In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home. Depending on where you live, median rents, incomes and home prices all vary. By determining the percentage of income a renter spends on housing in each state, and the amount needed for a 10% down payment, they were able to establish how long (in years) it would take for an average resident to save. According to the … [Read more...]

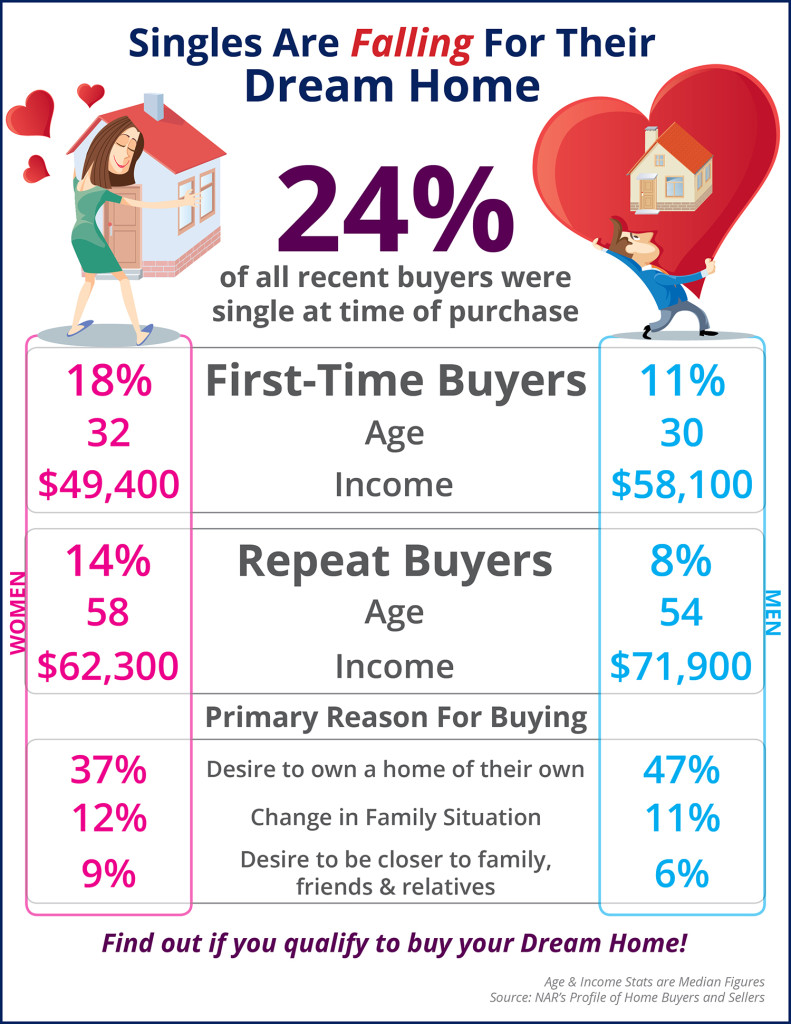

More & More Singles Are Falling For Their Dream Home [INFOGRAPHIC]

Some Highlights: 24% of all recent home buyers were single at the time of purchase. 47% of single men cite the desire to own a home of their own as the primary reason to buy. 18% of first-time buyers were single women. … [Read more...]

Building Wealth: First Rung on the Ladder is Housing

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is “an online resource for the most rigorous research and practical information on how a quality, stable, affordable home in a vibrant community contributes to individual and community success”. A recent story they published, The First Rung on the Ladder to Economic Opportunity Is Housing, discussed the importance of having affordable housing available to as many families as possible because: “The … [Read more...]

Real Estate: 2016 Will Be the Best Year in a Decade

A few weeks ago, Jonathan Smoke, the Chief Economist at realtor.com, exclaimed: “All indicators point to this spring being the busiest since 2006.” Now, Freddie Mac has doubled down on that claim and is saying that 2016 will be the best year that the real estate industry has seen in a decade. In their March Housing Outlook Report, Freddie Mac explained: “Despite the challenges facing the housing market, we expect this to be the best year for housing in a decade. Home sales, housing starts, and … [Read more...]

Don’t Wait! Move Up To Your Dream Home Now!

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates have stayed near historic lows. Sellers should realize that waiting to make the move when mortgage rates are projected to increase probably doesn’t make sense. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain budget for your monthly housing … [Read more...]

Don’t Be Fooled… Homeownership Is A Great Investment! [INFOGRAPHIC]

Some Highlights: Harvard University's Joint Center of Housing Studies recently released the top financial & emotional reasons to own a home. Owning is a good way to build up wealth that can be passed along to your family as it is usually a form of "forced savings." You're paying for a house whether you own or rent, but owning gives you control over your living space. … [Read more...]

2016 Home Sales Doing Just Fine!!

Some of the housing headlines are causing concern for some consumers who are in the process of either buying or selling a home. Pundits are concerned over the lack of new construction or the month-over-month sales numbers. Let’s set the record straight; 2015 was a good year for residential real estate in the United States and 2016 is starting out stronger. Here is a graph of total homes sold (new construction and existing homes) in the first two months in 2016 compared to last year: Will this momentum … [Read more...]

Past, Present & Future Home Values

In CoreLogic’s latest Home Price Index, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month, and projected appreciation over the next twelve months. Here are state maps for each category: The Past – home appreciation over the last 12 months The Present – home appreciation over the last month The Future – home appreciation projected over the next 12 months Bottom Line Homes across the country … [Read more...]

Sales Contracts Hit Highest Level in Months

The National Association of Realtors (NAR) just announced that the February Pending Home Sales Index reached it’s highest reading since July 2015. What is the Pending Home Sales Index (PHSI)? NAR’s PHSI is “a forward-looking indicator based on contract signings”. The higher the Pending Home Sales Index number, the more contracts have been signed by buyers that will soon translate to sales. February’s Index rose 3.5% month-over-month to 109.1. What does this mean for the … [Read more...]

Further Proof This Isn’t a Housing Bubble

Two weeks ago, we posted a blog which explained that current increases in home prices were the result of the well-known concept of supply & demand and should not lead to conversations of a new housing bubble. Today, we want to look at home prices as compared to current incomes. Here is a graph showing the monthly mortgage payment on a median priced home in the U.S. over the last 25 years: Mortgage payments are currently well below the historic average over that time period. Purchasers are not overextending … [Read more...]