Fannie Mae recently released their “What do consumers know about the Mortgage Qualification Criteria?” Study. The study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home. Here are three takeaways: 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary 86% of Americans either don’t know (59%) or are misinformed (25%) about what an appropriate Back End Debt-to-Income (DTI) ratios is 76% … [Read more...]

Obstacles to Homeownership: Perceived or Real?

Yesterday, we discussed the belief Americans have in homeownership and their desire to partake in this piece of the American Dream. We also discussed some of the obstacles preventing them from attaining that goal. However, studies have shown that that many of the obstacles mentioned are perceived, not real. A recent study by Fannie Mae, What Do Consumers Know About The Mortgage Qualification Criteria?, revealed that many consumers are either unsure or misinformed regarding the minimum requirements necessary to … [Read more...]

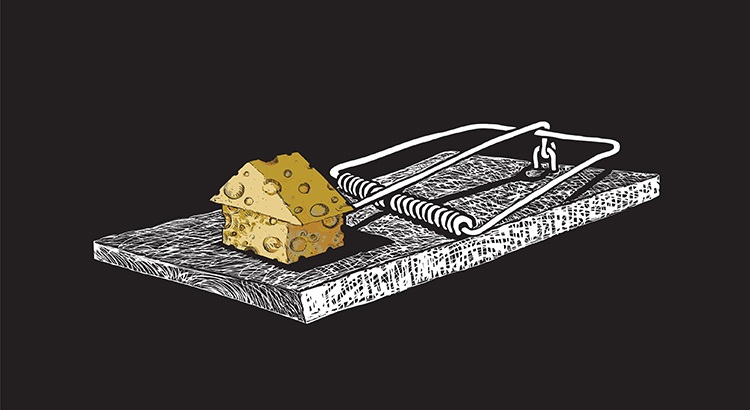

Don’t Let Rising Rents Trap You!

There are many benefits to homeownership. One of the top ones is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage. Don’t Become Trapped Jonathan Smoke, Chief Economist at realtor.com recently reported on what he calls a “Rental Affordability Crisis”. He warns that, “Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price appreciation in the year … [Read more...]