CoreLogic’s latest Equity Report revealed that one million borrowers regained equity in their homes in 2015. The outlook for 2016 remains positive as well, as an additional 850,000 properties would regain equity if home prices rose another 5% this year. The study also revealed: 95% of homes valued over $200,000 now have a positive equity position 87% of homes valued under $200,000 have entered a positive position The 11.5% growth in home equity in Q4 marked the 13th consecutive quarter of double digit … [Read more...]

The Importance of Using an Agent To Sell Your House

When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold. In order to accomplish all three goals, a seller should realize the importance of using a real estate professional. We realize that technology has changed the purchaser’s behavior during the home buying process. For the past three years, 92% of all buyers have used the internet in … [Read more...]

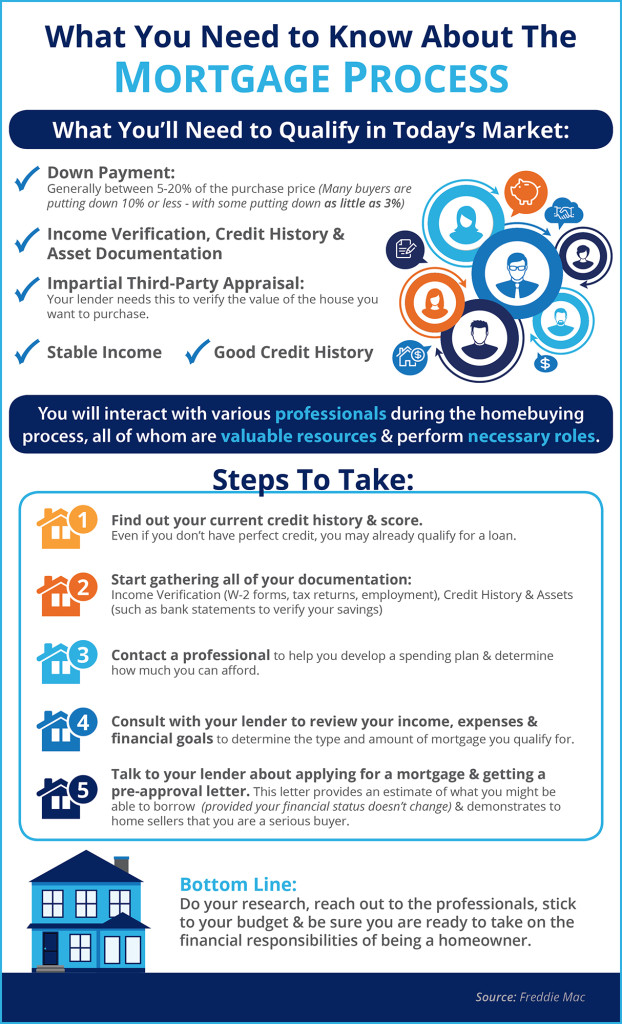

The Mortgage Process: What You Need To Know [INFOGRAPHIC]

Some Highlights: Many buyers are purchasing a home with a down payment as little as 3%. You may already qualify for a loan, even if you don't have perfect credit. Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford. … [Read more...]

What If I Wait Until Next Year To Buy A Home?

As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first-time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home. Let us explain. There are many factors that influence the ‘cost’ of a home. Two of the major ones are the home’s appreciation over time, and the interest rate at which a buyer can borrow the funds necessary to purchase … [Read more...]

Study Again Finds Homeownership to be a Better Way of Producing Wealth

According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index homeownership is a better way to produce greater wealth, on average, than renting. The BH&J Index is a quarterly report that attempts to answer the question: Is it better to rent or buy a home in today’s housing market? The index examines the entire US housing market and then isolates 23 major markets for comparison. The researchers use a “'horse race' comparison between an individual that is buying a home and an … [Read more...]

Study Again Finds Homeownership to be a Better Way of Producing Wealth

According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index homeownership is a better way to produce greater wealth, on average, than renting. The BH&J Index is a quarterly report that attempts to answer the question: Is it better to rent or buy a home in today’s housing market? The index examines the entire US housing market and then isolates 23 major markets for comparison. The researchers use a “'horse race' comparison between an individual that is buying a home and an … [Read more...]

Put Your Housing Cost To Work For You!

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. As we have said before, mortgage interest rates are still near historic lows and rents continue to rise. Housing Cost & Net Worth Whether you rent or buy, you have a monthly housing cost. As a buyer, you are contributing to YOUR net worth. Every mortgage payment is a form of what Harvard University’s Joint Center for Housing Studies calls “forced … [Read more...]

Put Your Housing Cost To Work For You!

There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. As we have said before, mortgage interest rates are still near historic lows and rents continue to rise. Housing Cost & Net Worth Whether you rent or buy, you have a monthly housing cost. As a buyer, you are contributing to YOUR net worth. Every mortgage payment is a form of what Harvard University’s Joint Center for Housing Studies calls “forced … [Read more...]

Home Is Where The Heart Is

Yesterday, we discussed the reasons why homeownership makes sense, financially. Today we wanted to touch on the emotional or ‘real’ reasons that many Americans strive to become homeowners. The Joint Center for Housing Studies at Harvard University performs a study every year surveying participants for the reasons that American’s feel are most important in regards to homeownership. The top 4 reasons to own a home cited by respondents were not financial. 1. It means … [Read more...]

Home Is Where The Heart Is

Yesterday, we discussed the reasons why homeownership makes sense, financially. Today we wanted to touch on the emotional or ‘real’ reasons that many Americans strive to become homeowners. The Joint Center for Housing Studies at Harvard University performs a study every year surveying participants for the reasons that American’s feel are most important in regards to homeownership. The top 4 reasons to own a home cited by respondents were not financial. 1. It means … [Read more...]