Recently there has been a lot of talk about home prices and if they are accelerating too quickly. In some areas of the country, seller supply (homes for sale) cannot keep up with the number of buyers out looking for a home, which has caused prices to rise.The great news about rising prices, however, is that according to CoreLogic’s latest US Economic Outlook, the average American household gained over $11,000 in equity over the course of the last year, largely due to home value increases.The map below was … [Read more...]

Starting to Look for a Home? Know What You WANT vs. What You NEED

In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search.If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale with rose-colored glasses.Do you … [Read more...]

How Historically Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.47%. Rates have remained at or below 3.5% each of the last 16 weeks, marking a historic low.The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.Purchasing power, simply put, is the amount of home you can afford buy for the budget you have available to spend. As rates increase, the price of … [Read more...]

Don’t Disqualify Yourself… Over Half of All Loans Approved Have a FICO Score Under 750

The results of countless studies have shown that potential home buyers, and even current homeowners, have an inflated view of what is really required to qualify for a mortgage in today’s market.One such study by the Wharton School of Business at the University of Pennsylvania, revealed that many Millennials have not yet considered purchasing a home, simply because they don’t believe they can qualify for a mortgage.The article quoted Jessica Lautz, the National Association of … [Read more...]

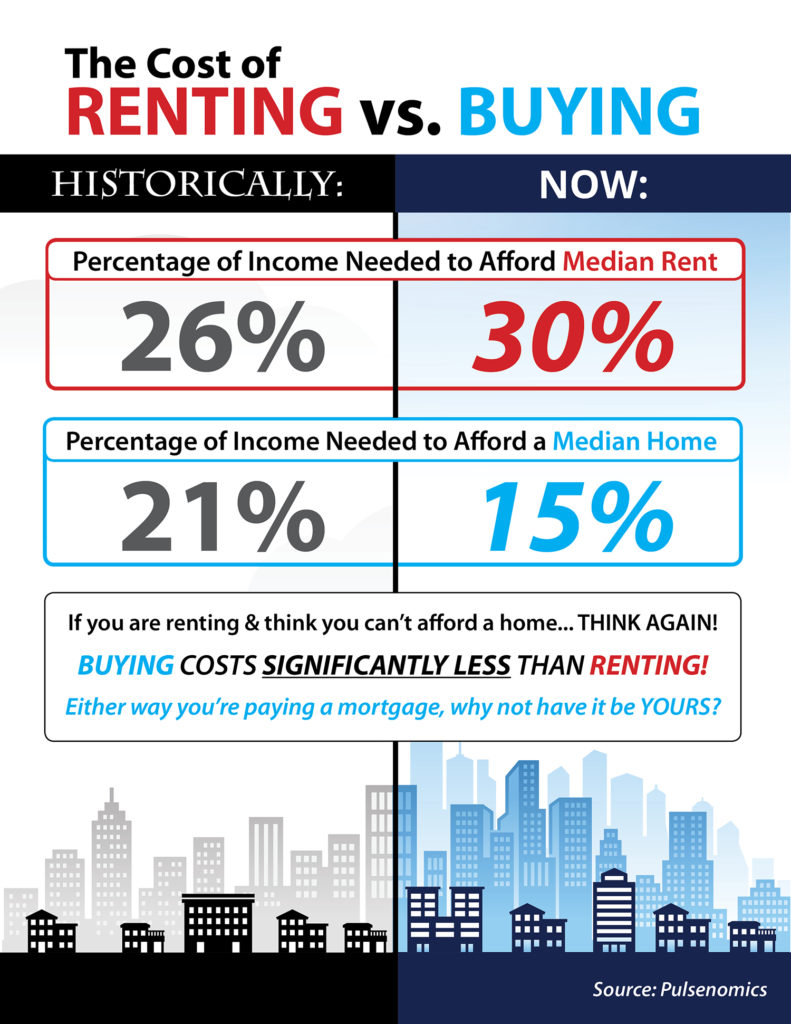

Do You Know the Cost of Renting vs. Buying? [INFOGRAPHIC]

Some Highlights:Historically, the choice between renting or buying a home has been a close decision.Looking at the percentage of income needed to rent a median priced home today (30%) vs. the percentage needed to buy a median priced home (15%), the choice becomes obvious.Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home of your own! … [Read more...]

