Just like our clocks this weekend in the majority of the country, the housing market will soon “spring forward!” Similar to tension in a spring, the lack of inventory available for sale in the market right now is what is holding back the market.Many potential sellers believe that waiting until Spring is in their best interest, and traditionally they would have been right.Buyer demand has seasonality to it, which usually falls off in the winter months, especially in areas of the country impacted by … [Read more...]

Thinking of Selling? Do it TODAY!!

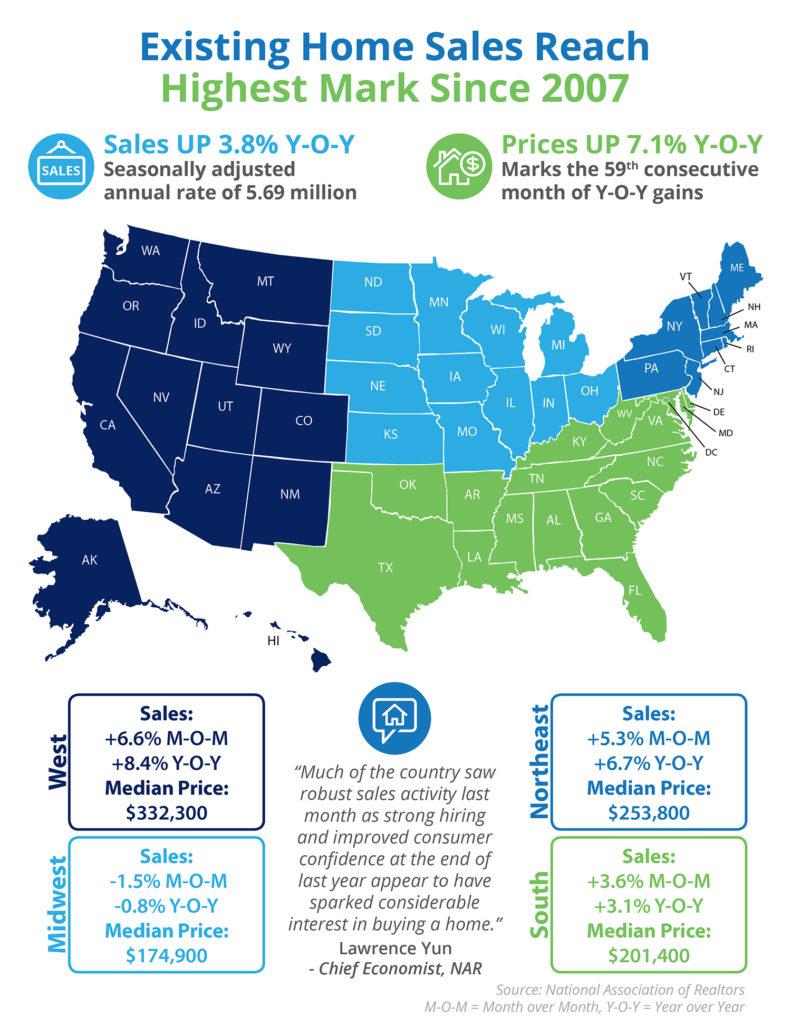

That headline might be a little aggressive. However, as the data on the 2017 housing market begins to roll in, we can definitely say one thing: If you are considering selling, IT IS TIME TO LIST YOUR HOME!The February numbers are not in yet, but the January numbers were sensational. Lawrence Yun, Chief Economist for the National Association of Realtors, said:“Much of the country saw robust sales activity last month as strong hiring and improved consumer confidence at the end of last year appear to have … [Read more...]

The Connection Between Home Prices & Family Wealth

Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.So, what does this mean for homeowners and their equity position?As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?Since the experts … [Read more...]

