prices are compared both regionally and by state. Based on the latest numbers, waiting to move may end up costing you more! … [Read more...]