There are many benefits to homeownership. One of the top benefits is being able to protect yourself from rising rents by locking in your housing cost for the life of your mortgage.Don’t Become Trapped Jonathan Smoke, Chief Economist at realtor.com, reported on what he calls a “Rental Affordability Crisis.” He warns that,“Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price … [Read more...]

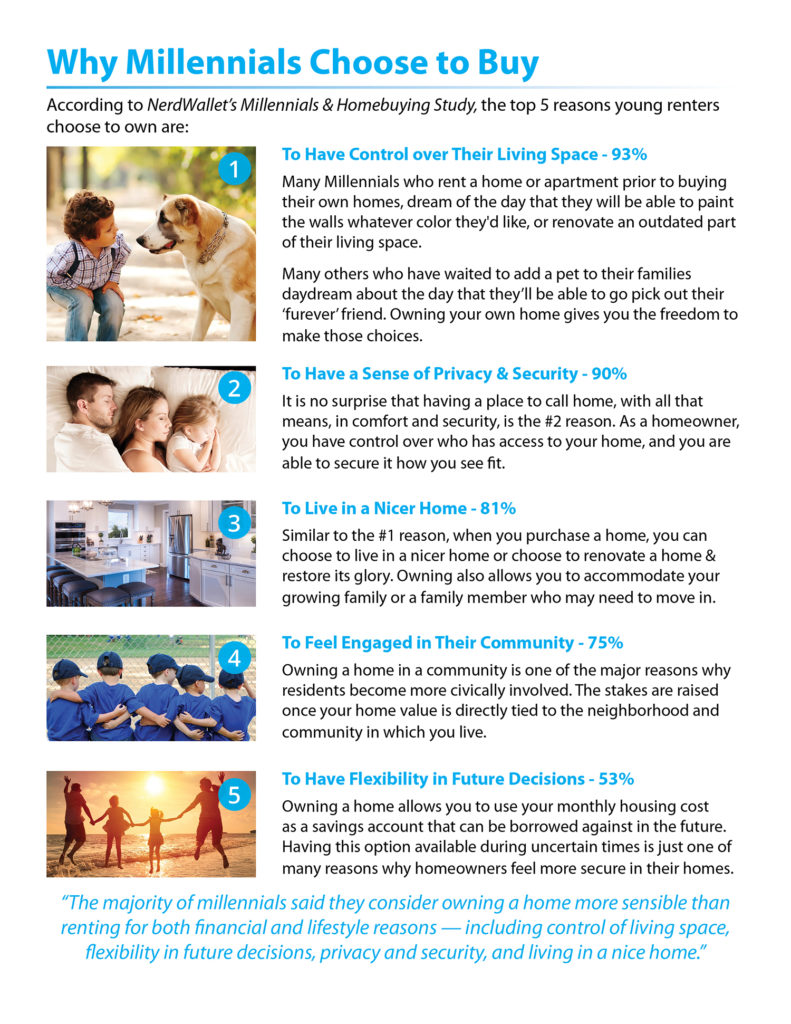

Why Millennials Choose to Buy [INFOGRAPHIC]

Some Highlights:“The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”At 93%, the top reason Millennials choose to buy is to have control over their living space.Many Millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls … [Read more...]

The ‘REAL’ News about Housing Affordability

Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).Here is how NAR defines the index:“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national … [Read more...]

Buying this Spring? Be Prepared for Bidding Wars

Traditionally, spring is the busiest season for real estate. Buyers come out in force and homeowners list their houses for sale hoping to capitalize on buyer activity. This year will be no different!Buyers have already been out in force looking for their dream homes and more are on their way, but the challenge is that the inventory of homes for sale has not kept up with demand, which has lead to A LOT of competition for the homes that are available.A recent Bloomberg article touched on the current market … [Read more...]

Again… You Do Not Need 20% Down to Buy NOW!

A survey by Ipsos found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. There are two major misconceptions that we want to address today.1. Down PaymentThe survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 40% of consumers think a 20% down payment is always required. In actuality, there are many loans written with a down payment … [Read more...]

