In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.Even if you are in a market that is not as competitive, knowing your budget will give you the confidence of knowing if your dream home is within your … [Read more...]

Is This the Year to Move Up to Your Dream Home? If So, Do it Early

It appears that Americans are regaining faith in the U.S. economy. The following indexes have each shown a dramatic jump in consumer confidence in their latest surveys:The University of Michigan Consumer Sentiment IndexNational Federation of Independent Businesses' Small Business Optimism IndexCNBC All-America Economic SurveyThe Conference Board Consumer Confidence SurveyIt usually means good news for the housing market when the country sees an optimistic future. People begin to dream again about the home their … [Read more...]

You Need a Professional on Your Team When Buying a Home

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to do it on their own. In today’s market: you need an experienced professional!You Need an Expert Guide if You Are Traveling a Dangerous PathThe field of real estate is loaded with land mines; you need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and is ready for you to move into can be … [Read more...]

Millionaire to Millennials: Buy a Home!!

Last week, CNBC ran an article quoting self-made millionaire David Bach explaining that not purchasing a home is "the single biggest mistake millennials are making" because buying real estate is "an escalator to wealth.”Bach went on to explain:"If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter."In his bestselling book, “The Automatic Millionaire,” Bach does the … [Read more...]

5 Reasons to Resolve to Hire a Real Estate Professional [INFOGRAPHIC]

Some Highlights:As we usher in the new year, one thing is for certain… if you plan to buy or sell a house this year, you need a real estate professional on your team!There are many benefits to using a local professional!Pick a pro who knows your local market and can help you navigate the housing market! … [Read more...]

Homeowner’s Net Worth Is 45x Greater Than A Renter’s

Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400).In a Forbes article, the National Association of Realtors’ (NAR) Chief Economist Lawrence Yun predicts that by the end of 2016, the net worth gap will widen even further to 45 times greater.The graph below … [Read more...]

The Fed Raised Rates: What Does that Mean for Housing?

You may have heard that the Federal Reserve raised rates last week… But what does that mean if you are looking to buy a home in the near future? Many in the housing industry have predicted that the Federal Open Market Committee (FOMC), the policy-making arm of the Federal Reserve, would vote to raise the federal fund's target rate at their December meeting. For only the second time in a decade, this is exactly what happened. There were many factors that contributed to the 0.25 point increase (from 0.50 to … [Read more...]

Whether You Rent or Buy: Either Way You’re Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either yours or your landlord’s.As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.Are you ready … [Read more...]

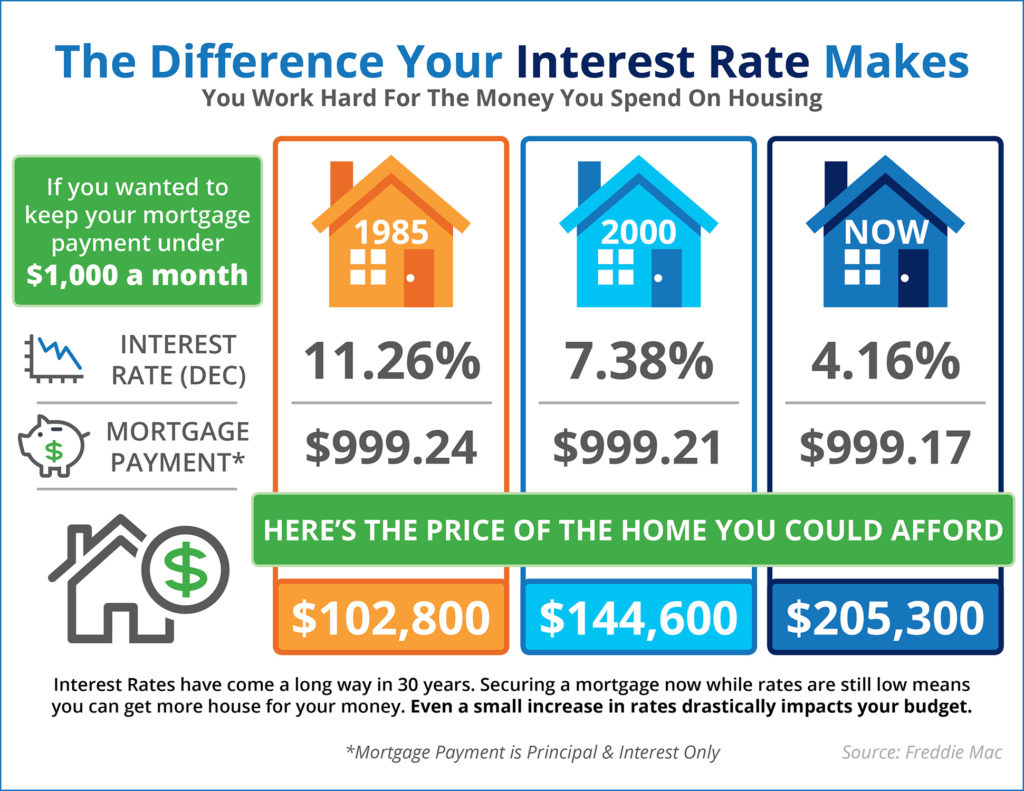

The Impact Your Interest Rate Has on Your Buying Power [INFOGRAPHIC]

Some Highlights:Your monthly housing cost is directly tied to the price of the home you purchase and the interest rate you secure for your mortgage.Over the last 30 years, interest rates have fluctuated greatly with rates in the double digits in the 1980s, all the way down to the near 4% we are experiencing now.Your purchasing power is greatly impacted by the interest rate you secure. Act now before rates go up! … [Read more...]

Building Your Family’s Wealth Over the Next 5 Years

Over the next five years, home prices are expected to appreciate 3.24% per year on average and to grow by 21.4% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.So, what does this mean for homeowners and their equity position?As an example, let’s assume a young couple purchases and closes on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?Since the experts predict that … [Read more...]

- « Previous Page

- 1

- …

- 93

- 94

- 95

- 96

- 97

- …

- 105

- Next Page »