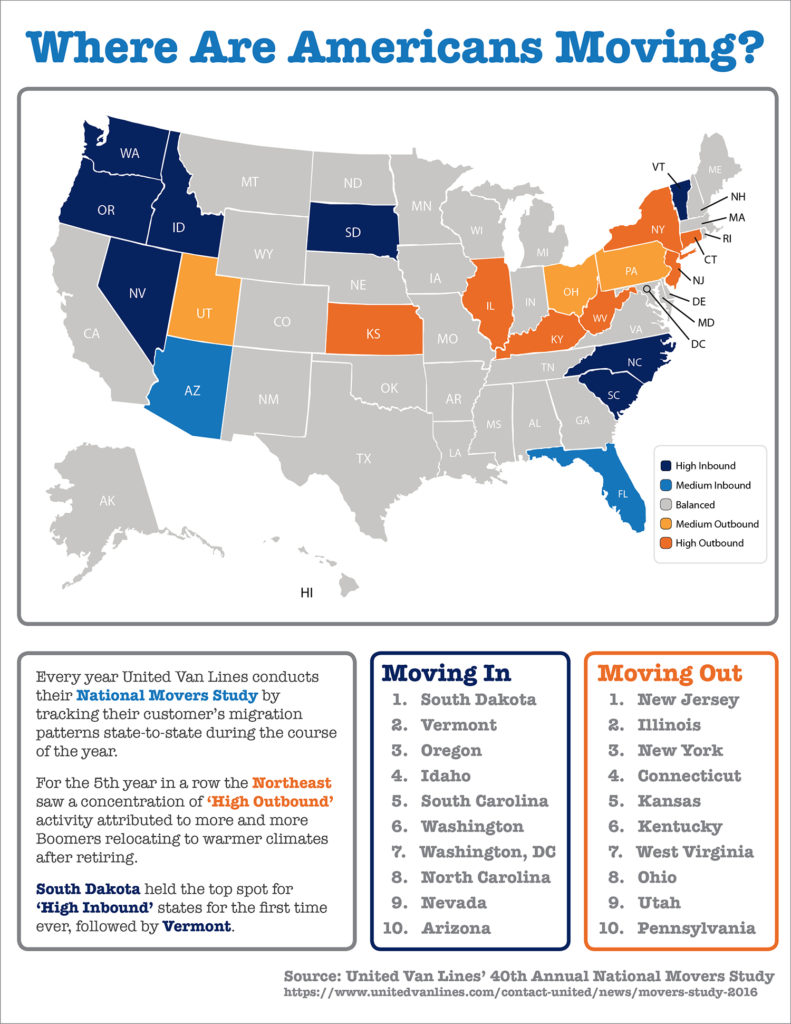

Where Did Americans Move in 2016?

Some Highlights:For the 5th year in a row, the Northeast saw a concentration of “High Outbound” activity.For the first time ever, South Dakota held the top spot for “High Inbound” states.Much of America’s outbound activity can be attributed to Boomers relocating to warmer climates after retiring. … [Read more...]

Mortgage Rates Impact on 2017 Home Values

There is no doubt that historically low mortgage interest rates were a major impetus to housing recovery over the last several years. However, many industry experts are showing concern about the possible effect that the rising rates will have moving forward.The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are all projecting that mortgage interest rates will move upward in 2017. Increasing interest rates will definitely impact purchasers and may stifle demand.In a … [Read more...]

Over Half of All Buyers Are Surprised by Closing Costs

According to a recent survey conducted by ClosingCorp, over half of all homebuyers are surprised by the closing costs required to obtain their mortgage.After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all, while another 35% were stunned by how much higher the fees were than expected.“Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance and … [Read more...]

How Long Do Most Families Stay in Their Home?

The National Association of Realtors (NAR) keeps historical data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years – an increase of almost 50%.Why the dramatic increase?The reasons for this change are plentiful!The fall in home prices during the housing crisis … [Read more...]

Where Are the Home Prices Heading in the Next 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.The results of their latest survey:Home values will appreciate by 4.4% over the … [Read more...]

Existing Home Sales Reach Highest Mark Since 2007 [INFOGRAPHIC]

Highlights:Sales of existing homes reached the highest pace in a decade at a seasonally adjusted annual rate of 5.69 million.January marked the 59th consecutive month of year-over-year price gains as the median home price rose 7.1% to $228,900.NAR’s Chief Economist, Lawrence Yun had this to say, “Much of the country saw robust sales activity last month as strong hiring and improved consumer confidence at the end of last year appear to have sparked considerable interest in buying a home." … [Read more...]

The Impact of Homeownership on Family Health

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.”Today, we want to cover the section of the … [Read more...]

- « Previous Page

- 1

- …

- 221

- 222

- 223

- 224

- 225

- …

- 250

- Next Page »