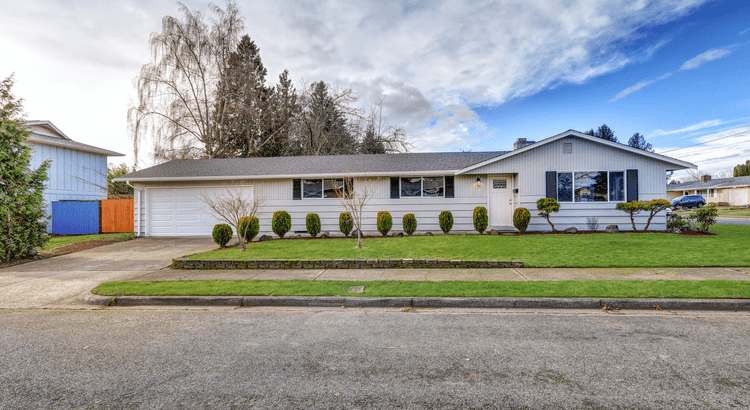

One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list.Think of it like this. Your wish list and your budget are the guardrails of your search. And when your budget needs to hold firm, there’s another lever you can pull. That’s seeing if you truly need all of your desired features. Because the truth is, a small compromise could be the difference between feeling stuck and getting the keys to your next home.The data shows more buyers are using that strategy … [Read more...]

Your Equity Could Change Everything About Your Next Move

A lot of people are asking the same thing right now: “Is it even a good time to sell?” And the truth may come as a bit of a surprise...For many homeowners, the answer is a strong yes.Why? Because of one major factor working in your favor: your equity. Odds are, if you’ve lived in your home for a while, you know you have significant equity. But how much are we really talking about? The number might just change everything about your next move.The Hidden Wealth of HomeownershipHere’s how it works. When you own a home, … [Read more...]

Why Selling Your House This Winter Gives You an Edge

Spring gets all the attention, but it’s not always the best time to sell a house. Yes, more buyers show up, but so do a lot of other sellers.Winter is different. With fewer homes on the market, your house has a much better chance of standing out. And that one advantage can make a big difference.Winter Is When Your Listing Stands OutHistory shows the number of homes for sale tends to drop during the winter months. It’s a trend that’s predictable almost every year.Data from Realtor.com shows this pattern clearly. … [Read more...]

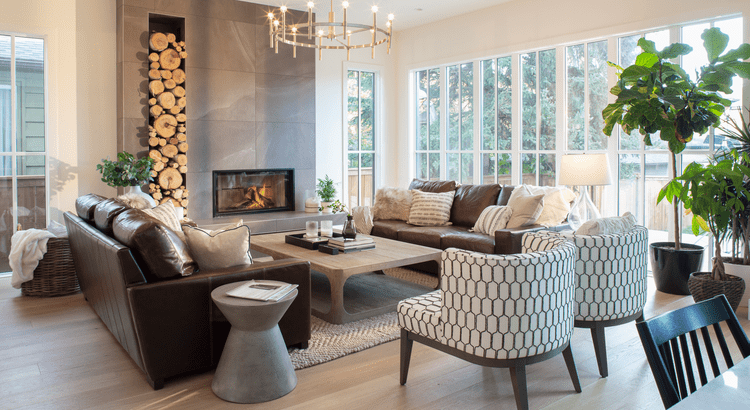

This May Be the Best Time To Buy a Brand-New Home

New home construction today is giving buyers something it feels like they haven't gotten much lately: a real shot at both the home they want and the deal they need. More brand-new options are on the market right now, and builders are rolling out incentives that make these homes more affordable than many people expect.It’s a combination that doesn’t come around often – and it’s putting buyers in a surprisingly strong position this season. Here’s why this moment matters and why it’s worth partnering with your own … [Read more...]

Why More Homeowners Are Giving Up Their Low Mortgage Rate

If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins – and it can be hard to let go. But here’s what you need to remember...A great rate won’t make up for a home that no longer works for you. Life changes, and sometimes, your home needs to change with it. And you’re not the only one making that choice.The Lock-In Effect Is Starting To EaseMany homeowners have been frozen in place by … [Read more...]

The 3 Housing Market Questions Coming Up at Every Gathering This Season

Whether it’s at a family gathering, your company party, or catching up with friends over the holidays, the housing market always finds its way into the conversation.Here are the top three questions on a lot of people’s minds this season, and straightforward answers to help you feel more confident about the market.1. “Will I even be able to find a home if I want to move?”Yes, more than you could a year or two ago.The number of homes for sale has been rising over the past few years. According to data from … [Read more...]

How To Find the Best Deal Possible on a Home Right Now

Want to know how to find the best deal possible in today’s housing market? Here’s the secret. Focus on homes that have been sitting on the market for a while.Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And that’s where the savviest buyers are finding homes other buyers overlook.The Opportunity: 1 in 5 Homes Has Had a Price Cut This YearAccording to Realtor.com, about 1 in every 5 listings (20.2%) have dropped their asking price at least once. And while so … [Read more...]

Why So Many People Are Thankful They Bought a Home This Year

Homebuyers are weighing their options right now, and they certainly have a lot on their minds. With everything going on in the job market, the economy, and more – there's a lot to think about these days. And maybe that’s making you wonder if it really makes sense to buy a home right now.But here’s what many recent buyers would tell you: even with all that, making a move is worth it. And this is why they’re thankful they went ahead and took the plunge already. Life doesn't wait for better market conditions. So, your … [Read more...]

Why Buying a Home Still Pays Off in the Long Run

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about mortgage rates – you just pay the bill and move on with your life.But here’s the part people don’t talk about enough: renting doesn’t help you build your financial future. Meanwhile, homeowners grow their net worth just by owning a home.So, if you’ve been wondering whether buying is still worth it, the long-term math is clearer than you might think.Renting vs. Owning: How … [Read more...]

4 Reasons Your House Is High on Every Buyer’s Wish List This Season

When the holidays roll around, travel plans, family gatherings, and all the chaos of the season may make you think it’s better to pull your listing off the market or to wait until 2026 to sell your house. But here’s the thing.Waiting could mean missing out on a great window of opportunity. Because while other sellers are stepping away, you can lean in – and that might actually give you the edge. Here are 4 reasons selling now may be the better bet. 1. Buyers This Time of Year Are SeriousDon’t let the season fool … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 250

- Next Page »