The Past, Present & Future of Home Prices

CoreLogic released their most current Home Price Index last week. In the report, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month and projected over the next twelve months.Here are state maps for each category: The Past – home appreciation over the last 12 monthsThe Present – home appreciation over the last monthThe Future – home appreciation projected over the next 12 monthsBottom LineHomes … [Read more...]

3 Questions to Ask Before Buying Your Dream Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.Ask yourself the following 3 questions to help determine if now is actually a good time for you to buy in today’s market.1. Why am I buying a home in the first place?This truly is the most important question to answer. Forget the finances for a minute. … [Read more...]

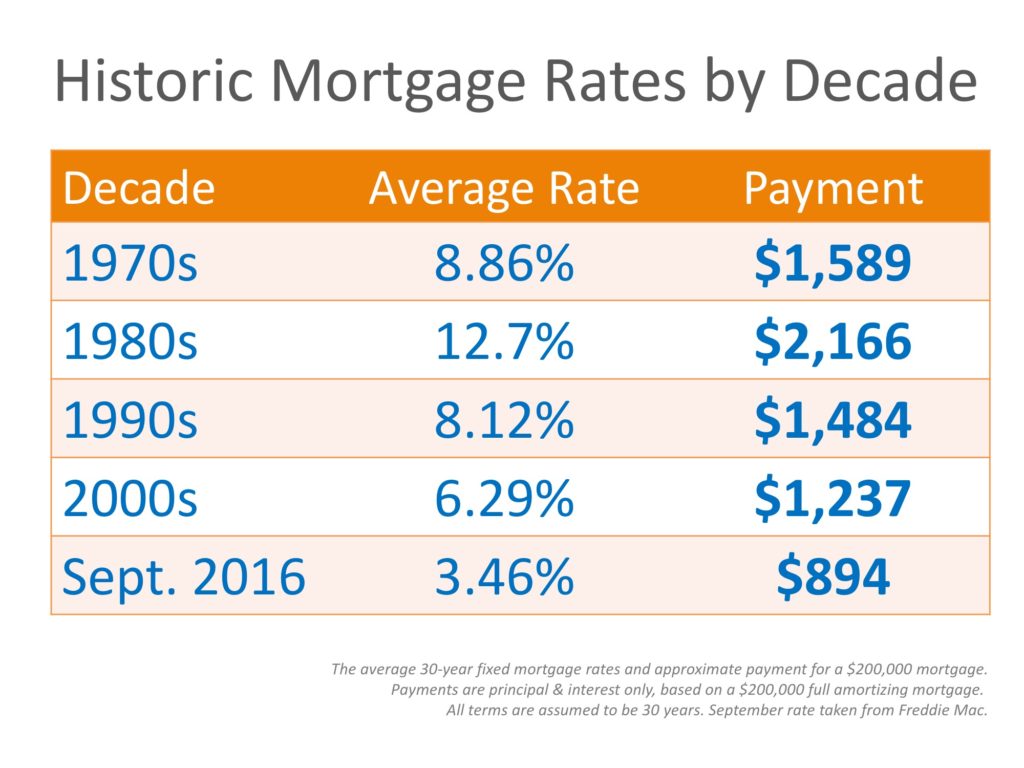

Mortgage Rates by Decade Compared to Today [INFOGRAPHIC]

Some Highlights:The interest rate you secure for your mortgage greatly influences your monthly housing costs.In the 1980s, 30-year fixed mortgage rates averaged in the high 12s making the monthly principal and interest payment over $2,000.Interest rates are still at historic lows; this is a great time lock in your housing cost and protect yourself from increasing rents, or refinance your current mortgage. … [Read more...]

Why We Need More Newly Constructed Homes

The number of new home sales is far off historic norms. The National Association of Realtors (NAR) just reported that the percentage of all house sales that were newly constructed homes has fallen to the lowest numbers in forty years. Here is a graph showing the percentages:This should come as no surprise as the number of new housing starts has fallen dramatically over the last several years:Bottom LineWe need more new construction for two reasons:It will relieve some of the pent-up buying demand that is causing … [Read more...]

Have You Put Aside Enough for Closing Costs?

There are many potential homebuyers, and even sellers, who believe that you need at least a 20% down payment in order to buy a home, or move on to their next home. Time after time, we have dispelled this myth by showing that there are many loan programs that allow you to put down as little as 3% (or 0% with a VA loan).If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs.Freddie Mac defines … [Read more...]

- « Previous Page

- 1

- …

- 96

- 97

- 98

- 99

- 100

- …

- 105

- Next Page »