There are many benefits to homeownership. One of the top ones is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage.Don’t Become TrappedJonathan Smoke, Chief Economist at realtor.com, reported on what he calls a “Rental Affordability Crisis.” He warns that,“Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price appreciation in the year ahead.”In the … [Read more...]

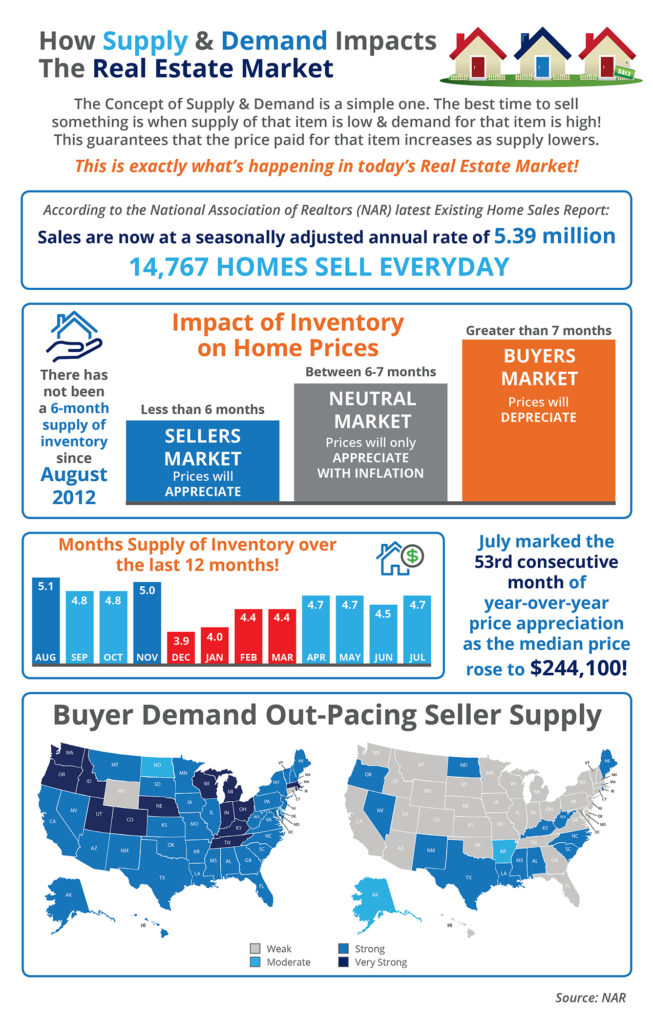

How Supply & Demand Impacts the Real Estate Market [INFOGRAPHIC]

Some Highlights:The Concept of Supply & Demand is a simple one. The best time to sell something is when supply of that item is low & demand for that item is high!Anything under a 6-month supply is a Seller’s Market!There has not been a 6-months inventory supply since August 2012!Buyer Demand continues to out-pace Seller Supply! … [Read more...]

How Scary is the Housing Affordability Index?

Some industry pundits are saying that the housing market may be heading for a slowdown. One of the data points they use is the falling numbers of the Housing Affordability Index, as reported by the National Association of Realtors (NAR).Here is how NAR defines the index:“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”Basically, a value of … [Read more...]

Housing Market Slowing Down? Don’t Tell Builders!

Many experts have been calling upon home builders to ramp up construction to help with the lack of existing inventory for sale. For the past two months, new home sales have surged, with July’s total coming in at the highest since October 2007.The latest estimates from the US Census Bureau and Department of Housing and Urban Development show that sales in July were 31.3% higher than this time last year, and 12.4% higher than last month, at a seasonally adjusted annual rate of … [Read more...]

2 Myths About Mortgages That May Be Holding Back Buyers

Fannie Mae’s “What do consumers know about the Mortgage Qualification Criteria?” Study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home.Myth #1: “I Need a 20% Down Payment”Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down … [Read more...]

