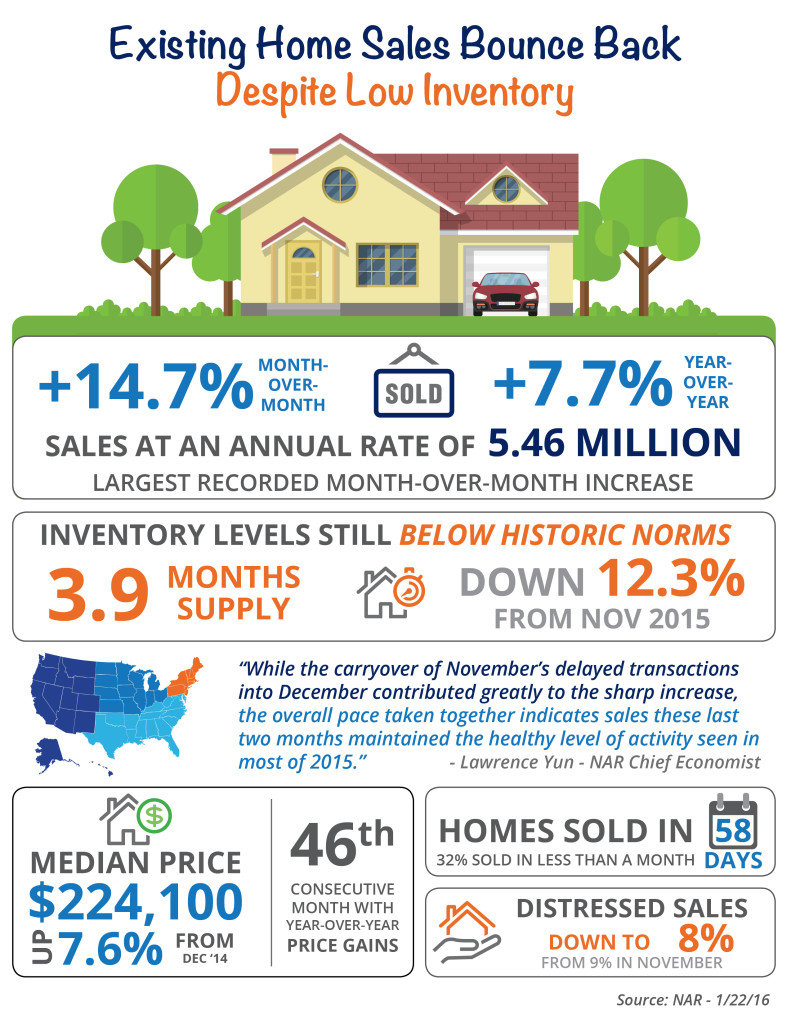

Some Highlights: Sales in December were 14.7% higher than those in November, marking the largest month-over-month increase ever recorded. Inventory levels are still below historic norms at 3.9-months supply. Median home price is up 7.6% from last year, marking the 46th consecutive month with year-over-year price gains. … [Read more...]

Sellers

Resources for anyone selling or considering selling a house in St Tammany, Jefferson, or Orleans parishes.

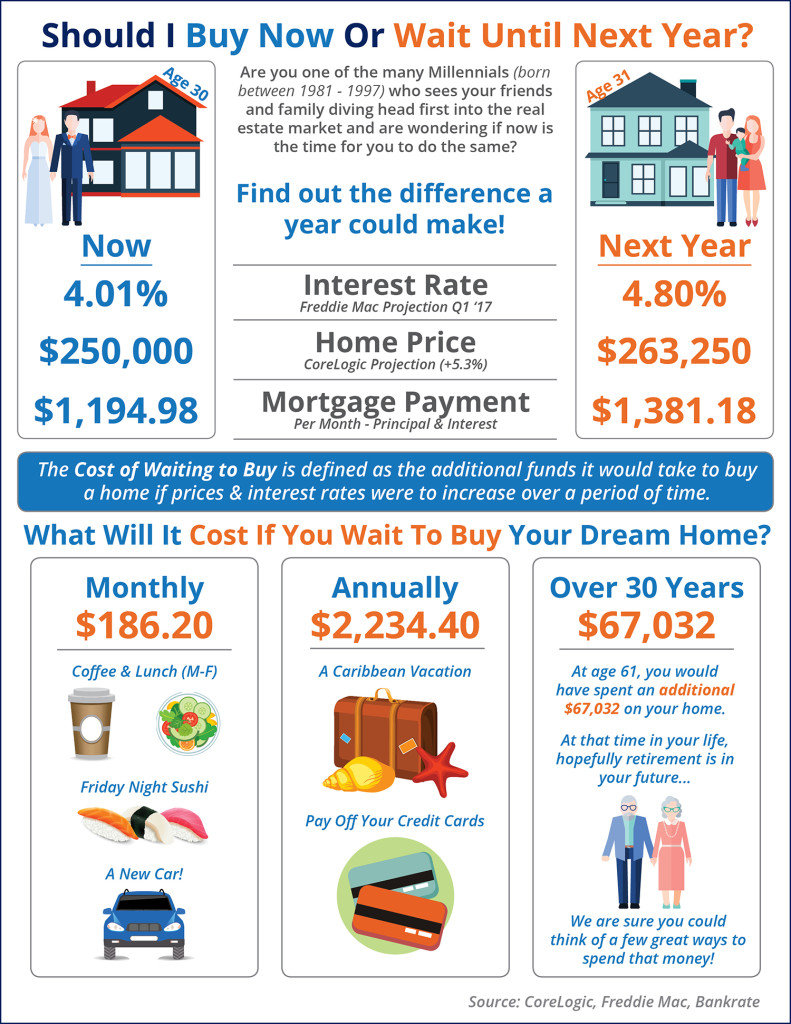

Should I Buy Now Or Wait Until Next Year? [INFOGRAPHIC]

Some Highlights: The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time. Freddie Mac predicts interest rates to rise to 4.8% by next year. CoreLogic predicts home prices to appreciate by 5.3% over the next 12 months. If you are ready and willing to buy your dream home, find out if you are able to! … [Read more...]