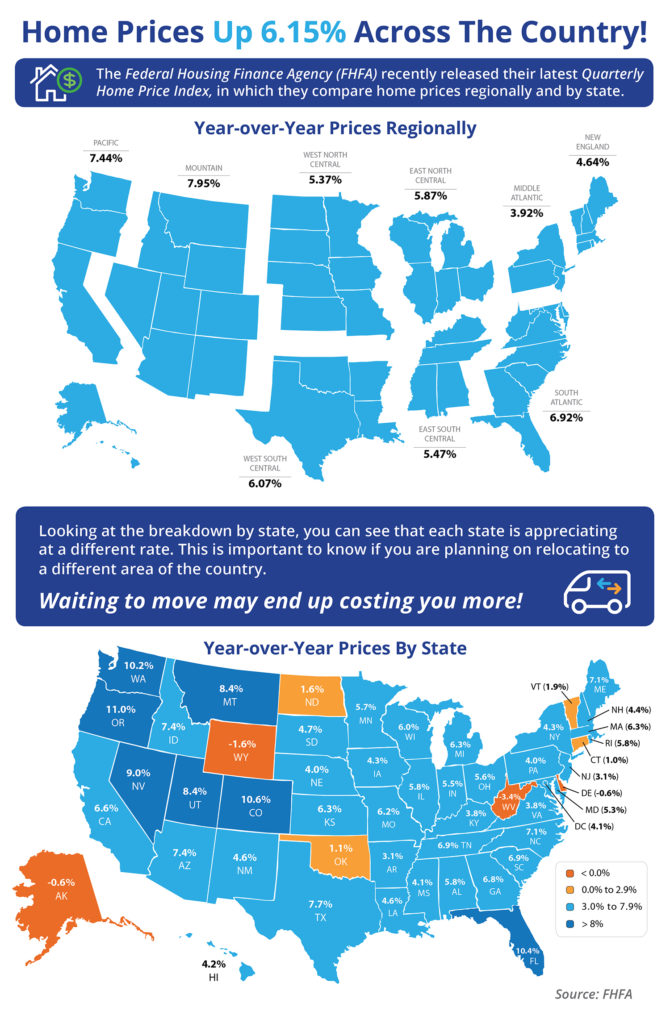

Home Prices Up 6.15% Across the Country! [INFOGRAPHIC]

Some Highlights:The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report.In the report, home prices are compared both regionally and by state.Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more!Alaska, Delaware, West Virginia & Wyoming were the only one states where home prices are lower than they were last year. … [Read more...]

Looking to Move-Up to a Luxury Home? Now’s the Time!

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! We recently shared data from Trulia’s Market Mismatch Study which showed that in today’s premium home market, buyers are in control. The inventory of homes for sale in the luxury market far exceeds those searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer, or can be found at a discount.Those who have a … [Read more...]

Millionaire to Millennials: Buy Now!

Self-made millionaire David Bach was quoted in a CNBC article explaining that "the single biggest mistake millennials are making" is not purchasing a home because buying real estate is "an escalator to wealth.”Bach went on to explain:"If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter."In his bestselling book, “The Automatic … [Read more...]

Renting or Buying… Either Way You’re Paying a Mortgage

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage - either yours or your landlord’s.As Entrepreneur Magazine, a premier source for small business, explained this month in their article, “12 Practical Steps to Getting Rich”:“While renting on a temporary basis isn't terrible, you should most certainly own the roof … [Read more...]

What Are the Experts Saying about Mortgage Rates?

Mortgage interest rates have risen over the last few months and projections are that they will continue their upswing throughout 2017. What impact will this have on the housing market? Here is what the experts are saying:Laurie Goodman, Co-director of the Urban Institute’s Housing Finance Policy Center:“In 1984, 1994, 2000, and 2013, every time we have rate increases, we have increases in nominal home prices. We expect this to be more pronounced, as there is a big demand-and-supply gap at the present … [Read more...]

- « Previous Page

- 1

- …

- 89

- 90

- 91

- 92

- 93

- …

- 105

- Next Page »