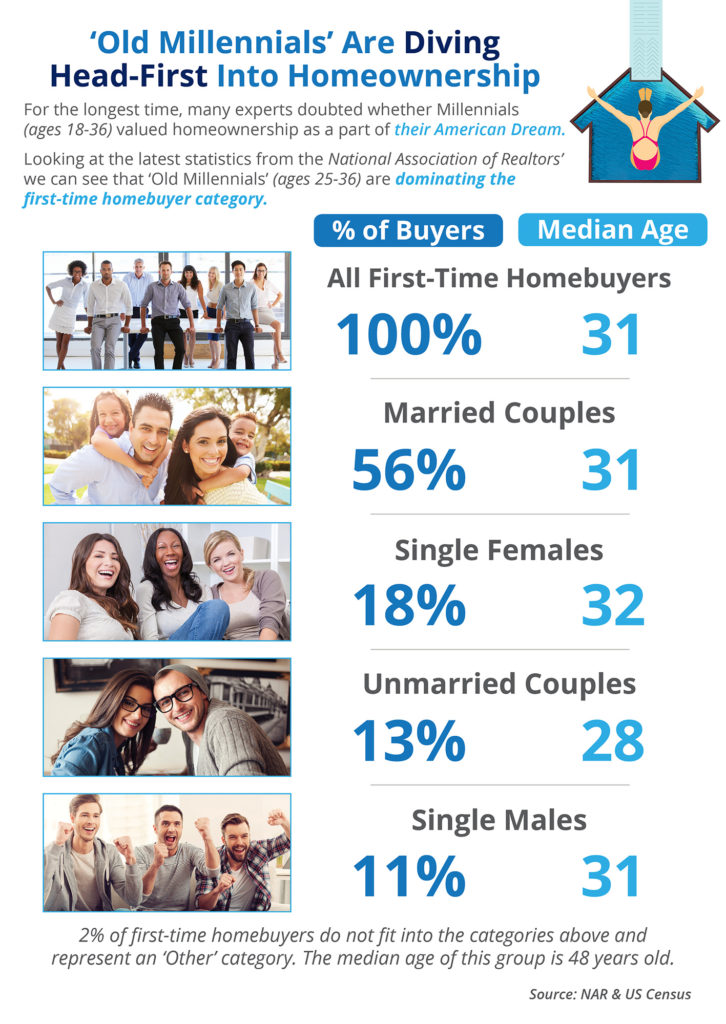

‘Old Millennials’ Are Diving Head-First into Homeownership [INFOGRAPHIC]

Some Highlights:‘Old Millennials’ are defined as 25-36 year olds according to the US Census Bureau.According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 31 years old.More and more ‘Old Millennials’ are realizing that homeownership is within their reach now! … [Read more...]

4 Stats That PROVE This Is NOT 2005 All over Again

Recent research by the National Association of Realtors (NAR) examined certain red flags that caused the housing crisis in 2005, and then compared them to today’s real estate market. Today, we want to concentrate on four of those red flags.Price to Rent RatioPrice to Income RatioMortgage TransactionsHouse FlippingAll four categories were outside historical norms in 2005. Home prices were way above normal ratios when compared to both rents and incomes at the time.NAR explained that mortgage transactions as a … [Read more...]

Real Life vs. Reality TV: 5 Myths Explained

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV ‘show hole’*? We’ve all been there… watching entire seasons of “Love it or List it,” “Fixer Upper,” “House Hunters,” “Flip or Flop,” “Property Brothers,” and so many more, just in one sitting. When you’re in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must … [Read more...]

How Do Rising Prices Impact Your Home Equity?

Yesterday, we shared the results of the latest Home Price Expectation Survey by Pulsenomics. One of the big takeaways from the survey is that over the next five years, home prices will appreciate 3.5% per year on average, and cumulatively will grow by around 18%.So what does this mean for homeowners and their equity position?For example, let’s assume a young couple purchased and closed on a $250,000 home in January of this year. If we only look at the projected increase in the price of that home, how much … [Read more...]

Luxury Home Sales & the Impact of the Stock Market

In a recent post, CoreLogic looked at the correlation between stocks and the sales of upper-end properties ($1 Million+ sales price). The report revealed: “The powerful ‘wealth effects’ generated by the rapid rise in equities between 2009 and 2015 drove a large rise in the sales of homes that sold for $1 million or more.Historically, sales of homes priced $1 million or more averaged 1.2 percent of all home sales. The spread between high-end sales and equities widened during the housing bubble … [Read more...]

- « Previous Page

- 1

- …

- 99

- 100

- 101

- 102

- 103

- …

- 105

- Next Page »