Thinking of Buying a Home? 3 Questions Every Buyer Should Answer First

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market. Answering the following 3 questions will help you determine if now is actually a good time for you to buy in today’s market. 1. Why am I buying a home in the first place? This truly is the most important question to answer. Forget the finances for a … [Read more...]

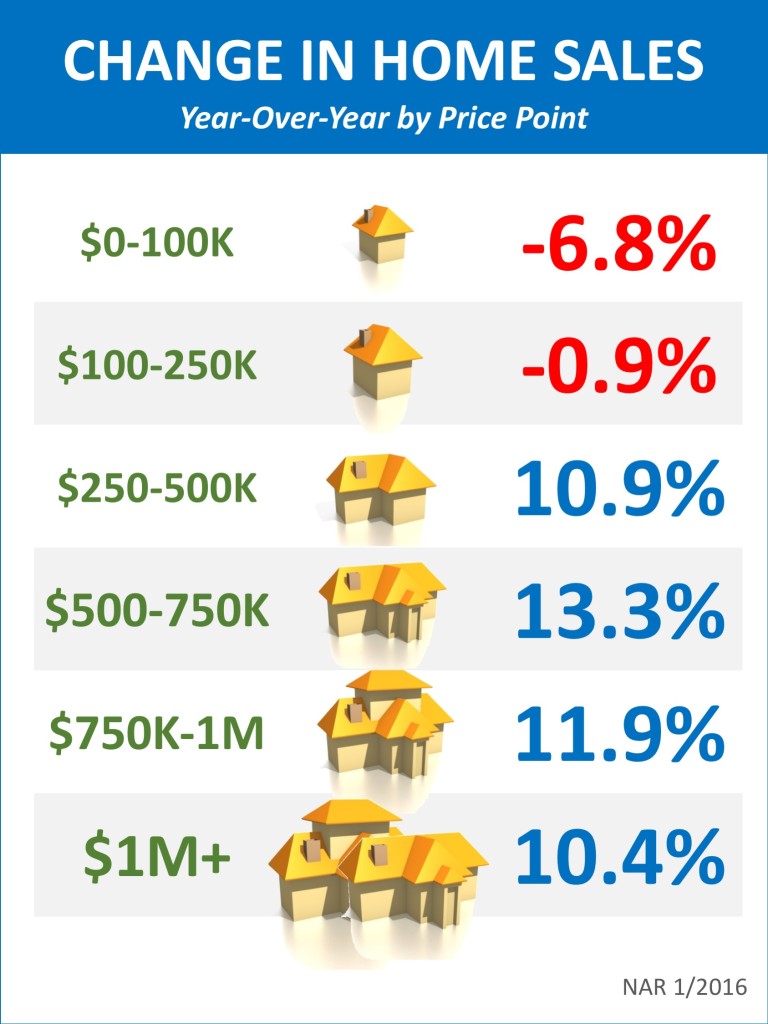

Change in Home Sales by Price Range [INFOGRAPHIC]

Some Highlights: Home Sales are up year-over-year in the top 4 price ranges and only slightly below last year's numbers in a fifth. A lack of distressed property inventory has led to a slow down in sales in the under $100K price range. As home prices continue to rise, there will be less homes available for sale in the lower ranges. … [Read more...]

Changes To Flood Insurance Deductibles

New Increased Flood Insurance Deductible Option There is a new $10,000 deductible option available for residential properties. For homeowners facing escalating flood insurance rates, these changes to flood insurance deductibles will be an option to help lower premiums. To take advantage of these savings, homeowners must be willing to pay a greater portion in the event of flood losses. Provided your mortgage company will permit the higher deductible, this high deductible option may offer homeowners some relief … [Read more...]

Changes To Flood Insurance Rates – Will Your Rate Increase?

Many local homeowners will be seeing changes to flood insurance rates in 2015 and 2016. The changes became effective on April 1, 2015 and will be applied to the next renewal of your flood insurance policy. These changes are increasing rates for many homeowners in the area, but don't be alarmed unnecessarily. We have all the details covered below. If you have questions about these changes or how these changes will affect the value of your property, contact us at 985.502.9707 or click here to send us a … [Read more...]

Selling A Home In New Orleans In November Has Benefits

In the past few weeks we have had the same discussion with several New Orleans area homeowners. All of the conversations revolved around concerns with putting their home on the market during what is perceived as a slow season for real estate. Selling a home in New Orleans during the holiday season has many distinct benefits. From experience over the years, we have seen this time of year as a huge opportunity for selling a home in New Orleans. Lenders in the New Orleans area are indicating that this week has been … [Read more...]

Not All ‘Buyers’ Are Able to Buy

Pre-Qualification vs Pre-Approval When a Buyer provides a pre-approval or pre-qualification letter, do you know the difference? Pre-Qualification Letter Prospective Buyers will often present a Seller with a pre-qualification letter to demonstrate their ability to obtain financing. However, most sellers do not realize a pre-qualification letter is NOT the same as a pre-approval. Receiving a pre-qualification letter simply means that the Buyer told the lender that they have good credit and make a particular … [Read more...]

- « Previous Page

- 1

- …

- 41

- 42

- 43