Here are four great reasons to consider buying a home today instead of waiting.1. Prices Will Continue to RiseCoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.9% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.8% over the next year.The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.2. Mortgage Interest Rates Are Projected to IncreaseFreddie … [Read more...]

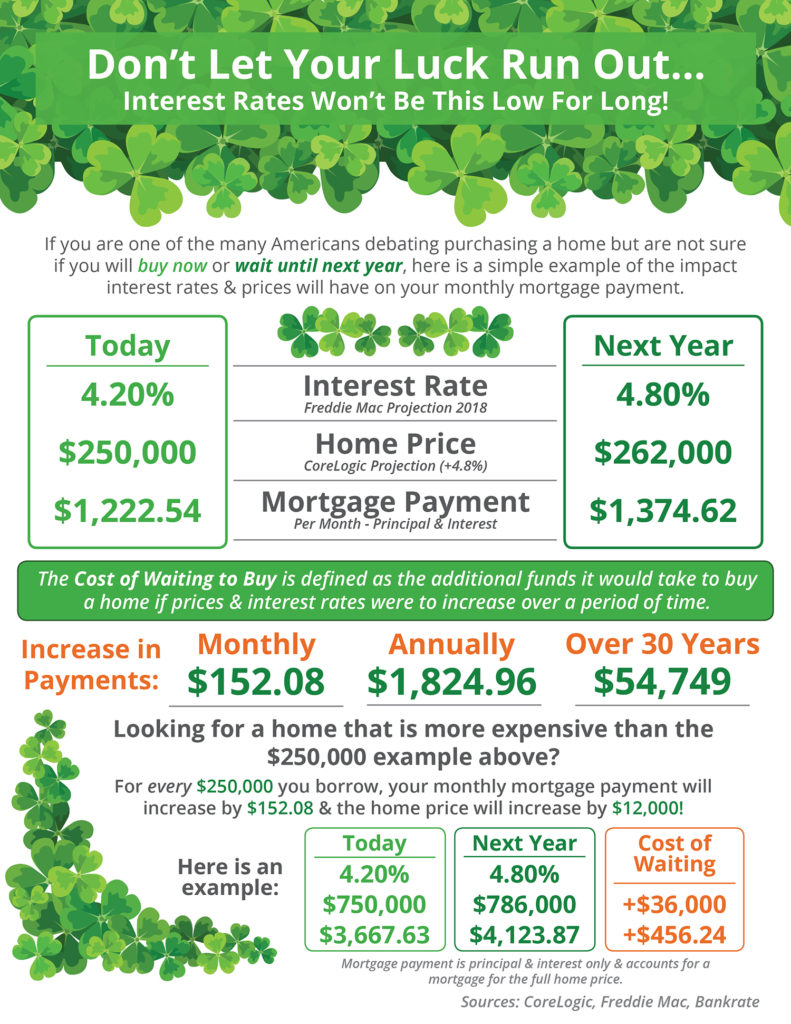

Don’t Let Your Luck Run Out [INFOGRAPHIC]

Some Highlights: The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.8% according to CoreLogic.Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage! … [Read more...]

Which Homes Have Appreciated the Most?

Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 7.1%. CoreLogic, in their most recent Home Price Insights Report, reveals that national home prices have increased by 6.9% year-over-year.The CoreLogic report broke down appreciation even further into four different price categories:Lower Priced Homes: priced at 75% or less of the medianLow-to-Middle Priced … [Read more...]

A Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture

The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the National Association of Realtors latest Existing Home Sales Report. Inventory is now 7.1% lower than this time last year, marking the 20th consecutive month of year-over-year drops.Historically, inventory must reach a 6-month supply for a normal market where home prices appreciate with inflation. Anything less than a 6-month supply is a sellers’ market, where the demand for … [Read more...]

Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.Here is a chart showing … [Read more...]

