In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.The updated numbers actually show that the range is an average of 5% less expensive in Orange County (CA) all the way up to 46% in Houston (TX), and 36% Nationwide! A recent study by GoBankingRates looked at the cost of renting vs. owing a home at the state level and concluded that in … [Read more...]

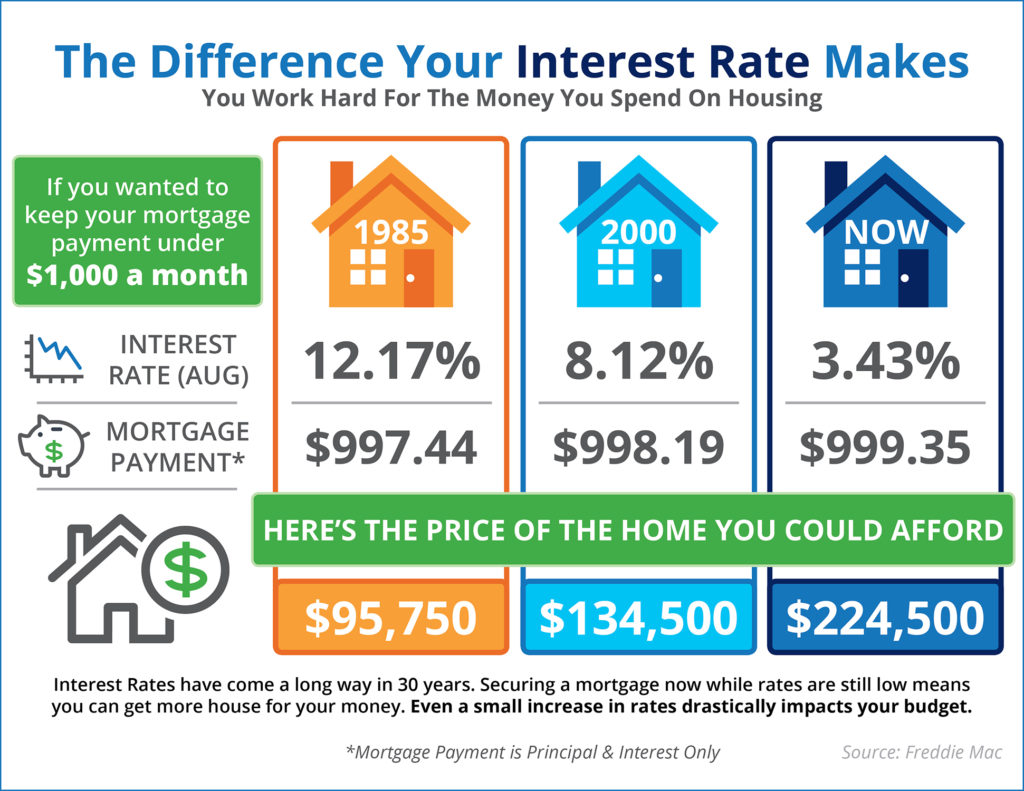

Do You Know the Impact Your Interest Rate Makes? [INFOGRAPHIC]

Some Highlights:Interest rates have come a long way in the last 30 years.The interest rate you secure directly impacts your monthly payment and the amount of house that you can afford if you plan to stay within a certain budget.Interest rates are at their lowest in years… RIGHT NOW!If buying your first home, or moving up to the home of your dreams is in your future, now may be the time to act! … [Read more...]

Warren Buffett: There is No Housing Bubble

With home prices expected to appreciate by over 5% this year, some are beginning to worry about a new housing bubble forming. Warren Buffet addressed this issue last week in an article by Fortune Magazine. He simply explained: “I don’t see a nationwide bubble in real estate right now at all.” Later, when questioned whether real estate and/or mortgaging could present the same challenges for the economy as they did in 2008, Buffet said: “I don’t think we will have a repeat of … [Read more...]

Americans Rank Real Estate #1 Long Term Investment

The Gallup organization recently released a survey in which Americans were asked to rank what they considered to be the “best long term investment.” Real estate ranked number one, with 35% of those surveyed saying it was a better long term investment than stocks & mutual funds, gold, savings accounts or bonds. Here is the breakdown: The survey revealed that real estate was the number one choice among each of the following groups: Men Women People between the ages of 18-29 People between the ages of … [Read more...]

Billionaire: Buy a Home… And if You Can, Buy a Second Home!

Three years ago, John Paulson gave a keynote address at the CNBC/Institutional Investor Conference. In his speech, he told those in attendance that he believes housing will continue its strong recovery for the next 4 to 7 years, saying that: "The housing market has bottomed. It's not too late to get involved. I still think buying a home is the best investment any individual can make. Affordability is still at an all-time high." When asked how the average person could take advantage of the current real estate … [Read more...]

One More Time… You Do Not Need 20% Down To Buy NOW

A survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today. 1. Down Payment The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 36% think a 20% down payment is always required. In actuality, there are many loans written with … [Read more...]

Thinking of Selling? The Market Needs Your Listing!!

The housing market is really heating up and buyer demand is dramatically increasing as we enter the spring season. However, one challenge to the current market is a major shortage of inventory. Below are a few comments made in the last month by industry experts. Lawrence Yun, Chief Economist of NAR “Looking ahead, the key for sustained momentum and more sales than last spring is a continuous stream of new listings quickly replacing what's being scooped up by a growing pool of buyers. Without adequate supply, … [Read more...]

Buying a Home is 36% Less Expensive Than Renting Nationwide!

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States. The updated numbers actually show that the range is an average of 5% less expensive in Orange County (CA) all the way up to 46% in Houston (TX), and 36% Nationwide! Other interesting findings in the report include: Interest rates have remained low and even though home prices have appreciated … [Read more...]

The Top Reasons Why Americans Buy Homes

Last week, the inaugural “Homebuyer Insights Report” was released by the Bank of America. The report revealed the reasons why consumers purchase homes and what their feelings are regarding homeownership. Consumer Lending Executive, D. Steve Boland, explained: “Homebuyers today are motivated by both emotional and practical reasons. Nearly all want more space, but a majority of homebuyers, especially those purchasing their first home, are also looking for a place to call their own, put down roots … [Read more...]

Over Half of Americans Planning on Buying in the Next 5 Years

According to the BMO Harris Bank Home Buying Report, 52% of Americans say they are likely to buy a home in the next five years. Americans surveyed for the report said that they would be willing to pay an average of $296,000 for a home and would average a 21% down payment. The report also included other interesting revelations. Those Looking to Buy 74% of those looking to buy a new home will consult with a real estate agent 59% said they will visit online real estate websites 37% will seek recommendations from … [Read more...]