So, you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market, you want to make sure that you make a good offer so that you can guarantee that your dream of making this house yours comes true!Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the 4 tips they covered along with some additional information for your consideration:1. Understand … [Read more...]

Do You Know the Cost of NOT Owning Your Home?

Owning a home has great financial benefits, yet many continue renting! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.Zillow recently reported that:“With Rents continuing to climb and interest rates staying low, many renters find themselves gazing over the homeownership fence and wondering if the grass really is greener. Leaving aside, for the moment, the difficulties of saving for a down payment, … [Read more...]

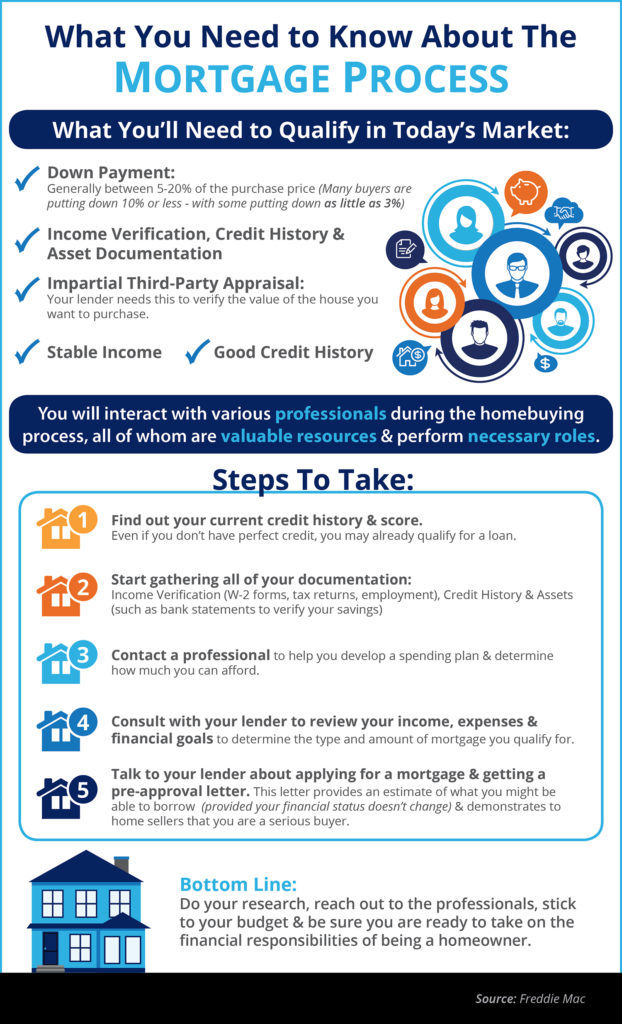

What You Need to Know About Qualifying for a Mortgage [INFOGRAPHIC]

Some Highlights:Many buyers are purchasing a home with a down payment as little as 3%.You may already qualify for a loan, even if you don't have perfect credit.Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford. … [Read more...]

3 Reasons the Housing Market is NOT in a Bubble

With housing prices appreciating at levels that far exceed historical norms, some are fearful that the market is heading for another bubble. To alleviate that fear, we just need to look back at the reasons that caused the bubble ten years ago.Last decade, demand for housing was artificially propped up because mortgage lending standards were way too lenient. People that were not qualified to purchase were able to attain a mortgage anyway. Prices began to skyrocket. This increase in demand caused homebuilders in many … [Read more...]

Gallup: Real Estate is Best Long-Term Investment 4 Years Running

Every year, Gallup surveys Americans to determine their choice for the best long-term investment. Respondents are given a choice between real estate, stocks/mutual funds, gold, savings accounts/CDs, or bonds.For the fourth year in a row, Real Estate has come out on top as the best long-term investment! This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26%. The full results are shown in the chart below.The study makes it a point to draw attention to the contrast of the … [Read more...]

Inventory Shortages Are Slowing Down the Market

The real estate market is moving more and more into a complete recovery. Home values are up. Home sales are up. Distressed sales (foreclosures and short sales) have fallen dramatically. It seems that 2017 will be the year that the housing market races forward again.However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the summer, supply is not keeping up.Here are the thoughts of a few industry experts on … [Read more...]

Is 2017 the Year to Move Up to Your Dream Home? If So, Do It Early!

If you are considering moving up to your dream home, it may be better to do it earlier in the year than later. The two components of your monthly mortgage payment (home prices and interest rates) are both projected to increase as the year moves forward, and interest rates may increase rather dramatically. Here are some predictions on where rates will be by the end of the year:Freddie Mac“While full employment and rising inflation are signs of a strong economy, they also have the potential to push mortgage … [Read more...]

Do You Know the Cost of Waiting? [INFOGRAPHIC]

Some Highlights: The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.9% according to CoreLogic.Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage! … [Read more...]

Financial Planning: 4 Reasons to Buy a House Today

Homeownership will always be a part of the American Dream. There are advantages to owning your own home (educational, health, social) that far transcend any economic impact. However, we want to look at several of the financial advantages of homeownership in today’s post.1. Buying is Cheaper Than RentingThe results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States. … [Read more...]

Buying a Home? Do You Know the Lingo?

Buying a home can be intimidating if you are not familiar with the terms used during the process. To start you on your path with confidence, we have compiled a list of some of the most common terms used when buying a home.Freddie Mac has compiled a more exhaustive glossary of terms in their “My Home” section of their website.Annual Percentage Rate (APR) – This is a broader measure of your cost for borrowing money. The APR includes the interest rate, points, broker fees and certain other credit … [Read more...]

- « Previous Page

- 1

- …

- 216

- 217

- 218

- 219

- 220

- …

- 250

- Next Page »