According to data from the most recent Origination Insight Report by Ellie Mae, the average FICO® score on closed loans reached 753 in February. As lending standards have tightened recently, many are concerned over whether or not their credit score is strong enough to qualify for a mortgage. While stricter lending standards could be a challenge for some, many buyers may be surprised by the options that are still available for borrowers with lower credit scores. The fact that the average American has seen their … [Read more...]

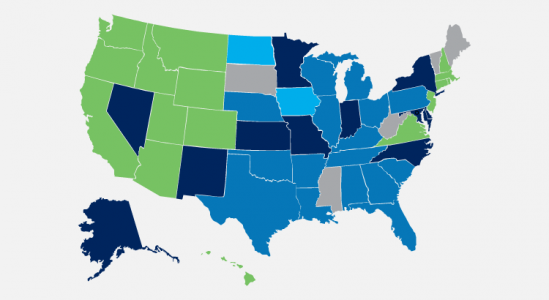

Americans See Major Home Equity Gains [INFOGRAPHIC]

Some Highlights Today’s home price appreciation is driving equity higher throughout the country. If your needs are changing and you’re ready for a new home, your equity may be a great asset to power your next move. Now is a great time to put your equity toward a down payment on the home of your dreams. … [Read more...]

To Renovate or Not To Renovate Before You Sell

When thinking about selling, homeowners often feel they need to get their house ready with some remodeling to make it more appealing to buyers. However, with so many buyers competing for available homes right now, renovations may not be as vital as they would be in a more normal market. Here are two things to keep in mind if you’re thinking of selling this season. 1. There aren’t enough homes for sale right now. A normal market has a 6-month supply of houses for sale, but today’s housing inventory sits far below … [Read more...]

What Is the Strongest Tailwind to Today’s Recovering Economy?

Last year started off with a bang. Unemployment was under 4%, forecasters were giddy with their projections for the economy, and the residential housing market had the strongest January and February activity in over a decade. Then came the announcement on March 11, 2020, from the World Health Organization declaring COVID-19 a worldwide pandemic. Two days later, the White House declared it a national emergency. Businesses and schools were forced to close, shelter-in-place mandates were enacted, and the economy came … [Read more...]

What Is the #1 Financial Benefit of Homeownership?

There are many financial and non-financial benefits of homeownership, and the greatest financial one is wealth creation. Homeownership has always been the first rung on the ladder that leads to forming household wealth. As Freddie Mac explains: “Homeownership has cemented its role as part of the American Dream, providing families with a place that is their own and an avenue for building wealth over time. This ‘wealth’ is built, in large part, through the creation of equity…Building equity through your monthly … [Read more...]

How to Make a Winning Offer on a Home

Today’s homebuyers are faced with a strong sellers’ market, which means there are a lot of active buyers competing for a relatively low number of available homes. As a result, it’s essential to understand how to make a confident and competitive offer on your dream home. Here are five tips for success in this critical stage of the homebuying process. 1. Listen to Your Real Estate Advisor An article from Freddie Mac gives direction on making an offer on a home. From the start, it emphasizes how trusted professionals … [Read more...]

How to Be a Competitive Buyer in Today’s Housing Market [INFOGRAPHIC]

Some Highlights With so few houses for sale today, it’s important to be prepared when you’re ready to buy a home. Meeting with your lender early, knowing your must-haves and nice-to-haves, preparing for a bidding war, and keeping your emotions in check are all ways to gain confidence in the homebuying process. If you’re looking for an expert guide to help you navigate today’s lightning-fast housing market, let’s connect today. … [Read more...]

Will the Housing Market Bloom This Spring?

Spring is almost here, and many are wondering what it will bring for the housing market. Even though the pandemic continues on, it’s certain to be very different from the spring we experienced at this time last year. Here’s what a few industry experts have to say about the housing market and how it will bloom this season. Danielle Hale, Chief Economist, realtor.com: “Despite early weakness, we expect to see new listings grow in March and April as they traditionally do heading into spring, and last year’s … [Read more...]

6 Simple Graphs Proving This Is Nothing Like Last Time

Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year before. 2020 was so strong that many now fear the market’s exuberance mirrors that of the last housing boom and, as a result, we’re now headed for another crash. However, there are many reasons this real estate market is nothing like 2008. Here are six … [Read more...]

How Upset Should You Be about 3% Mortgage Rates?

Last Thursday, Freddie Mac announced that their 30-year fixed mortgage rate was over 3% (3.02%) for the first time since last July. That news dominated real estate headlines that day and the next. Articles talked about the “negative impact” it may have on the housing market. However, we should realize two things: 1. The bump-up in rate should not have surprised anyone. Many had already projected that rates would rise slightly as we proceeded through the year. 2. Freddie Mac’s comments about the rate increase were … [Read more...]

- « Previous Page

- 1

- …

- 120

- 121

- 122

- 123

- 124

- …

- 250

- Next Page »