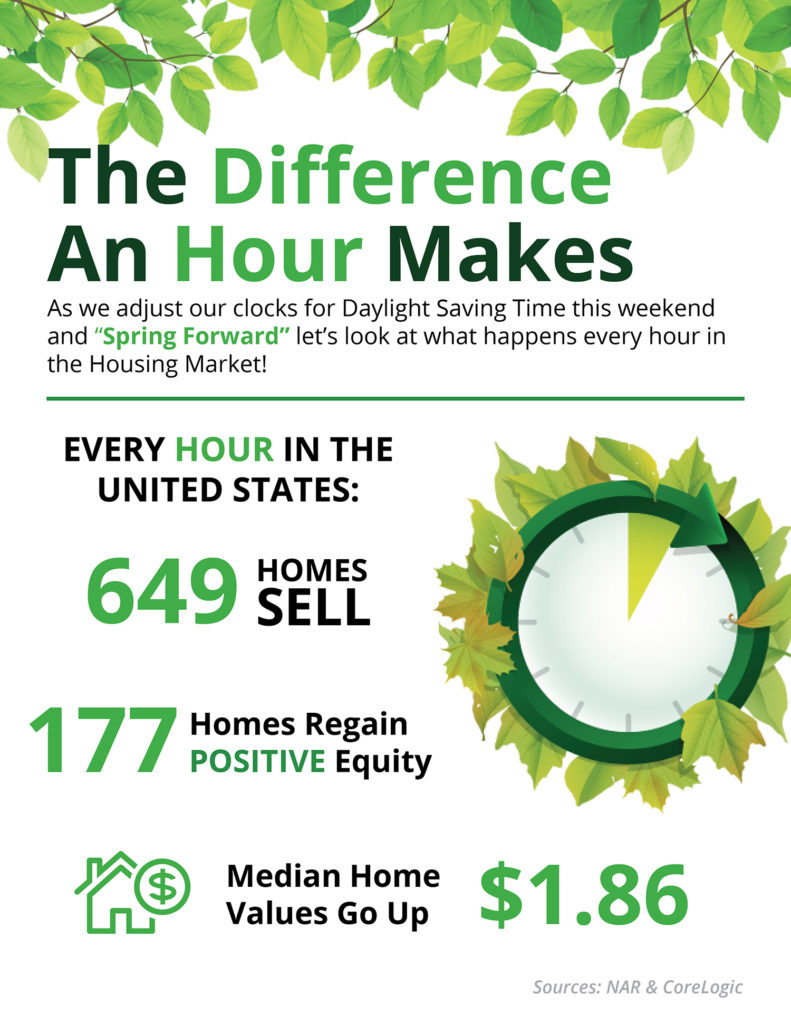

Spring Forward: The Difference An Hour Makes [INFOGRAPHIC]

Some Highlights:Don’t forget to set your clocks forward this Sunday, March 12th at 2:00 AM EST in observance of Daylight Savings Time.Unless of course, you are a resident of Arizona or Hawaii!Every hour in the United States: 649 homes are sold, 177 homes regain equity (meaning they are no longer underwater on their mortgage), and the median home price rises $1.86! … [Read more...]

Builder Confidence Hits 11-Year High

In many areas of the country, there are not enough homes for sale to satisfy the number of buyers looking to purchase their dream homes. Experts have long proposed that a ramp-up in new, single-family home construction would be one of the many ways to overcome this inventory shortage.According to a recent survey conducted by the National Association of Home Builders (NAHB) and Wells Fargo, housing market confidence amongst builders reached an 11-year high last month.What Does High Confidence Mean for the Housing … [Read more...]

The Connection Between Home Prices & Family Wealth

Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.So, what does this mean for homeowners and their equity position?As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?Since the experts … [Read more...]

Mortgage Rates Impact on 2017 Home Values

There is no doubt that historically low mortgage interest rates were a major impetus to housing recovery over the last several years. However, many industry experts are showing concern about the possible effect that the rising rates will have moving forward.The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are all projecting that mortgage interest rates will move upward in 2017. Increasing interest rates will definitely impact purchasers and may stifle demand.In a … [Read more...]

Over Half of All Buyers Are Surprised by Closing Costs

According to a recent survey conducted by ClosingCorp, over half of all homebuyers are surprised by the closing costs required to obtain their mortgage.After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all, while another 35% were stunned by how much higher the fees were than expected.“Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance and … [Read more...]

- « Previous Page

- 1

- …

- 90

- 91

- 92

- 93

- 94

- …

- 105

- Next Page »