According to Freddie Mac’s latest Primary Mortgage Market Survey, the 30-year fixed rate mortgage interest rate jumped up to 3.94% last week. Interest rates had been hovering around 3.5% since June, and many are wondering why there has been such a significant increase so quickly. Why did rates go up?Whenever there is a presidential election, there is uncertainty in the markets as to who will win. One way that this is noticeable is through the actions of investors. As we get closer to the first Tuesday of … [Read more...]

You Can Never Have TMI about PMI

When it comes to buying a home, whether it is your first time or your fifth, it is always important to know all the facts. With the large number of mortgage programs available that allow buyers to purchase a home with a down payment below 20%, you can never have Too Much Information (TMI) about Private Mortgage Insurance (PMI).What is Private Mortgage Insurance (PMI)?Freddie Mac defines PMI as:“An insurance policy that protects the lender if you are unable to pay your mortgage. It's a monthly fee, rolled into … [Read more...]

The Dangers of “Tight Mortgage Credit” Headlines

The availability of mortgage credit is not at the same level that it was during the boom in housing (2005), and that’s good news. However, the constant headlines which talk about “tight credit” are causing some potential home buyers to doubt their ability to purchase. We want to rectify the misconception of what is required for a down payment in order to purchase a home in today’s market.Freddie Mac recently discussed the confusion many first-time homebuyers have about the down payment they … [Read more...]

Think All Millennials Live in Their Parent’s Basement? Think Again!

According to the Census Bureau, millennials have overtaken baby boomers as the largest generation in U.S. History. Millennials, or America's youth born between 1982-2000, now represent more than one quarter of the nation’s population, totaling 83.1 million.There has been a lot of talk about how, as a generation, millennials have ‘failed to launch’ into adulthood and have delayed moving out of their family’s home. Some experts have even questioned whether or not millennials want to move … [Read more...]

How Long Do Families Stay in a Home?

The National Association of Realtors (NAR) keeps historic data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years – an increase of almost 50%.Why the dramatic increase?The reasons for this change are plentiful. The top two reasons are:The fall in home prices during the … [Read more...]

Buying a Home? 4 Demands to Make on Your Real Estate Agent

Are you thinking of buying a home? Are you dreading having to walk through strangers’ houses? Are you concerned about getting the paperwork correct? Hiring a professional real estate agent can take away most of the challenges of buying. A great agent is always worth more than the commission they charge, just like a great doctor or great accountant.You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish an average agent from a great one.Here are the top 4 … [Read more...]

Taking the Fear out of the Mortgage Process

A considerable number of potential buyers shy away from jumping into the real estate market due to their uncertainty about the buying process. A specific cause for concern tends to be mortgage qualification.For many, the mortgage process can be scary, but it doesn’t have to be!In order to qualify in today’s market, you’ll need to have saved for a down payment (the average down payment on all loans was 11% last month, with many buyers putting down 3% or less), a stable income and good credit … [Read more...]

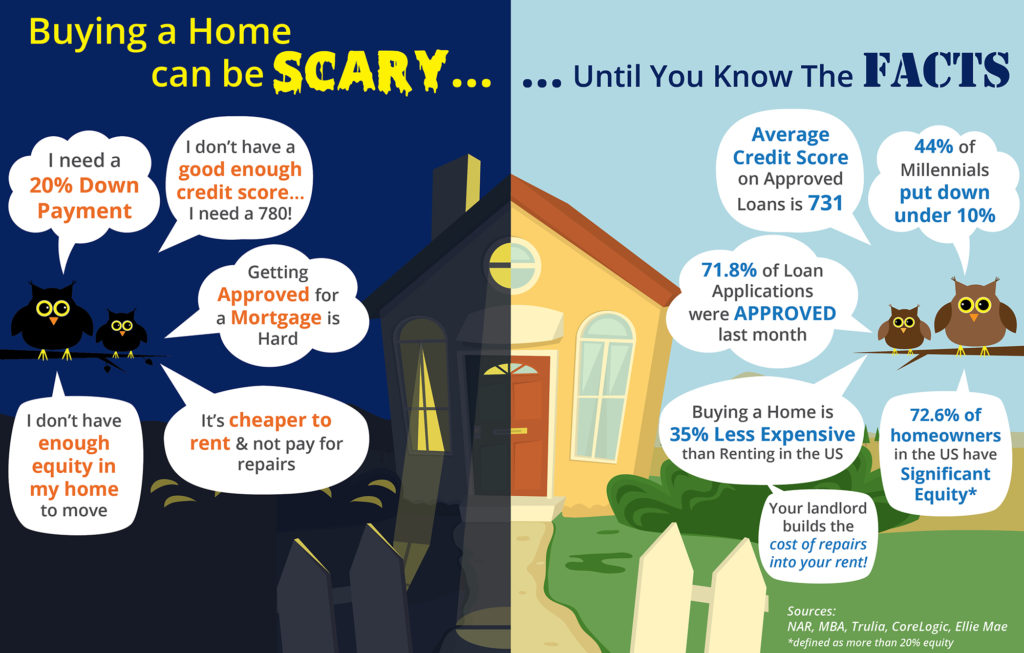

Buying a Home Can Be Scary… Know the Facts [INFOGRAPHIC]

Some Highlights:36% of Americans think they need a 20% down payment to buy a home.44% of Millennials who purchased a home this year have put down less than 10%.8% of loan applications were approved last month.The average credit score of approved loans was 731 in September. … [Read more...]

What to Expect When Home Inspecting

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection.This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.How to Choose an InspectorYour agent will most likely have a short list of inspectors that … [Read more...]

Buying is Now 37.7% Cheaper Than Renting in the US

The results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.The updated numbers actually show that the range is an average of 17.4% less expensive in Honolulu (HI), all the way up to 53.2% less expensive in Miami & West Palm Beach (FL), and 37.7% nationwide!Other interesting findings in the report include:Interest rates have remained low, and even though home … [Read more...]

- « Previous Page

- 1

- …

- 95

- 96

- 97

- 98

- 99

- …

- 105

- Next Page »